Acer 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report112

Financial Standing

Acer Incorporated 2008 Annual Report 113

(d) Other expenses

In 2007 and 2008, the Consolidated Companies paid iD Soft Capital Inc. management service fees

amounting to NT$69,333 and NT$61,633, respectively.

(e) Advances to/from related parties

The Consolidated Companies paid certain expenses on behalf of related parties. Additionally, related

parties paid certain expenses and accounts payable on behalf of the Consolidated Companies. As of

December 31, 2007 and 2008, the Consolidated Companies had aggregate receivables from related

parties of NT$59,403 and NT$45,173, respectively, and payables to related parties of NT$609,717 and

NT$189,964, respectively, resulting from these transactions.

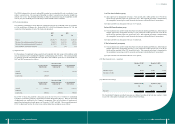

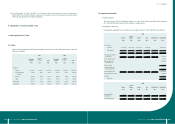

(3) Main management compensation

As of December 31, 2007 and 2008, the gross compensation of the Consolidated Companies’ main

management was as follows:

2007 2008

Amount Amount

NT$ NT$ US$

Salaries 178,334 249,243 7,595

Cash awards and special allowances 69,669 134,574 4,101

Business expense 6,520 1,989 60

Employee bonus 482,825 360,581 10,987

737,348 746,387 22,743

The estimated employee bonus and directors’ and supervisors’ remuneration discussed in note 4(20)

includes the above amounts.

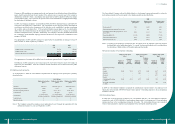

6. Pledged Assets

Assets pledged for various purposes were as follows:

Book value of pledged assets

at December 31,

Pledged assets Pledged to secure 2007 2008

NT$ NT$ US$

Cash in bank and time deposits Contract bidding and project

fulllment

398,459 109,586 3,339

Property, plant and equipment,

and property not in use

Credit lines of bank loans 1,692,140 4,902 149

2,090,599 114,488 3,488

As of December 31, 2007 and 2008, the above pledged cash in bank and time deposits were classied as “other

nancial assets” and “restricted assets ‒ current” in the accompanying consolidated balance sheets.

In 2007, the Consolidated Companies intended to acquire Packard Bell B.V., a company in Europe, with cash.

As of December 31, 2007, the Consolidated Companies had deposited NT$1,958,585 to an escrow account for

the purpose of business acquisition. The escrow deposit was recorded in “restricted assets – current” in the

accompanying consolidated balance sheets. The business combination was completed on March 14, 2008.

7. Commitments and Contingencies

(1) Royalties

(a) The Company has entered into a patent cross license agreement with IBM. The agreement mainly states

that both parties have the right to make use of either party’s global technological patents to manufacture

and sell personal computer products. The Company agrees to make xed payments periodically to IBM,

and the Company will not have any additional obligation for the use of IBM patents other than the xed

amounts of payments agreed upon.

(b) The Company and Lucent Technologies Inc. entered into a Patent Cross License agreement. The license

agreement in essence authorizes both parties to use each other’s worldwide computer-related patents for

manufacturing and selling personal computer products. The Company agrees to make fixed payments

periodically to Lucent, and the Company will not have any additional obligation for the use of Lucent

patents other than the xed amounts of payments agreed upon.

(c) On June 6, 2008, the Company entered into a Patent Cross License agreement with Hewlett Packard

Development Company (HP). The previous patent infringement was settled out of court, and the Company

agreed to make xed payments periodically to HP. The Company will not have any additional obligation

for the use of HP patents other than the xed amounts of payments agreed upon.

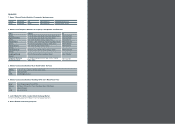

(2) Others

As of December 31, 2007 and 2008, the Company had provided outstanding stand-by letters of credit totaling

NT$133,085 and NT$133,304, respectively, for bidding on sales contracts and for customs duty contract

implementation.

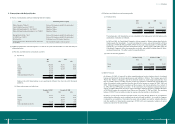

(3) The Consolidated Companies have entered into several operating lease agreements for warehouses, land and

ofce buildings. Future minimum lease payments were as follows:

Year NT$ US$

2009 528,674 16,109

2010 305,084 9,296

2011 126,589 3,857

2012 72,843 2,220

2012 and thereafter 114,930 3,502

1,148,120 34,984