Avon 2001 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 25

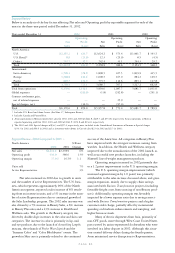

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Avon Products, Inc.

Dollars in millions, except share data

Cautionary Statement for Purposes of the “Safe Harbor” State-

ment Under the Private Securities Litigation Reform Act of 1995

Certain statements in this report which are not historical

facts or information are forward-looking statements within

the meaning of the Private Securities Litigation Reform

Act of 1995. Such forward-looking statements are based

on management’s reasonable current assumptions and

expectations. Such forward-looking statements involve

risks, uncertainties and other factors, which may cause the

actual results, levels of activity, performance or achieve-

ment of Avon Products, Inc. (“Avon” or the “Company”)

to be materially different from any future results expressed

or implied by such forward-looking statements, and there

can be no assurance that actual results will not differ mate-

rially from management’s expectations. Such factors

include, among others, the following: general economic

and business conditions in the Company’s markets, includ-

ing economic and political uncertainties in Latin America;

the Company’s ability to implement its business strategy

and its Business Transformation initiatives, including the

integration of similar activities across markets to achieve

efficiencies; the Company’s ability to achieve anticipated

cost savings and its profitability and growth targets;

the impact of substantial currency fluctuations in the

Company’s principal foreign markets and the success of

the Company’s foreign currency hedging and risk man-

agement strategies; the impact of possible pension

funding obligations and increased pension expense on the

Company’s cash flow and results of operations; the effect

of legal and regulatory proceedings, as well as restrictions

imposed on the Company, its operations or its Represen-

tatives by foreign governments; the Company’s ability to

successfully identify new business opportunities; the

Company’s access to financing; and the Company’s ability

to attract and retain key executives. Additional informa-

tion identifying such factors is contained in Item 1 of

the Company’s Form 10-K report for the year ended

December 31, 2002, filed with the U.S. Securities and

Exchange Commission. The Company undertakes no

obligation to update any such forward-looking statements.

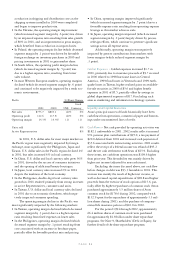

The following discussion of the results of operations

and financial condition of Avon should be read in conjunc-

tion with the information contained in the Consolidated

Financial Statements and Notes thereto. These statements

have been prepared in conformity with generally accepted

accounting principles in the U.S. and require management

to make estimates and assumptions that affect the reported

amounts of assets and liabilities, the disclosure of contin-

gent assets and liabilities at the date of the financial state-

ments and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ

materially from those estimates. On an ongoing basis,

management reviews its estimates, including those related

to allowances for doubtful accounts receivable, allowances

for sales returns, provisions for inventory obsolescence,

income taxes and tax valuation reserves, stock-based

compensation, loss contingencies and the determination

of discount and other rate assumptions for pension,

post-retirement and post-employment benefit expenses.

Changes in facts and circumstances may result in revised

estimates, which are recorded in the period they

become known.

Critical Accounting Estimates

Avon believes the accounting policies described below rep-

resent its critical accounting policies due to the estimation

processes involved in each. See Note 1, Description of the

Business and Summary of Significant Accounting Policies,

for a detailed discussion of the application of these and

other accounting policies.

Allowances for Doubtful Accounts Receivable >

Representatives contact their customers, selling primarily

through the use of brochures for each sales campaign. Sales

campaigns are generally for a two-week duration in the

U.S. and a three to four week duration outside the U.S.

The Representative purchases products directly from Avon

and may or may not sell them to an end user. In general,

the Representative, an independent contractor, remits a

payment to Avon each sales campaign, which relates to the

prior campaign cycle. The Representative is generally pre-

cluded from submitting an order for the current sales cam-

paign until the accounts receivable balance for the prior

campaign is paid; however, there are circumstances where

the Representative fails to make the required payment. In

these circumstances, the Company records an estimate of

an allowance for doubtful accounts on those receivable bal-

ances that it believes are uncollectible based on an analysis

of historical data and current circumstances. Over the past

three years, annual bad debt expense has been approxi-

mately $100.0. The Company generally has no detailed

information concerning, or any communication with,

any end user of its product beyond the Representative.

Avon has no legal recourse against the end user for the

collectibility of any accounts receivable balances due from

the Representative to Avon. If the financial condition of

Avon’s Representatives were to deteriorate, resulting in an

impairment of their ability to make payments, additional

allowances may be required.