Avon 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

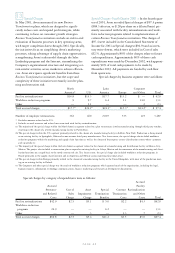

PAGE 57

At December 31, 2002, certain Avon subsidiaries

held U.S. dollar denominated assets, primarily to mini-

mize foreign-currency risk and provide liquidity as fol-

lows: Mexico ($23.5), Argentina ($12.4), Venezuela ($6.8)

and Brazil ($7.6). For the years ended December 31, 2002

and 2001, Other (income) expense, net included net trans-

action gains of $27.8 and $8.0, respectively, related to

these U.S. dollar denominated assets.

Hedges of Net Investments in Foreign Operations > Avon

uses foreign currency forward contracts and foreign

currency denominated debt to hedge the foreign currency

exposure related to the net assets of certain of its

foreign subsidiaries.

During 2001, Avon entered into loan agreements

and notes payable to borrow Japanese yen to hedge Avon’s

net investment in its Japanese subsidiary (see Note 4,

Debt and Other Financing). During 2001, Avon also

entered into foreign currency forward contracts to hedge

its net investment in its Mexican subsidiary. The forward

contracts were settled in 2002. For the years ended

December 31, 2002 and 2001, net losses of $.8 and net

gains of $5.1, respectively, related to the effective portion

of these hedges were included in foreign currency transla-

tion adjustments within Accumulated other comprehen-

sive loss on the Consolidated Balance Sheets.

Credit and Market Risk > Avon attempts to minimize its

credit exposure to counterparties by entering into interest

rate swap, forward rate, interest rate cap contracts and

treasury lock agreements only with major international

financial institutions with “A” or higher credit ratings as

issued by Standard & Poor’s Corporation. Avon’s foreign

currency and interest rate derivatives are comprised of

over-the-counter forward contracts, swaps or options with

major international financial institutions. Although the

Company’s theoretical credit risk is the replacement cost

at the then estimated fair value of these instruments,

management believes that the risk of incurring credit risk

losses is remote and that such losses, if any, would not

be material.

Non-performance of the counterparties on the bal-

ance of all the foreign exchange and interest rate swap and

forward rate agreements would not result in a material

write-off at December 31, 2002. In addition, in the event

of non-performance by such counterparties, Avon would

be exposed to market risk on the underlying items being

hedged as a result of changes in foreign exchange and

interest rates.

Fair Value of Financial Instruments > The fair value of a

financial instrument is the amount at which the instru-

ment could be exchanged in a current transaction between

willing parties, other than in a forced sale or liquidation.

The methods and assumptions used to estimate fair

value are as follows:

Grantors trust > The fair values of these investments,

principally fixed income funds and equity securities, were

based on the quoted market prices for issues listed on secu-

rities exchanges.

Debt maturing within one year and Long-term debt >

The fair values of all debt and other financing were esti-

mated based on quoted market prices.

Share repurchase commitments and foreign exchange

forward and option contracts > The fair values of forward

and option contracts were estimated based on quoted mar-

ket prices from banks.

Interest rate swap, forward rate, treasury lock and cap

agreements > The fair values of interest rate swap, forward

rate, treasury lock and cap agreements were estimated

based on quotes from market makers of these instruments

and represent the estimated amounts that Avon would

expect to receive or pay to terminate the agreements.

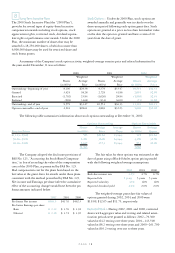

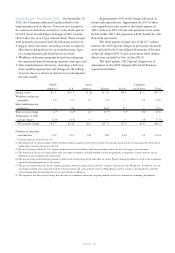

The asset (liability) amounts recorded in the bal-

ance sheet (carrying amount) and the estimated fair values

of financial instruments at December 31 consisted of

the following:

2002 2001

Carrying Fair Carrying Fair

Amount Value Amount Value

Cash and cash

equivalents $ 606.8 $ 606.8 $ 508.5 $ 508.5

Grantors trust 49.6 49.6 62.1 62.1

Debt maturing

within one year (605.2) (647.1) (88.8) (88.8)

Long-term debt,

net of related dis-

count or premium (769.2) (760.5) (1,236.2) (1,250.3)

Share repurchase

commitments ——(.6) (.7)

Foreign exchange

forward and

option contracts 7.2 7.2 (7.3) (7.3)

Interest rate swap,

forward rate,

treasury lock and

cap agreements 82.1 82.1 35.1 35.1