Avon 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 36

to meet anticipated requirements for working capital,

dividends, capital expenditures, the stock repurchase pro-

gram and other cash needs.

Avon has a five-year $600.0 revolving credit and

competitive advance facility (the “credit facility”), which

expires in 2006. The credit facility may be used for gen-

eral corporate purposes, including financing working

capital and capital expenditures and supporting the stock

repurchase program. The interest rate on borrowings

under the credit facility is based on LIBOR or on the

higher of prime or 1/2% plus the federal funds rate. The

credit facility has an annual facility fee, payable quarterly,

of $0.5, based on Avon’s current credit ratings. The credit

facility contains customary covenants, including one

which requires Avon’s interest coverage ratio (determined

in relation to Avon’s consolidated pretax income and inter-

est expense) to equal or exceed 4:1. At December 31,

2002, Avon was in compliance with all covenants in the

credit facility. At December 31, 2002 and December 31,

2001, there were no borrowings under the credit facility.

Avon maintains a $600.0 commercial paper program,

which is supported by the credit facility. Outstanding

commercial paper effectively reduces the amount available

for borrowing under the credit facility. At December 31,

2002 and December 31, 2001, Avon had no commercial

paper outstanding.

The cost of borrowings under the credit facility, as

well as the amount of the facility fee and utilization fee

(applicable only if more than 50% of the facility is bor-

rowed), depend on Avon’s credit ratings. A downgrade in

Avon’s credit ratings would increase the cost to Avon of

maintaining and borrowing under the credit facility, or

preclude Avon from issuing commercial paper or increase

the cost to Avon of issuing commercial paper in the future.

The credit facility does not contain a rating downgrade

trigger that would prevent Avon from borrowing under

the credit facility. The credit facility would become

unavailable for borrowing only if Avon were to fail to sat-

isfy one of the conditions to borrowing in the facility.

These conditions to borrowing are generally based on the

accuracy of certain representations and warranties, compli-

ance by Avon with the covenants in the credit facility (dis-

cussed above) and the absence of defaults, including but

not limited to bankruptcy and insolvency, change of con-

trol, failure to pay other material debts and failure to stay

or pay material judgments, as those events are described

more fully in the credit facility agreement.

At December 31, 2002, Avon was in compliance

with all covenants in its indentures (see Note 4, Debt and

Other Financing). Such indentures do not contain any rat-

ing downgrade triggers that would accelerate the maturity

of its debt. Neither the credit facility nor any of the inden-

tures contains any covenant or other requirement relating

to maintenance of a positive shareholders’ equity balance.

Avon had uncommitted domestic lines of credit

available of $37.9 in 2002 and 2001 with various banks.

In addition, as of December 31, 2002 and 2001, there

were international lines of credit totaling $411.4 and

$457.4, respectively, of which $63.9 and $87.9, respec-

tively, were outstanding and included in Notes payable

and Long-term debt. At December 31, 2002 and 2001,

Avon had letters of credit outstanding totaling $27.7

and $25.9, respectively, which guarantee various insurance

activities. In addition, Avon had outstanding letters

of credit for various trade activities and commercial

commitments executed in the ordinary course of business,

such as purchase orders for normal replenishment of

inventory levels.

On February 25, 2003, the Company filed a

Registration Statement on Form S-3 with the SEC, which

is intended to register $1,000.0 of debt securities. The

Registration Statement is not yet effective as of the date

of this filing.

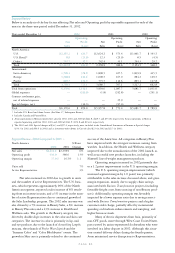

Debt and Contractual Financial Obligations and Commitments > At December 31, 2002, Avon’s debt and contractual finan-

cial obligations and commitments by due date were as follows:

2007 and

2003 2004 2005 2006 Beyond Total

Notes payable $ 63.7 $ — $ — $ — $ — $ 63.7

Long-term debt 538.6(1) 200.0 — 75.0 400.0 1,213.6

Capital lease obligations 2.9 4.4 1.9 .1 .2 9.5

Operating leases 72.8 57.3 43.3 32.5 193.6 399.5

Other long-term obligations 6.1 2.5 — — — 8.6

Total debt and contractual financial

obligations and commitments(2) $684.1 $264.2 $45.2 $107.6 $593.8 $1,694.9

(1) $100.0 of bonds embedded with option features maturing in May 2018 can be sold back to Avon at par or can be called at par by the call option holder

and resold to investors as 15-year debt in May 2003. Convertible Notes of $438.4 maturing in 2020 may be redeemed at the option of Avon on or after

July 12, 2003. In addition, at the holders’ option, the Convertible Notes may be sold to Avon, for cash or shares at Avon’s discretion, at the redemption

price on July 12, 2003, July 12, 2008 and July 12, 2013.

(2) The amount of debt and contractual financial obligations and commitments excludes amounts due pursuant to derivative transactions.