Acer 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report36

Capital and Shares

Acer Incorporated 2008 Annual Report 37

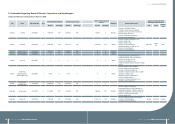

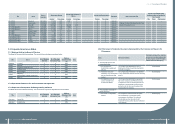

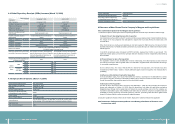

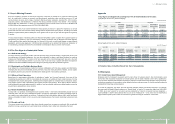

4.4 Global Depository Receipts (GDRs) Issuance (March 31, 2009)

Date of issuance

Description November 1,1995 July 23, 1997

Date of issuance November 1,1995 July 23, 1997

Location of issuance and transaction London London

Total amount of issuance US$220,830,000 US$160,600,000

Unit price of issuance US$32.475 US$40.15

Total number of units issued 6,800,000units 4,000,000units

Sources of valuable securities

demonstrated Capital increased in cash Capital increased in cash

Number of valuable securities

demonstrated

Each unit stands for Acer’s 5 common

shares

Each unit stands for Acer’s 5 common

shares

Rights and obligations of GDR holders Same as Acer’s common shareholders Same as Acer’s common shareholders

Consignee None None

Depository organization Citicorp Citicorp

Custodian organization Citibank Taipei Branch Citibank Taipei Branch

Balance not retrieved 9,927,667 units of Global Deposit Receipt as representing

49,638,422 shares of common stocks

Method to allocate fees incurred during

the period of issuance and existence

The expenses incurred by issuance being

taken to offset premium reserve. Expenses

incurred during existence being taken as

expenses of the current term.

The expenses incurred by issuance being

taken to offset premium reserve. Expenses

incurred during existence being taken as

expenses of the current term.

Any key issue for the depository and

custodian agreements None None

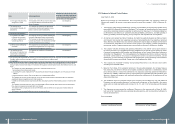

Market

Price Per

Share

2008

Highest US$11.50

Lowest US$ 5.95

Average US$ 8.86

Until Mar.

31th, 2009

Highest US$ 7.55

Lowest US$ 5.94

Average US$ 6.65

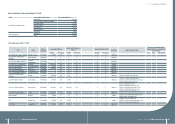

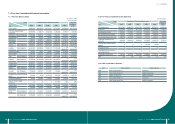

4.5 Employee Stock Options: (March 31, 2009)

Employee Stock Option Granted First Grant of 2008

Approval Date by the Authority September 15, 2008

Grant Date November 03, 2008

Number of Options Granted 14,000 units

Percentage of Shares Exercisable

to Outstanding Common Shares (%) 0.5297

Option Duration 3 years

Source of Option Shares new Common stocks

Vesting Schedule From the 2nd anniversary of the grant date, except that all or partial options revoked

by the company, 100% vested options can be exercised without conditions

Shares Exercised 0

Value of Shares Exercised NT$ 0

Shares Unexercised 14,000,000 shares

Adjusted Exercise Price Per Share NT$ 25.28

Percentage of Shares Unexercised

to Outstanding Common Shares (%) 0.52975

Impact on Shareholders’ Equity Dilution to Shareholders’ Equity is limited.

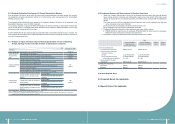

4.6 Issuance of New Shares Due to Company’s Mergers and Acquisitions:

4.6.1 Underwriter’s Opinion for the Mergers and Acquisitions

1. Underwriter’s Opinion of the Impact of Acer’s Operating Business, Financial Aspect and Stock Holders’ Equity

(1) Impact of Acer’s Operating Business after Acquisition

Acer ranked among the world’s top ve PC vendors, and E-ten was a leading vendor of smart handheld devices.

The merger of the two companies was anticipated to expand Acer’s product offering and client base, and

increase sales.

When E-ten became a wholly-owned subsidiary of Acer and merged its R&D resources, the launch of Acer

branded smartphones in Q4 2008 immediately enhanced our product offering in the mobile Internet device (MID)

market segment.

In Q4 2008, smartphone sales increased to NT$110.24 billion, representing 10.69% on-year growth. This

signicant increase goes to prove the new synergies that were expected, in terms of expanded product offering

and client base.

(2) Financial Impact on Acer after Acquisition

The acquisition of E-ten not only beneted Acer in terms of technology in the MID segment, but also enhanced

our scale of procurement. With the greater scale, Acer was able to negotiate better costs and reect the savings

in our product competitiveness.

On the balance sheet, Acer issued 168,158,878 new shares for this acquisition, and increased long term

investments by NT$8.7 billion. Growth in the Q4 2008 sales again shows the acquisition has increased Acer’s

protability.

(3) Inuence on Stockholders’ Equity after Acquisition

As for stockholder’s equity, Acer issued 168,158,878 new shares in exchange for 179,930,000 E-ten shares;

hence Acer’s long term investment increased by NT$8.7 billion and then increase its book value per share.

Overall, the acquisition has a positive impact on Acer stockholder’s equity.

(4) Evaluation of the Acquisition

The date of Acer’s and E-ten’s share conversion was September 1, 2008, and the Company has issued the

shares and registered on October 14, 2008. After this acquisition, both sides will gain better purchasing

bargaining power through Acer’s supply chain and reduce the overall purchase cost so that the company can

increase its stockholder’s equity and protability. Both sides also can enhance company’s competitiveness and

profitability by sharing resources of financial, business, channels, purchasing, R&D and Acer’s global brand

image. It’s foreseen that the coalition synergy will gradually emerge.

2. Execution Update and Impact of Acer’s Stock Holders’ Equity of the Unachieved Goals: Not applicable.

4.6.2 Resolutions of Mergers and Acquisitions in the Meeting of the Board of Directors in the

Previous Year: None