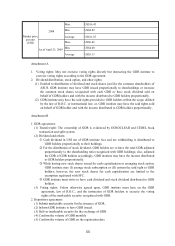

Asus 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

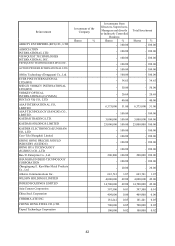

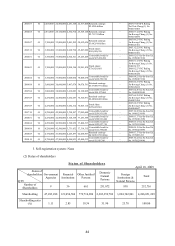

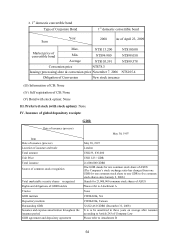

47

ˇˊʳ

shareholders meeting.

Note 3: If the stock dividend is to be adjusted retroactively, please list the earnings per share before and after the

adjustment.

Note 4: According to the regulations of security issuance, if the dividend that is not distributed can be accumulated

till the year with retained earnings, the accumulated unpaid dividend of the year must be disclosed.

Note 5: Profit ratio = Closing price per share of the year / Earning per share

Note 6: Earning ratio = Closing price per share of the year / Cash dividend per share

Note 7: Cash dividend yield rate = Cash dividend per share / Closing price per share of the year

Note 8: Subject to the approval of the annual shareholders meeting.

Note 9: The data collected up to March 31, 2009 were included in the report printed on April 23, 2009 for data accuracy.

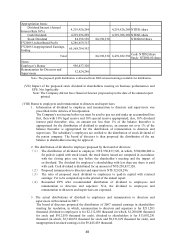

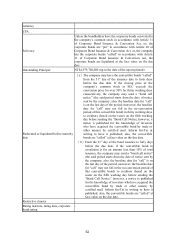

(VI) Execution of Dividend Policy

1. Dividend Policy

The company is in a changing industrial environment and a growing industrial life cycle. For the

company’ s long-term financial planning and the shareholder’ s need for cash inflow, the annual

distribution of cash dividend may not be for an amount below 10% of cash dividend and stock

dividend together.

2. Proposed Distribution of Dividends:

(1)The earnings after tax is NT$16,456,567,092. After being allocated with 10% legal reserve for

NT$ 1,645,656,709, the retained earnings available for distribution in 2008 is

NT$14,810,910,383.The proposed profit distribution will be implemented according to

“Article of Incorporation” in the following way: (Please refer to the Distribution of Retained

Earnings):

i. shareholder dividend: NT$ 4,219,926,269, distributed in cash.

ii. Shareholder cash dividends: NT$ 4,219,926,269.

iii. Shareholder stock dividends: NT$ 84,398,530.

(2) If shareholder’ s cash dividend is less than NT$ 1, the distribution will be made in the form of

cash rounded and adjusted by a specific represent arranged by the Chairman of the Board of

Directors.

(3) The Board of Directors is authorized to adjust the stock dividend per share when the amount

of stock dividend to each share is affected due to the fact that convertible bondholders

exercise their rights to convert bonds into shares, which results in changes in the numbers of

total shares outstanding.

(4) After being resolved in the Shareholder’ s meeting, the proposal of dividend allocation will be

executed on the record date which was determined by the Board of Directors.

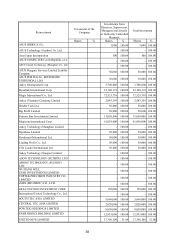

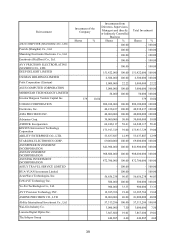

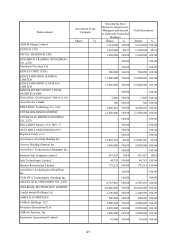

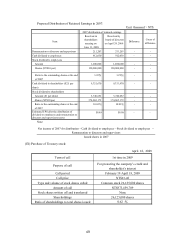

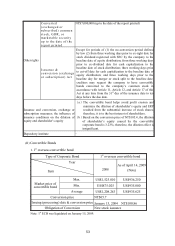

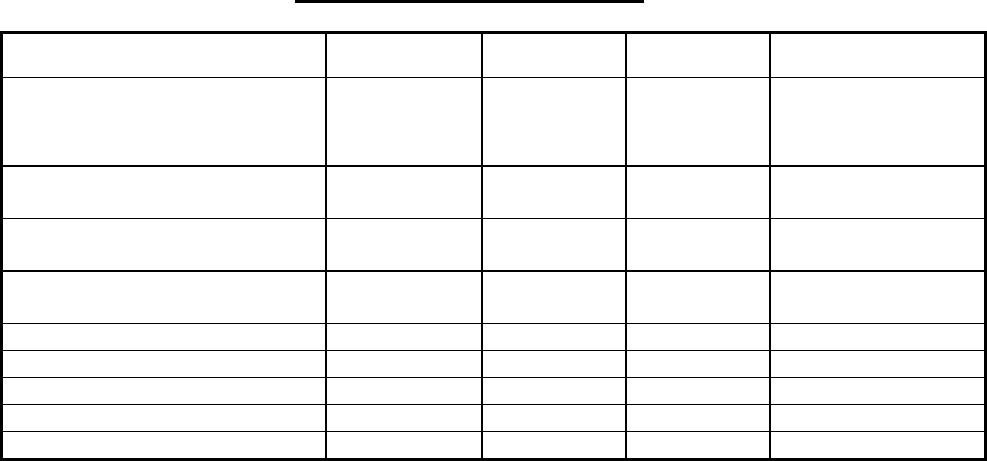

Distribution of Retained Earnings

2008 /Unit: NT$

Account Name Amount Capitalization Cash Remarks

Unappropriated Earning, Beginning

(Before adjusted) 59,950,057,949

(-)The retrospective adjustments

for convertible bonds payable 601,019,446

Unappropriated Earning, Beginning

(Adjusted) 59,349,038,503

(-)Effect of Changes of The

Investee Companies' Equity 66,913,426

Unappropriated Earning 59,282,125,077

FY2008 Profit After Tax 16,456,567,092

(-)10% Legal Reserve 1,645,656,709

FY2008 Distributable Profit 14,810,910,383

FY2008 Distributable Earnings 74,093,035,460