Avon 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 48

Notes to Consolidated Financial Statements

Avon Products, Inc.

In millions, except per share data

Description of the Business and Summary

of Significant Accounting Policies

Business > Avon Products, Inc. (“Avon” or the “Company”)

is a global manufacturer and marketer of beauty and

related products. Avon’s business is primarily comprised of

one industry segment, direct selling, which is conducted

in North America, Latin America, the Pacific and Europe.

The Company’s reportable segments are based on geo-

graphic operations. Sales are made to the ultimate cus-

tomers principally by independent Avon Representatives.

The product categories include Beauty, which consists of

cosmetics, fragrance and toiletries (“CFT”); Beauty Plus,

which consists of jewelry, watches and apparel and acces-

sories; Beyond Beauty, which consists of home products,

gift and decorative and candles; and Health and Wellness,

which consists of vitamins, an aromatherapy line, exercise

equipment, as well as stress relief and weight manage-

ment products.

Avon launched a retail brand in the U.S. in the third

quarter of 2001. In January 2003, Avon announced that it

would end its business relationship with J.C. Penney and

sell the brand “beComing” through Avon’s direct selling

channel in the U.S. (see Note 17, Subsequent Events).

Significant Accounting Policies >

Principles of Consolidation > The consolidated financial

statements include the accounts of Avon and its majority

and wholly-owned subsidiaries. Intercompany balances

and transactions are eliminated.

Use of Estimates > These statements have been prepared

in conformity with generally accepted accounting princi-

ples in the U.S. and require management to make esti-

mates and assumptions that affect the reported amounts

of assets and liabilities, the disclosure of contingent assets

and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during

the reporting period. Actual results could differ materially

from those estimates. On an ongoing basis, management

reviews its estimates, including those related to allowances

for doubtful accounts receivable, allowances for sales

returns, provisions for inventory obsolescence, income

taxes and tax valuation, stock-based compensation, loss

contingencies and the determination of discount and other

actuarial assumptions for pension, post-retirement and

post-employment benefit expenses. Changes in facts and

circumstances may result in revised estimates, which are

recorded in the period in which they become known.

1Foreign Currency > Statement of Financial Accounting

Standards (“FAS”) No. 52 distinguishes between transla-

tion adjustments, which are usually reported as a separate

component of Shareholders’ (deficit) equity, and foreign

currency transactions, which are included in the determi-

nation of net income. Financial statements of foreign sub-

sidiaries operating in other than highly inflationary

economies are translated at year-end exchange rates for

assets and liabilities and average exchange rates during the

year for income and expense accounts. The resulting trans-

lation adjustments are recorded within Accumulated other

comprehensive loss. Financial statements of subsidiaries

operating in highly inflationary economies are translated

using a combination of current and historical exchange

rates and any translation adjustments are included in earn-

ings. Gains or losses resulting from foreign currency trans-

actions are recorded in earnings in Other (income)

expense, net.

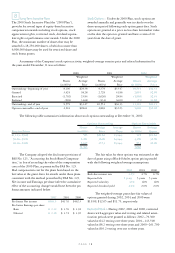

Financial statement translation of subsidiaries oper-

ating in highly inflationary economies and foreign cur-

rency transactions resulted in net gains in 2002 ($16.0)

and net losses in 2001 ($7.7) and 2000 ($12.6), which are

included in Other (income) expense, net. Other (income)

expense in 2002 included transaction gains of $27.8

pretax related to U.S. dollar denominated assets, mainly

in Argentina, Venezuela, Brazil and Mexico. Foreign

exchange in 2001 included transaction gains of $8.0 pre-

tax related to the translation of a U.S. dollar intercompany

loan receivable on Avon Argentina’s balance sheet. In

addition, Cost of sales and Marketing, distribution and

administrative expenses included the unfavorable impact

of the translation of inventories and prepaid expenses at

historical rates in countries with highly inflationary

economies in 2002–$.7 (2001–$2.0; 2000 of $3.2).

Revenue Recognition > Net sales primarily includes sales

generated as a result of Representative orders less any dis-

counts, commissions, taxes and other deductions. Avon

recognizes revenue upon delivery, when both title and

risks and rewards of ownership pass to the independent

Representatives, who are Avon’s customers. Avon’s inter-

nal financial systems accumulate revenues as orders are

shipped to the representative. Since Avon reports revenue

upon delivery, revenues per the financial system must be

reduced for an estimate of the financial impact of those

orders shipped but not delivered at the end of each report-

ing period. Avon uses estimates in determining revenue

and operating profit for orders that have been shipped but

not delivered as of the end of the period. These estimates

are based on daily sales levels, delivery lead times, gross