Avon 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 35

Pension Plan Funding and Expense > The Company main-

tains qualified defined benefit pension plans, which cover

substantially all employees in the U.S. and in certain

international locations. Additionally, the Company has

unfunded supplemental pension benefit plans for certain

current and retired executives. (See Note 10, Employee

Benefit Plans).

The expected return on plan assets for all pension

plans approximated $74.0 for the year ended December

31, 2002, and was calculated based upon the average

expected long-term rate of return on plan assets. For

the year ended December 31, 2002, the assumed rate of

return on assets globally was 8.3%, which represents the

weighted average rate of return on all plan assets including

the U.S. and non-U.S. plans. In determining the long-

term rate of return, the Company considers the nature

of the plans’ investments, an expectation for the plans’

investment strategies and the historical rates of return.

The majority of the Company’s pension plan assets

relate to the U.S. pension plan. The assumed rate of return

for 2002 for the U.S. plan was 8.75%. Historical rates of

return for the U.S. plan for the most recent 10-year and

20-year periods were 8.3% and 10.7%, respectively. In

the U.S. plan, the Company’s asset allocation policy has

favored U.S. equity securities, which have returned 11%

and 13%, respectively, over the 10-year and 20-year period.

In addition, the current rate of return assumption

for the U.S. plan was based on an asset allocation of approx-

imately 35% in corporate and government bonds (which

are expected to earn approximately 5% to 7% in the long-

term) and 65% in equity securities (which are expected to

earn approximately 9% to 11% in the long-term). Similar

assessments were performed in determining rates of return

on non-U.S. pension plan assets, to arrive at the Company’s

current weighted average rate of return of 8.3%.

During 2002, the assets associated with the

Company’s benefit plans experienced negative investment

returns, most significantly in the U.S. plan, where the

market value of plan assets declined approximately 13%.

As a result, Avon made a cash contribution to its U.S.

qualified pension plan of $120.0 in 2002 versus $25.0 in

2001. Despite the stock market’s poor performance of

recent years, the Company continues to believe that 8.3%

is a reasonable long-term rate of return and will continue

to evaluate the expected rate of return, at least annually,

and adjust as necessary.

The discount rate for each individual plan used

for determining future pension obligations is based on

a review of long-term bonds that receive a high rating

given by a recognized rating agency. The weighted-aver-

age discount rate for U.S. and non-U.S. plans determined

on this basis has decreased from 6.7% at December 31,

2001 to 6.3% at December 31, 2002.

Future effects of pension plans on the operating

results of the Company will depend on economic condi-

tions, employee demographics, mortality rates, the num-

ber of associates electing to take lump-sum payments,

investment performance and funding decisions. However,

given current assumptions (including those noted above),

2003 pension expense related to the U.S. plan is expected

to increase in the range of $20.0 to $25.0. The Company

does not anticipate that this incremental expense will

affect its ability to meet its financial targets.

A 50 basis change (in either direction) on the

expected rate of return on plan assets, the discount rate or

the rate of compensation increases would have the follow-

ing effect on 2002 pension expense:

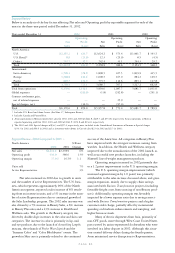

Increase/(Decrease) in

pension expense

50 basis point 50 basis point

increase decrease

Rate of return on assets (3.9) 3.9

Discount rate (6.3) 7.4

Rate of compensation increase 3.1 (3.0)

In addition, at December 31, 2002, the Company

recognized a liability on its balance sheet for each pension

plan if the fair value of the assets of that pension plan is

less than the accumulated benefit obligation, or “ABO.”

This liability is called a “minimum pension liability” and

is recorded as a charge in Accumulated other comprehen-

sive loss in Shareholders’ (deficit) equity. In December

2002, Avon recorded a charge to Accumulated other com-

prehensive loss of $239.0 (see Note 5, Accumulated Other

Comprehensive Loss). This charge primarily represents

the after tax impact of recording the minimum pension

liability for the U.S. pension plan, and to a lesser extent,

for the pension plan in the United Kingdom. This charge

has no impact on the Company’s net income, liquidity, or

cash flows.

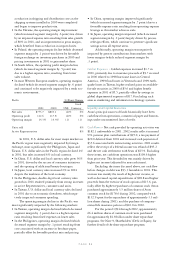

Capital Resources > Total debt of $1,372.2 at December

31, 2002, increased $47.1 from $1,325.1 at December 31,

2001, principally due to adjustments to reflect the fair

value of outstanding interest rate swaps (see Note 4, Debt

and Other Financing), amortization of the discount on

Avon’s outstanding convertible notes and translation of

Avon’s Japanese yen denominated notes payable. Total

debt of $1,325.1 at December 31, 2001, increased $111.5

from $1,213.6 at December 31, 2000, principally due to

the issuance in September 2001 of Japanese yen denomi-

nated notes payable and adjustments to debt to reflect the

fair value of outstanding interest rate swaps.

During 2002 and 2001, cash flows from operating

activities, combined with cash on hand, were used for

repurchases of common stock, payment of dividends and

capital expenditures. Management believes that cash from

operations and available sources of financing are adequate