Avon 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 37

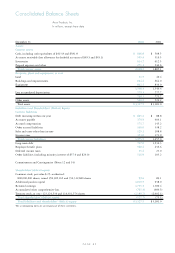

See Note 4, Debt and Other Financing, and Note

12, Leases and Commitments, for further information

on Avon’s debt and contractual financial obligations

and commitments.

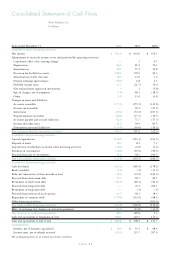

Inventories > Avon’s products are generally marketed during

12 to 26 individual sales campaigns each year. Each cam-

paign is conducted using a brochure offering a wide assort-

ment of products, many of which change from campaign to

campaign. It is necessary for Avon to maintain relatively

high inventory levels as a result of the nature of its busi-

ness, including the number of campaigns conducted annu-

ally and the large number of products marketed. Avon’s

operations have a seasonal pattern characteristic of many

companies selling CFT, fashion jewelry and accessories, gift

and decorative items, and apparel. Holiday sales cause a

peak in the fourth quarter, which results in the build up

of inventory at the end of the third quarter. Inventory

levels are then reduced by the end of the fourth quarter.

Inventories of $614.7 at December 31, 2002, were slightly

higher than at December 31, 2001. At the same time,

inventory days outstanding declined from 2001, reflecting

Avon’s efforts to manage purchases and inventory levels

while maintaining a focus on operating the business at effi-

cient inventory levels. It is Avon’s objective to continue to

focus on inventory management. However, the addition or

expansion of product lines, which are subject to changing

fashion trends and consumer tastes, as well as planned

expansion in high growth markets, may cause inventory

levels to grow periodically.

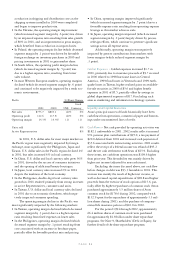

Capital Expenditures > Capital expenditures during 2002

were $126.5 compared with $155.3 in 2001. Those

expenditures were made for improvements on existing

facilities, continued investments for capacity expansion,

facility modernization, information systems and equip-

ment replacement projects. Numerous construction

and information systems projects were in progress at

December 31, 2002, with an estimated cost to complete

of approximately $206.0. Capital expenditures in 2003

are currently expected to be in the range of $175.0–$200.0.

These expenditures will include improvements on existing

facilities, continued investments for capacity expansion,

facility modernization (primarily the construction of a new

research and development facility), information systems

and equipment replacement projects.

Foreign Operations

For the three years ended 2002, 2001 and 2000, the

Company derived approximately 60% of its consolidated

net sales and total operating profit from operations

of subsidiaries outside of the U.S. In addition, as of

December 31, 2002 and 2001, these subsidiaries com-

prised approximately 50% of the Company’s consolidated

total assets. Avon has significant net assets in Brazil,

Mexico, Japan, Poland, Argentina, the United Kingdom,

Canada and Venezuela.

The functional currency for most of Avon’s foreign

operations is the local currency. The cumulative effects

of translating balance sheet accounts from the functional

currency into the U.S. dollar at current exchange rates

are included in Accumulated other comprehensive loss in

Shareholders’ (deficit) equity. The U.S. dollar is used as the

functional currency for operations in hyperinflationary for-

eign economies where cumulative inflation rates exceed

100% over a three-year period. Effective January 1, 1995,

Venezuela was designated as a country with a hyperinfla-

tionary economy due to cumulative inflation rates over the

three-year period 1992–1994. Venezuela converted back

to non-hyperinflationary status effective January 1, 2002,

due to reduced cumulative inflation rates. Effective

January 1, 1997, Russia was designated as a country with

a hyperinflationary economy due to cumulative inflation

rates over the three-year period 1994–1996. Russia has

converted to non-hyperinflationary status effective January

1, 2003, due to reduced cumulative inflation rates.

During 2002, the Brazilian real weakened as

investor sentiment turned bearish in the run up to the

November presidential election. Investors were worried

about the economic policies of the leading candidate from

the Worker’s Party. As predicted by the polls, the

Worker’s Party candidate won the election. Investors ini-

tially reacted negatively to the results but subsequently

turned more favorable as the newly elected government

announced its cabinet appointments. As a result, the real

strengthened towards the end of the year and into the

beginning of 2003. Investors remain cautious, however, as

they question the government’s ability to reconcile voter

demands for faster growth and a more even distribution

of wealth to the demands of the International Monetary

Fund (“IMF”) to control the budget deficit and inflation.

Continued or greater real weakness in 2003 could have an

adverse impact on Brazil’s U.S. dollar results.

In Venezuela, the government decision to allow the

bolivar to float freely resulted in a significant weakening

of the currency. A general strike and anti-government

protests escalated to the point where, during the fourth

quarter, the country’s economy was severely disrupted.

The protests virtually shut down the country’s oil exports,

the primary source of the country’s foreign exchange

reserves. Ports remain closed and the banking system is

working on a limited schedule. The disruption of oil

exports and the resulting drop in foreign exchange reserves

forced the government to close the foreign exchange mar-

kets in early 2003. In February 2003, exchange controls

were imposed on foreign currency transactions.

Continuation of the political unrest has disrupted Avon’s

ability to conduct normal business operations as well as to

obtain foreign currency to pay for imported products.

Alternative methods are being pursued to pay foreign

vendors including loans or guarantees from its parent.

Without a resolution to the political and economic issues,

Avon’s operations will be negatively impacted in 2003.