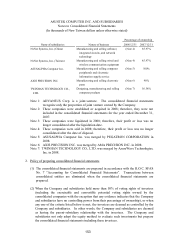

Asus 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

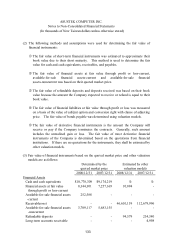

143

2007

2007

2008

(Adjusted)

2008

(Adjusted)

CASH FLOWS FROM OPERATING ACTIVITIES:

CASH FLOWS FROM INVESTING ACTIVITIES:

Consolidated net income

$18,924,931

$30,415,697

Purchase of investments

(2,540,579)

(1,819,211)

Adjustments to reconcile net income to net cash provided by operating activities:

Proceeds from disposal of investments

1,500,079

876,872

Effect of change in exchange rate from foreign consolidated subsidiaries

(75,872)

(316,057)

Refund from capital reduction and liquidation of long-term investments

166,146

18,581

Cash dividends received from investees under the equity method

215,686

41,100

Increase in refundable deposits

(40,307)

(360,731)

Service cost of employee stock option for subsidiaries

5,433

-

Acquisition of property, plant and equipment

(12,689,532)

(15,402,237)

Depreciation

7,983,423

6,417,385

Proceeds from disposal of property, plant and equipment

463,405

533,778

Amortization

2,264,757

1,683,107

I

Purchase of deferred charges and other intangible assets

(4,643,036)

(2,436,416)

Depreciation and devaluation of assets held for lease and idle assets

30,349

8,588

Proceeds from disposal of other assets and intangible assets

71,674

496,102

Impairment loss

952,215

361,755

Decrease in other assets-others

216,622

494

Investment income under the equity method

(52,249)

(113,340)

Increase in consolidation debit

(7,862)

-

Amortization of investment premium arising from acquisition

165,994

99,143

Purchase of minority interests

(49,076)

(56,262)

Gain on disposal of investments

(87,321)

(153,674)

Increase in cash from acquisition of subsidiaries

60,089

338,643

Gain on disposal of assets

(77,342)

(80,678)

Net cash used in investing activities

(17,492,377)

(17,810,387)

Loss on disposal of assets

215,111

288,303

Loss on obsolescence of property, plant and equipment

32,337

7,152

Property, plant and equipment transferred to other expense and loss accounts

5,608

22,801

CASH FLOWS FROM FINANCING ACTIVITIES:

Other accounts transferred to property, plant and equipment

-

(20,429)

Payments for bonus to employees, directors and supervisors

(1,220,106)

(380,173)

Deferred charges transferred to other expense and loss accounts

10,665

14,216

Payments for cash dividends

(9,351,630)

(6,244,458)

Amortization of deferred issuing cost of bonds

3,044

8,140

Redemption of bonds payable

(712,499)

-

Gain on foreign exchange of bonds payable

(74,038)

(27,575)

Increase in short-term loans

7,332,433

1,163,778

Amortization of discount and premium on bonds

267,507

264,646

Increase in deposits received

90,528

51,116

Gain on redemption of bonds payable

(26,350)

-

Redemption of long-term loans

(1,097,852)

(150,956)

(Gain)/Loss on valuation of financial liabilities

(68,979)

250,921

Increase in long-term loans

10,001,484

972,900

Shares trust dividends paid to employees

286,223

-

Subsidiaries' treasury stocks purchased by subsidiaries

(439,928)

-

Changes in operating assets and liabilities:

Cash dividends distributed to minority shareholders

(2,752,496)

-

(Increase)/Decrease in financial assets at fair value through profit or loss-current

(8,529)

(3,887,669)

Increase in subsidiaries' capital from minority shareholders

785,322

3,049,293

(Increase)/Decrease in notes and accounts receivable-net

38,295,786

8,522,689

Net cash provided by/(used in) financing activities

2,635,256

(1,538,500)

(Increase)/Decrease in other receivables-net

(3,056,369)

(1,721,681)

(Increase)/Decrease in inventories-net

6,131,153

9,308,279

Effect of changes of certain subsidiaries

(375,400)

(161,794)

(Increase)/Decrease in prepayments

(705,599)

137,517

(Increase)/Decrease in other current assets

(502,270)

(113,040)

NET INCREASE IN CASH AND CASH EQUIVALENTS

6,132,684

8,894,370

(Increase)/Decrease in deferred income tax assets-current

(1,333,274)

(597,531)

CASH AND CASH EQUIVALENTS, BEGINNING OF THE YEAR

43,585,783

34,691,413

(Increase)/Decrease in deferred pension costs

3,133

1,364

CASH AND CASH EQUIVALENTS, END OF THE YEAR

$49,718,467

$43,585,783

(Increase)/Decrease in accounts receivable-overdue

-

24

(Increase)/Decrease in compensating interest receivable

(19,475)

(54,913)

Increase/(Decrease) in financial liabilities at fair value through profit or loss-current

407

2

SUPPLEMENTAL DISCLOSURES OF CASH FLOWS INFORMATION:

Increase/(Decrease) in notes and accounts payable

(55,570,520)

(29,602,755)

Cash paid during the year for:

Increase/(Decrease) in income tax payable

(1,905,273)

2,507,265

Interest

$501,023

$316,897

Increase/(Decrease) in accrued expenses

2,900,671

3,862,324

Income tax

$8,908,524

$7,020,098

Increase/(Decrease) in other payables

3,478,979

200,683

Increase/(Decrease) in receipts in advance

2,116,671

311,693

INVESTING AND FINANCING ACTIVITIES NOT AFFECTING CASH FLOWS

Increase/(Decrease) in other current liabilities

470,916

46,004

Bonds payable converted to capital stock

$1,484,149

$3,509,518

Increase/(Decrease) in accrued pension liabilities

(56,149)

(34,294)

Bonds payable-current portion

$11,988,037

$-

Increase/(Decrease) in deferred income tax liabilities-noncurrent

189,745

334,093

Long-term loans-current portion

$2,219,239

$672,655

Increase/(Decrease) in other liabilities-others

34,070

13,796

Bonus appropriated to employees

$47,623

$447,410

Issuance of shares in exchange of shares of investee

$-

$2,698,526

Net cash provided by operating activities

21,365,205

28,405,051

Financial assets carried at cost-noncurrent transferred to other receivables

$-

$19,686

The accompanying notes are an integral part of the consolidated financial statements.

English Translations of Financial Statements Originally Issued in Chinese

FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 (Retrospectively Adjusted)

ASUSTEK COMPUTER INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in Thousands of New Taiwan Dollars)