Avon 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

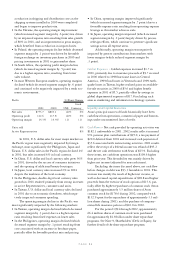

PAGE 39

Avon’s long-term borrowings, interest rate swaps

and treasury lock agreement were analyzed at year end to

determine their sensitivity to interest rate changes. Based

on the outstanding balance of all these financial instru-

ments at December 31, 2002, a hypothetical 50 basis point

change (either an increase or a decrease) in interest rates

prevailing at that date, sustained for one year, would not

represent a material potential change in fair value, earn-

ings or cash flows. This potential change was calculated

based on discounted cash flow analyses using interest rates

comparable to Avon’s current cost of debt. In 2002, Avon

did not experience a material change in fair value, earnings

or cash flows associated with changes in interest rates.

Foreign Currency Risk > Avon is exposed to changes in

financial market conditions in the normal course of its

operations, primarily due to international businesses and

transactions denominated in foreign currencies and the use

of various financial instruments to fund ongoing activities.

Avon uses foreign currency forward contracts and

options to hedge portions of its forecasted foreign currency

cash flows resulting from intercompany royalties, inter-

company loans, and other third-party and intercompany

foreign currency transactions where there is a high proba-

bility that anticipated exposures will materialize. These

contracts have been designated as cash flow hedges. At

December 31, 2002, the primary currencies for which

Avon has net underlying foreign currency exchange rate

exposure are the U.S. dollar versus the Argentine peso,

Brazilian real, British pound, Canadian dollar, the euro,

Japanese yen, Mexican peso, Philippine peso, Polish zloty,

Russian ruble and Venezuelan bolivar.

Avon also enters into foreign currency forward con-

tracts and options to protect against the adverse effects

that exchange rate fluctuations may have on the earnings

of its foreign subsidiaries. These derivatives do not qualify

for hedge accounting and therefore, the gains and losses on

these derivatives have been recognized in earnings each

reporting period. Avon’s hedges of its foreign currency

exposure cannot entirely eliminate the effect of changes in

foreign exchange rates on Avon’s consolidated financial

position, results of operations and cash flows.

Avon uses foreign currency forward contracts and

foreign currency denominated debt to hedge the foreign

currency exposure related to the net assets of certain of its

foreign subsidiaries. During 2001, Avon entered into loan

agreements and notes payable to borrow Japanese yen to

hedge Avon’s net investment in its Japanese subsidiary (see

Note 4, Debt and Other Financing). During 2001, Avon

also entered into foreign currency forward contracts to

hedge its net investment in its Mexican subsidiary. These

forward contracts were settled in 2002. For the years

ended December 31, 2002 and 2001, net losses of $.8 and

net gains of $5.1, respectively, related to the effective por-

tion of these hedges were included in foreign currency

translation adjustments within Accumulated other com-

prehensive loss on the Consolidated Balance Sheets.

At December 31, 2002, Avon held foreign currency

forward and option contracts to buy and sell foreign

currencies, including cross-currency contracts to sell one

foreign currency for another, with notional amounts in

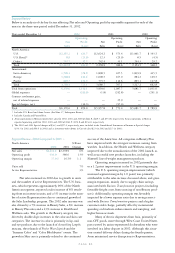

U.S. dollars as follows:

Buy Sell

Argentine peso $ — $ 2.7

Brazilian real — 24.0

British pound 6.6 31.1

Canadian dollar — 27.4

Czech koruna — 3.7

Euro 54.8 13.9

Japanese yen 17.4 18.0

Mexican peso — 16.5

Philippine peso — 4.0

Polish zloty 1.2 17.1

Taiwanese dollar — 5.3

Other currencies 1.2 8.3

Total $81.2 $172.0

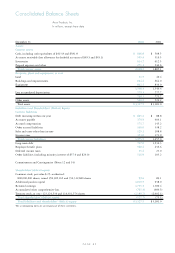

At December 31, 2002, certain Avon subsidiaries

held U.S. dollar denominated assets, primarily to minimize

foreign-currency risk and provide liquidity. These sub-

sidiaries included Mexico ($23.5), Argentina ($12.4),

Venezuela ($6.8) and Brazil ($7.6). For the years ended

December 31, 2002 and 2001, Other (income) expense, net

included net transaction gains of $27.8 and $8.0, respec-

tively, related to these U.S. dollar denominated assets.

Avon’s foreign-currency financial instruments were

analyzed at year end to determine their sensitivity to for-

eign exchange rate changes. Based on the Company’s for-

eign exchange contracts at December 31, 2002, the

impact of a 10% appreciation or 10% depreciation of the

U.S. dollar against the Company’s foreign exchange con-

tracts would not represent a material potential change in

fair value, earnings or cash flows. This potential change

does not consider the underlying foreign currency expo-

sures of the Company. The hypothetical impact was calcu-

lated on the combined option and forward positions using

forward rates at December 31, 2002, adjusted for an

assumed 10% appreciation or 10% depreciation of the

U.S. dollar against the foreign contracts. The impact of

payoffs on option contracts is not significant to this calcu-

lation. In 2002, net foreign exchange gains associated with

the Company’s foreign exchange contracts did not repre-

sent a material change in fair value, earnings or cash flows.

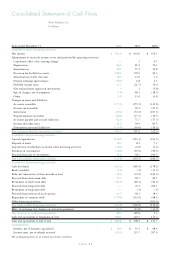

Equity Price Risk > Avon is exposed to equity price fluc-

tuations for investments included in the grantors trust

(see Note 10, Employee Benefit Plans). A 10% change

(either an increase or decrease) in equity prices would not

be material based on the fair value of equity investments

as of December 31, 2002.

Credit Risk > Avon attempts to minimize its credit expo-

sure to counterparties by entering into interest rate swap,