Avon 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 24

The Financial Section

2

4

6

8

10

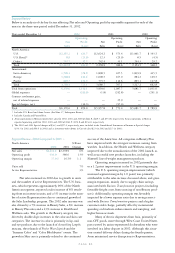

Net Sales–Constant vs.

Actual U.S. Dollars

$ In billions

Base year = 1998

98 99 00 01 02

■Net Sales, Constant U.S. Dollars

(excludes currency translation)

■Net Sales, Actual U.S. Dollars

200

400

600

800

1000

1200

Business Unit

Operating Profit

$ In millions

98 99 00 01 02

2002 Results by

Geographic Region

■North America

■Latin America

■Europe

■Pacific

Net Sales

Business Unit Operating Profit

39%

37%

33%

18 %

12 %

28%

20%

13 %

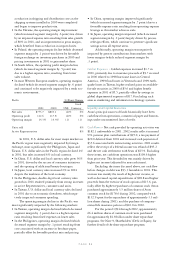

.17

.34

.51

.68

.85

Dividends Paid

Per Common Share

In dollars

98 99 00 01 02

45

90

135

180

225

Capital Expenditures

$ In millions

98 99 00 01 02

3

6

9

12

15

Year-End Market

Capitalization

$ In billions

98 99 00 01 02

Contents

25 Management’s

Discussion and

Analysis of Financial

Condition and Results

of Operations

25 Cautionary Statement

25 Critical Accounting

Estimates

26 Business

27 Results of Operations –

Consolidated

30 Segment Review

34 Liquidity and Capital

Resources

37 Foreign Operations

38 Risk Management

Strategies and Market

Rate Sensitive

Instruments

40 Accounting Changes

40 Contingencies

41 Disclosure Controls

and Procedures

42 Results of Operations

by Quarter

43 Market Prices Per

Share of Common

Stock by Quarter

44 Consolidated

Statements of Income

45 Consolidated Balance

Sheets

46 Consolidated

Statements of

Cash Flows

47 Consolidated

Statements of Changes

in Shareholders’

(Deficit) Equity

48 Notes to Consolidated

Financial Statements

73 Report of Management

and Report of

Independent

Accountants

74 Eleven-Year Review

Table of contents

-

Page 1

... Statement 25 Critical Accounting 28% Estimates 26 Business 27 Results of Operations - 600 Business Unit Operating Profit 12% 18% 37% Consolidated 30 Segment Review 400 34 Liquidity and Capital Resources 37 Foreign Operations 38 Risk Management 33% Strategies and Market Rate Sensitive North America... -

Page 2

... may not sell them to an end user. In general, the Representative, an independent contractor, remits a payment to Avon each sales campaign, which relates to the prior campaign cycle. The Representative is generally precluded from submitting an order for the current sales campaign until the accounts... -

Page 3

...for additional information. Income Taxes and Valuation Reserves > Avon records a tion and measurement principles of Accounting Principles Board ("APB") Opinion 25, "Accounting for Stock Issued to Employees," in accounting for its long-term stockbased incentive plans. No compensation cost related to... -

Page 4

... includes shipping and handling fees billed to Representatives, which totaled $57.7, $42.5 and $40.9 in 2002, 2001 and 2000, respectively. Gross Margin > Gross margin improved in 2002 due to increases in North America (.8 point, which increased consolidated gross margin by .3 point), partially... -

Page 5

... favorable foreign exchange movements in 2001 on Japanese yen contracts ($2.4). Effective Tax Rate > The effective tax rate was higher in 2002 because the net Special charges of $36.3 (see Note 13, Special Charges) gave rise to a lower tax benefit due to the loss positions of certain international... -

Page 6

... initiatives focus on simplifying Avon's marketing processes, taking advantage of supply chain opportunities, strengthening Avon's sales model through the Sales Leadership program and the Internet, streamlining the Company's organizational structure and integrating certain similar activities across... -

