Avon 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 49

margin and variable expenses. Avon also estimates an

allowance for sales returns based on historical experience

with product returns. In addition, Avon estimates an

allowance for doubtful accounts receivable based on analy-

sis of historical data.

Other Revenue > Other revenue includes shipping and

handling fees charged to Representatives.

Cash and Cash Equivalents > Cash equivalents are stated

at cost plus accrued interest, which approximates fair

value. Cash equivalents are high quality, short-term

money market instruments with an original maturity of

three months or less and consist of time deposits with a

number of U.S. and non-U.S. commercial banks and

money market fund investments.

Inventories > Inventories are stated at the lower of cost

or market. Cost is determined using the first-in, first-

out (“FIFO”) method for all inventories. Avon classifies

inventory into various categories based upon their stage

in the product life cycle, future sales plans and disposition

process. Avon assigns a degree of obsolescence risk to

products based on this classification to determine the

level of obsolescence provision.

Property, plant and equipment > Property, plant and

equipment are stated at cost. Substantially all buildings,

improvements and equipment are depreciated using the

straight-line method over estimated useful lives.

Estimated useful lives for buildings and improvements

range from approximately 20 to 45 years and equipment

range from three to 15 years. Upon disposal of property,

plant and equipment, the cost of the assets and the related

accumulated depreciation are removed from the accounts

and the resulting gain or loss is reflected in earnings.

Avon capitalizes interest on borrowings during the

active construction period of major capital projects.

Capitalized interest is added to the cost of the underlying

asset and depreciated over the useful lives of the assets.

For 2002, 2001 and 2000, Avon capitalized $1.0, $0,

and $2.3 of interest, respectively.

Deferred Software > In accordance with Statement of

Position 98-1, “Accounting for the Costs of Computer

Software Developed or Obtained for Internal Use,” certain

systems development costs related to the purchase, devel-

opment and installation of computer software are capital-

ized and amortized over the estimated useful life of the

related project, not to exceed five years. Costs incurred

prior to the development stage, as well as maintenance,

training costs, and general and administrative expenses are

expensed as incurred. Unamortized deferred software costs

totaled $86.3 and $99.6 at December 31, 2002 and 2001,

respectively, and are included in Other assets on the

Consolidated Balance Sheets.

Investments in Debt and Equity Securities>Debt and

equity securities that have a readily determinable fair

value and management does not intend to hold to matu-

rity are classified as available-for-sale and carried at fair

value. Unrealized holding gains and losses are recorded as

a separate component of Shareholders’ (deficit) equity, net

of deferred taxes.

Stock Awards > Avon applies the recognition and meas-

urement principles of APB Opinion 25, “Accounting for

Stock Issued to Employees,” and related interpretations in

accounting for its long-term stock-based incentive plans,

which are described in Note 8, Long-Term Incentive

Plans. No compensation cost related to grants of stock

options was reflected in Net income, as all options granted

under the plans had an exercise price equal to the market

value of the underlying common stock on the date of

grant. Compensation cost related to grants of restricted

stock is measured as the quoted market price of Avon’s

stock at the measurement date and is amortized to expense

over the vesting period. The effect on Net income and

Earnings per share if Avon had applied the fair value

recognition provisions of Financial Accounting Standard

(“FAS”) No. 123, “Accounting for Stock-Based Compen-

sation,” to stock-based compensation for the years ended

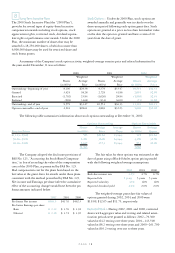

December 31 was as follows.

2002 2001 2000

Net income, as reported $534.6 $444.6 $479.1

Less: Stock-based compensation

expense determined under

FAS No. 123, net of tax (30.1) (27.6) (16.8)

Pro forma Net income $504.5 $417.0 $462.3

Earnings per share:

Basic–as reported $ 2.26 $ 1.88 $ 2.01

Basic–pro forma 2.14 1.76 1.94

Diluted–as reported 2.22 1.85 1.99

Diluted–pro forma 2.10 1.74 1.92

Financial Instruments > The Company uses derivative

financial instruments, including interest rate swaps, for-

ward interest rate agreements, treasury lock agreements,

forward contracts and options, to manage interest rate and

foreign currency exposures. Effective January 1, 2001,

Avon records all derivative instruments at their fair values

on the Consolidated Balance Sheets as either assets or

liabilities (see Notes 2, Accounting Changes, and 7,

Financial Instruments and Risk Management).

Avon also uses financial instruments, including for-

ward contracts to purchase Avon common stock, to hedge

certain employee benefit costs and the cost of Avon’s share

repurchase program. Contracts that require physical or net

share settlement and contracts that give Avon a choice of

net-cash settlement or settlement in its own shares are

recorded as equity instruments and are initially measured

at fair value with subsequent changes in fair value not