Avon 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 65

Special Charges

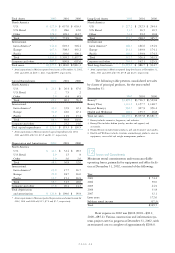

In May 2001, Avon announced its new Business

Transformation plans, which are designed to signifi-

cantly reduce costs and expand profit margins, while

continuing to focus on consumer growth strategies.

Business Transformation initiatives include an end-to-end

evaluation of business processes in key operating areas,

with target completion dates through 2004. Specifically,

the initiatives focus on simplifying Avon’s marketing

processes, taking advantage of supply chain opportunities,

strengthening Avon’s sales model through the Sales

Leadership program and the Internet, streamlining the

Company’s organizational structure and integrating cer-

tain similar activities across markets to achieve efficien-

cies. Avon anticipates significant benefits from these

Business Transformation initiatives, but the scope and

complexity of these initiatives necessarily involve plan-

ning and execution risk.

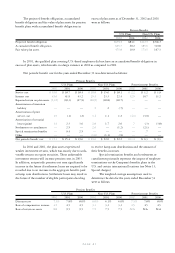

13 Special Charges–Fourth Quarter 2001 > In the fourth quar-

ter of 2001, Avon recorded Special charges of $97.4 pretax

($68.3 after tax, or $.28 per share on a diluted basis) pri-

marily associated with facility rationalizations and work-

force reduction programs related to implementation of

certain Business Transformation initiatives. The charges of

$97.4 were included in the Consolidated Statement of

Income for 2001 as Special charges ($94.9) and as inven-

tory write-downs, which were included in Cost of sales

($2.5). Approximately 80% of the charges relate to future

cash expenditures. Approximately 60% of these cash

expenditures were made by December 2002, with approxi-

mately 90% of total cash payments to be made by

December 2003. All payments are funded by cash flow

from operations.

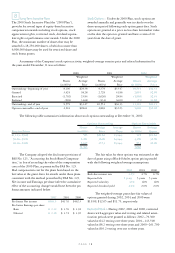

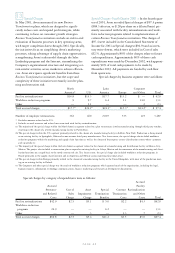

Special charges by business segment were as follows:

North Latin Corporate

America* U.S. America Europe and Other Total

Facility rationalizations†$16.8 $14.3 $17.7 $13.2 $ — $ 62.0

Workforce reduction programs .9 9.7 6.4 2.1 14.0 33.1

Other — 2.1 — — .2 2.3

Total accrued charges $17.7(a) $26.1(b) $24.1(c) $15.3(d) $14.2(e) $ 97.4

Number of employee terminations 362 460 2,007 533 125 3,487

* Excludes amounts related to the U.S.

† Includes accrued severance and related costs associated with facility rationalizations.

(a) The majority of the special charge within the North America segment related to a plan to outsource jewelry manufacturing through third party vendors,

resulting in the closure of a jewelry manufacturing facility in Puerto Rico.

(b) The special charge within the U.S. segment primarily related to the closure of a manufacturing facility in Suffern, New York. Production is being moved

to an existing facility in Springdale, Ohio and to one or more third party manufacturers. To a lesser extent, the special charge also included workforce

reduction programs within the marketing and supply chain functions as well as the closure of four express centers (distribution centers where customers

pick up products).

(c) The majority of the special charge within the Latin America segment related to the closure of a manufacturing and distribution facility in Mexico City,

Mexico. The project also included a construction plan to expand an existing facility in Celaya, Mexico and the movement of the manufacturing and distri-

bution functions on a staged basis to the newly constructed site. To a lesser extent, the special charge also included workforce reduction programs in

Brazil (primarily in the supply chain function) and in Argentina and Mexico (across numerous functional areas).

(d) The special charge within Europe primarily related to the closure of a manufacturing facility in the United Kingdom, with most of the production mov-

ing to an existing facility in Poland.

(e) The Corporate and other special charge was the result of workforce reduction programs which spanned much of the organization, including the legal,

human resources, information technology, communications, finance, marketing and research & development departments.

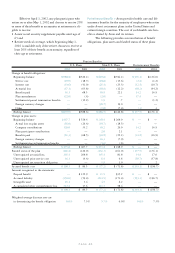

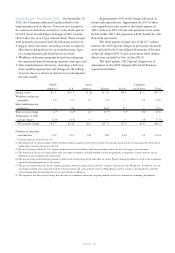

Special charges by category of expenditures were as follows:

Accrued

Accrued Facility

Severance Cost of Asset Special Contract Rationalization

and Related Sales Impairment Termination Termination and Other

Costs Charge Charge Benefits Costs Costs Total

Facility rationalizations $42.9 $2.5 $5.1 $ 5.0 $2.2 $4.3 $62.0

Workforce reduction

programs 26.9 — — 6.2 — — 33.1

Other — — .3 — 1.3 .7 2.3

Total accrued charges $69.8 $2.5 $5.4 $11.2 $3.5 $5.0 $97.4