Page 7

... as Special charges ($34.3 in 2002 and $94.9 in 2001) and as inventory write-downs in Cost of sales ($2.0 in 2002 and $2.5 in 2001). Segment Review - 2002 Compared to 2001 > North America Net sales Operating profit Operating margin Units sold Active Representatives %/Point 2002 2001 Change $2,412... -

Page 8

... pension plan. See the "Liquidity and Capital Resources" section of Management's Discussion of Results of Operations and Financial Condition. Latin America 2002 2001 Net sales $1,700.1 $1,898.5 378.8 427.5 Operating profit Operating margin 22.3% 22.5% Units sold Active Representatives %/Point Change... -

Page 9

... of new product launches, including the Kiss Goodbye to Breast Cancer lipstick campaign, and inventory clearance programs, partially offset by a temporary pause in Representative recruitment resulting from the events of September 11th. Operating margin in North America declined 0.4 point in 2001... -

Page 10

...a reduction in import duties. In Poland, the operating margin decline (which decreased segment margin by .1 point) was driven by favorable foreign exchange on inventory purchases in 2000 and pricing investments in 2001 to gain market share. In South Africa, the operating profit margin decline (which... -

Page 11

... 13%. As a result, Avon made a cash contribution to its U.S. qualified pension plan of $120.0 in 2002 versus $25.0 in 2001. Despite the stock market's poor performance of recent years, the Company continues to believe that 8.3% is a reasonable long-term rate of return and will continue to evaluate... -

Page 12

... outstanding letters of credit for various trade activities and commercial commitments executed in the ordinary course of business, such as purchase orders for normal replenishment of inventory levels. On February 25, 2003, the Company filed a Registration Statement on Form S-3 with the SEC, which... -

Page 13

... the construction of a new research and development facility), information systems and equipment replacement projects. Foreign Operations For the three years ended 2002, 2001 and 2000, the Company derived approximately 60% of its consolidated net sales and total operating profit from operations of... -

Page 14

... on pricing and recalculating currency risk. The system and equipment conversion costs were not material. Risk Management Strategies and Market Rate Sensitive Instruments Derivative Instruments > As discussed above, Avon operates associated with changes in interest rates and foreign exchange rates... -

Page 15

... exchange gains associated with the Company's foreign exchange contracts did not represent a material change in fair value, earnings or cash flows. Equity Price Risk > Avon is exposed to equity price fluctuations for investments included in the grantors trust (see Note 10, Employee Benefit Plans... -

Page 16

... over-thecounter forward contracts, swaps or options with major international financial institutions. Although Avon's theoretical credit risk is the replacement cost at the then estimated fair value of these instruments, management believes that the risk of incurring credit risk losses is remote and... -

Page 17

... totaling approximately $24.0 at the exchange rates on the date of this filing: $11.0 primarily relating to the documentation of certain sales, and $13.0 relating to excise taxes. The procedural rules for conducting audits in Poland changed effective January 1, 2003, and the Company was informed... -

Page 18

... for inventory write-downs related to the Special charges. (See Note 13, Special charges). 2001 Net sales Other revenue Gross profit* Contract settlement gain, net of related expenses Special charges Operating profit Income before taxes, minority interest and cumulative effect of accounting change... -

Page 19

....12 49.88 2001 Low $38.00 35.55 42.00 43.07 Avon common stock is listed on the New York Stock Exchange. At December 31, 2002, there were 20,852 shareholders of record. The Company believes that there are over 90,000 additional shareholders who are not "shareholders of record" but who beneficially... -

Page 20

... Income Avon Products, Inc. In millions, except per share data Years ended December 31 Net sales Other revenue Total revenue Costs, expenses and other: Cost of sales* Marketing, distribution and administrative expenses Contract settlement gain, net of related expenses (Note 15) Special charges, net... -

Page 21

... and equipment, at cost Land Buildings and improvements Equipment Less accumulated depreciation Other assets Total assets Liabilities and Shareholders' (Deficit) Equity Current liabilities Debt maturing within one year Accounts payable Accrued compensation Other accrued liabilities Sales and taxes... -

