Asus 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251

|

|

91

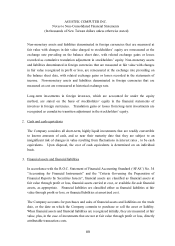

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements

(In thousands of New Taiwan dollars unless otherwise stated)

6. Long-term investments under the equity method

(1) The difference between the acquisition cost and the Company’s share of net assets of the

investee is analyzed and accounted for in the manner similar to acquisition cost

allocation as provided in the R.O.C. SFAS No. 25 “Business Combinations-Accounting

Treatment under Purchase Method” under which goodwill is no longer amortized.

(2) When the Company has control or significant influence over an investee company, the

Company shall account for such investment under the equity method.

(3) If certain long-term equity investments have incurred existing or extremely probable

losses, the Company shall recognize investment loss in proportion to the percentage of

ownership. The investment loss recognized shall first bring down the specific

investment and receivables accounts to zero, then the remaining loss, if any, will be

recorded as “Other liabilities-credit to long-term investments”.

(4) Unrealized intercompany gains or losses arising from transactions between affiliated

companies shall be eliminated. Unrealized gross profits from downstream sales shall be

debited to “unrealized gross profits” and credited to “deferred credits”, whereas

unrealized gross profits from upstream and side-stream sales shall be debited to

“investment loss” and credited to “long-term investments”.

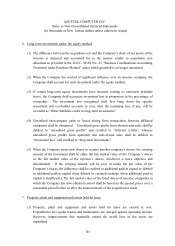

(5) When the Company issues new shares to acquire another company’s shares, the carrying

amount of the investment shall be either the fair market value of the Company’s shares

or the fair market value of the investee’s shares, whichever is more objective and

determinable. If the carrying amount will be over or under the par value of the

Company’s shares, the difference shall be credited to additional paid-in capital or debited

to additional paid-in capital (then debited to retained earnings when additional paid-in

capital is insufficient). The fair market value of the listed shares of investee companies in

which the Company has now obtained control shall be based on the quoted prices over a

reasonable period before or after the announcement of the acquisition is made.

7. Property, plant and equipment and assets held for lease

(1) Property, plant and equipment and assets held for lease are carried at cost.

Expenditures for regular repairs and maintenance are charged against operating income.

However, improvements that materially extend the useful lives of the assets are

capitalized.