Asus 2008 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2008 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251

|

|

157

ASUSTEK COMPUTER INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(In thousands of New Taiwan dollars unless otherwise stated)

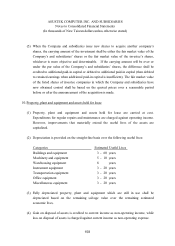

7. Inventories

Inventories are valued at the lower of cost or market value under the gross method. Cost is

determined on a weighted-average basis. The market values of raw materials and supplies

are determined on the basis of replacement cost while the market values of work in process

and finished goods are determined by net realizable value.

8. Noncurrent assets held for sale

The carrying value of noncurrent assets (disposal group) held for sale rather than held for

ongoing operation to recover the carrying value is valued at the either lower of carrying

amount or fair values less costs to sell.

9. Long-term investments under the equity method

(1) The difference between the acquisition cost and the Company’s and subsidiaries’ share

of net assets of the investee is analyzed and accounted for in the manner similar to

acquisition cost allocation as provided in the R.O.C. SFAS No. 25 “Business

Combinations-Accounting Treatment under Purchase Method” under which goodwill is

no longer amortized.

(2) When the Company and subsidiaries have control or significant influence over an

investee company, the Company and subsidiaries shall account for such investment under

the equity method.

(3) If certain long-term equity investments have incurred existing or extremely probable

losses, the Company and subsidiaries shall recognize investment loss in proportion to the

percentage of ownership. The investment loss recognized shall first bring down the

specific investment and receivables accounts to zero, then the remaining loss, if any, will

be recorded as “Other liabilities-credit to long-term investments”.

(4) Unrealized intercompany gains or losses arising from transactions between affiliated

companies shall be eliminated. Unrealized gross profits from downstream sales shall be

debited to “unrealized gross profits” and credited to “deferred credits”, whereas

unrealized gross profits from upstream and side-stream sales shall be debited to

“investment loss” and credited to “long-term investments”.