Page 22

... for doubtful accounts Amortization of debt discount Foreign exchange (gains) losses Deferred income taxes Net realized losses (gains) on investments Special charges, net of payments Other Changes in assets and liabilities: Accounts receivable Income tax receivable Inventories Prepaid expenses... -

Page 23

...$2.4 Minimum pension liability adjustment, net of taxes of $108.6 Net derivative losses on cash flow hedges, net of taxes of $.2 Total comprehensive income Dividends-$.80 per share Exercise of stock options, including tax benefits of $10.5 1,995,461 Repurchase of common stock Grant, cancellation and... -

Page 24

... U.S. dollar denominated assets, mainly in Argentina, Venezuela, Brazil and Mexico. Foreign exchange in 2001 included transaction gains of $8.0 pretax related to the translation of a U.S. dollar intercompany loan receivable on Avon Argentina's balance sheet. In addition, Cost of sales and Marketing... -

Page 25

...fair values on the Consolidated Balance Sheets as either assets or liabilities (see Notes 2, Accounting Changes, and 7, Financial Instruments and Risk Management). Avon also uses financial instruments, including forward contracts to purchase Avon common stock, to hedge certain employee benefit costs... -

Page 26

... subsequent changes in fair value recognized as gains or losses in the income statement. At December 31, 2002, Avon did not hold any forward contracts to purchase Avon common stock. Research and Development > Research and development costs are expensed as incurred and aggregated in 2002-$48.4 (2001... -

Page 27

...101, Avon changed its revenue recognition policy to recognize revenue upon delivery, when both title and risks and rewards of ownership pass to the independent Representative. In accordance with the provisions of SAB No. 101, the Company recorded a charge to earnings of $6.7, net of a tax benefit of... -

Page 28

...a Philippine company formed to purchase land in the Philippines. The remaining 60% interest is held by Company-sponsored retirement plans. The investment is accounted for under the equity method. At December 31, 2002, Avon guarantees $2.5 of Mirabella's third-party borrowings. Based on current facts... -

Page 29

..., at average annual interest rates of approximately 7.7% and 7.3%, respectively. Such lines have no compensating balances or fees. At December 31, 2002 and 2001, Avon also had letters of credit outstanding totaling $27.7 and $25.9, respectively, which guarantee various insurance activities. In... -

Page 30

...and expense for tax and financial reporting purposes at December 31 consisted of the following: 2002 Deferred tax assets: Postretirement benefits Accrued expenses Special and non-recurring charges Employee benefit plans Foreign operating loss carryforwards Postemployment benefits Revenue recognition... -

Page 31

...foreign subsidiaries. Avon does not enter into derivative financial instruments for trading purposes, nor is Avon a party to leveraged derivatives. Accounting Policies > Derivatives are recognized on the bal- ance sheet at their fair values. The accounting for changes in fair value (gains or losses... -

Page 32

... years ended December 31, 2002 and 2001, the net gains or losses reclassified from OCI to earnings for cash flow hedges that had been discontinued because the forecasted transactions were not probable of occurring, were not material. At December 31, 2002, Avon held foreign currency forward contracts... -

Page 33

... contracts, swaps or options with major international financial institutions. Although the Company's theoretical credit risk is the replacement cost at the then estimated fair value of these instruments, management believes that the risk of incurring credit risk losses is remote and that such losses... -

Page 34

..., "Accounting for Stock-Based Compensation," in lieu of recording the value of the compensation costs of the 2000 Plan, as permitted by FAS No. 123. Had compensation cost for the plans been based on the fair value at the grant dates for awards under those plans consistent with the method prescribed... -

Page 35

... 7.4 million shares at a total cost of approximately $337.4 under this program. Employee Benefit Plans Savings Plan > The Company offers a qualified defined 10 contribution plan for U.S.-based employees, the Avon Products, Inc. 401(k) Personal Savings Account, which allows eligible participants... -

