Asus 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251

|

|

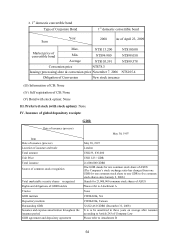

51

ˈ˄ʳ

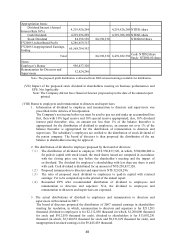

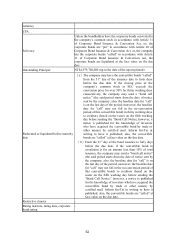

Converted (exchanged

or subscribed) common

stock, GDR, or

marketable security up

to the date of the report

printed

US$273,711,000 (up to the date of the report printed)

Other rights

Issuance & conversion

(exchange or

subscription) Act

Except for the corporate bonds redeemed, called, and

cancelled; also, in the no-conversion period regulated by

law, the creditors may have the corporate bonds

converted from the 31st day of the issuance to ten days

b

efore the due date. For the conversion of corporate

b

onds, it can be converted to common stock as follows:

Derived the numerator by having the principal of the

bond multiples by the exchange rate on the pricing date

(NT$33.82=US$1) and the conversion price at the time o

f

request made as denominator for calculating the

conversion to common stock shares. The company will

not pay cash or others for the amount of odd shares.

Issuance and conversion, exchange or

subscription measures; the influence o

f

issuance conditions on the dilution of equity

and shareholder’ s equity

(a) The corporate bond is with 0% interest rate; therefore,

it is possible to acquire long-term fund at low cost and

interest expense. The conversion price of this

convertible bond is based on the issuance of common

stock with premium; therefore, no negative impact on

the shareholder’ s equity. Moreover, if investors

exercise “put” or the corporate bond is due and

liquidated, the company will have the corporate bond

“redeemed” at a price below the principal; therefore,

it is with a positive effect on the shareholder’ s equity.

(b) Based on the conversion price of NT$100.86, the

dilution of shareholder’ s equity caused by the

convertible corporate bond is 4.7%; therefore, the

dilution effect is insignificant.

Depository institute -

Note: 1st ECB was liquidated on January 15, 2009.

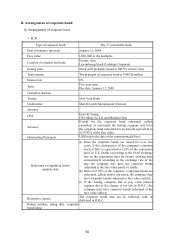

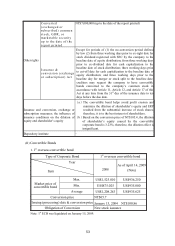

2. CB

Type of corporate bond The 1st domestic convertible bond

Date of issuance (process) November 7, 2006

Face value NT$100 thousand

Location of issuance and trade Taiwan, GreTai securities market

Issuing price Issued at the face value 100%

Total amount NT$12,000,000 thousand

Interest rate 0%

Term Five-year term

Due date: November 7, 2011

Guarantee institute -

Trustee Trust Department of FuBon Bank

Underwriter FuBon Securities Co.