Page 36

... on plan assets (56.6) Company contributions 126.0 - Plan participant contributions Benefits paid (61.3) Foreign currency changes - Settlements/special termination benefits - Ending balance $ 475.8 Funded status of the plan (183.2) 365.4 Unrecognized actuarial loss Unrecognized prior service cost 16... -

Page 37

... of employee terminations on the Company's benefits plans in the U.S. and certain international locations (see Note 13, Special charges). The weighted-average assumptions used to determine the data for the years ended December 31 were as follows: Pension Benefits U.S. Plans 2002 2001 Discount rate... -

Page 38

... periodic benefit cost shown above and in 2002 amounted to $9.7 (2001-$10.5, 2000-$10.2). The benefit obligation under this program at December 31, 2002 was $40.6 (2001-$35.5) and was primarily included in Employee Benefit Plans. Avon also maintains a Supplemental Life Insurance Plan ("SLIP") under... -

Page 39

... - $ 789.9 North America: U.S. U.S. Retail Other Total International: Latin America* Europe Pacific Total Total from operations Global expenses Contact settlement gain, net of related expenses Special charges, net†Total * Avon's operations in Mexico reported net sales for 2002, 2001 and 2000 of... -

Page 40

... accessories. ‡ Beyond Beauty includes home products, gift and decorative and candles. § Health and Wellness includes vitamins, aromatherapy products, exercise equipment, stress relief and weight management products. Depreciation and Amortization 2002 2001 2000 North America $ 42.5 $ 32.4 $ 28... -

Page 41

... initiatives focus on simplifying Avon's marketing processes, taking advantage of supply chain opportunities, strengthening Avon's sales model through the Sales Leadership program and the Internet, streamlining the Company's organizational structure and integrating certain similar activities across... -

Page 42

... to the 2001 charges) affected all business segments as follows: Supply chain Workforce reduction programs Sales transformation initiatives Total accrued charge Adjustment to 2001 special charge Net accrued charge Number of employee terminations U.S. $ 3.2 1.2 1.8 6.2(b) (4.4) $ 1.8 Latin America... -

Page 43

... marketing, information technology, human resources, research and development and strategic planning. The Cost of sales charge for inventory write-downs primarily represents losses associated with store and branch closures (primarily Pacific) as well as the discontinuation of selected product lines... -

Page 44

... Charges: Provision Non-cash write-offs Cash expenditures Balance at December 31, 2002 $69.8 (2.7) - 67.1 (5.7) (1.0) (33.3) $27.1 Cost of Sales Charge $ 2.5 - (2.5 Asset Impairment Charge $ 5.4 - (5.4) - (.6) .6 - $ - Special Termination Benefits $ 11.2 - (11.2 Contract Termination Costs... -

Page 45

... award could be material to the Consolidated Financial Statements. Avon is a defendant in an action commenced in the Supreme Court of the State of New York by Sheldon Solow d/b/a Solow Building Company, the landlord of the Company's former headquarters in New York City. Plaintiff seeks aggregate... -

Page 46

...Supplemental Income Statement Information For the years ended December 31, 2002, 2001 and 2000, the components of Other (income) expense, net were as follows: 2002 Argentina excise tax settlement $ - Foreign exchange (gains) (16.0) losses, net Legal fees 5.7 Amortization of debt issue costs 6.7 and... -

Page 47

Report of Management Report of Independent Accountants To the Board of Directors and Shareholders of Avon Products, Inc. In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, cash flows and changes in shareholders' equity after the ... -

Page 48

... sheet data Working capital Capital expenditures Property, plant and equipment, net Total assets Debt maturing within one year Long-term debt Total debt Shareholders' (deficit) equity Number of employees United States International Total employees(10) (1) In 2002, Avon recorded Special charges... -

Page 49

... Special charges related to this program totaled $136.4 ($111.9 net of tax, or $.43 per share on a diluted basis). In 1999, Avon recorded an Asset impairment charge of $38.1 pretax ($24.0 after tax, or $.09 per share on a diluted basis) related to the write-off of an order management software system...