Acer 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report90

Financial Standing

Acer Incorporated 2008 Annual Report 91

In October 2007, the Company reduced its investment in Apacer to an ownership interest of less than

50% and no longer held a controlling interest in Apacer. Consequently, Apacer was excluded from the

consolidated nancial statements, and the investments in Apacer were accounted for using the equity method.

The Consolidated Companies continuously decreased their ownership in Apacer in 2008, and thus had no

signicant inuence over Apacer’s operating and nancial policies. Commencing on August 1, 2008, the

investments in Apacer were reclassied as “nancial assets carried at cost ‒ noncurrent”.

Commencing from December 31, 2007, the Consolidated Companies decreased their ownership interest

in HiTRUST.COM and thus had no significant influence over HiTRUST.COM’s operating and financial

policies. Consequently, the equity investments in HiTRUST.COM were reclassified as “financial assets

carried at cost ‒ noncurrent”.

In 2007, the Consolidated Companies sold portions of their investments in Wistron, Apacer, HiTRUST.

COM, and other investees, and an aggregate gain of NT$1,834,450 was recognized from these sales.

In 2008, the Company sold portions of their investment in Wistron, and recognized a disposal gain of

NT$1,441,906.

In 2008, the Consolidated Companies recognized liquidation loss of NT$7,262 on EB EASY (TWN) Corp.

The loss was recorded under “other investment loss” in the accompanying consolidated income statements.

The Company’s capital surplus was reduced by NT$169,810 and NT$78,255 in 2007 and 2008, respectively,

as a result of recognizing changes in investees’ equity accounts or disposal of equity-method investments.

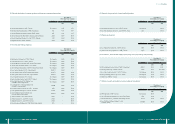

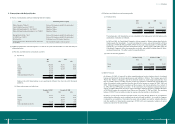

(11) Available-for-sale nancial assets ‒ noncurrent

December 31, 2007 December 31, 2008

NT$ NT$ US$

Qisda Corporation (“Qisda”) 2,655,514 520,718 15,867

Silicon Storage Technology Inc. (“Silicon”) 10,571 8,192 249

Yosun Industrial Corp. 704,762 386,660 11,782

RoyalTek Co., Ltd. - 93,390 2,846

Quanta Computer Inc. -151,527 4,617

3,370,847 1,160,487 35,361

The Company sold all its ownership interest in a subsidiary, Sertek Inc., on July 1, 2007. The price

included cash consideration and stock consideration amounting to 27,000,000 shares of Yosun Industrial

Corp. Through the acquisition of E-Ten Information System Co., Ltd. in September 2008, the Consolidated

Companies increased their investment in RoyalTek Co., Ltd. and Quanta Computer Inc.

In 2007, the Consolidated Companies sold portions of their investments in Qisda, Silicon and other investees,

and an aggregate gain of NT$109,491 was recognized from these sales. In 2008, no disposal activities

occurred.

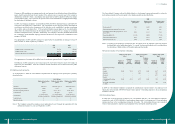

(12) Property, plant and equipment

The Company’s subsidiary ACI sold the ofce building located in Singapore in March 2008, with a disposal

gain of NT$788,944. Additionally, the Company’s subsidiary Gateway disposed of computer equipment and

machinery in 2008 with a loss of NT$269,057. The gain and loss were netted and recorded under “gain on

disposal of property and equipment, net” in the accompanying consolidated income statements.

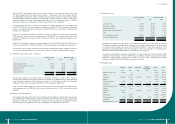

(13) Property not in use

December 31, 2007 December 31, 2008

NT$ NT$ US$

Leased assets ‒ land 818,630 807,538 24,607

Leased assets ‒ buildings 2,855,547 2,827,810 86,166

Damaged ofce premises 457,558 457,558 13,942

Property held for sale and development 1,761,173 1,391,260 42,393

Others - 29,019 884

Less: Accumulated depreciation (543,805) (570,088) (17,371)

Accumulated asset impairment (1,543,000) (1,946,376) (59,308)

3,806,103 2,996,721 91,313

Damaged office premises are office premises that suffered fire damage. As of December 31, 2008 the

Consolidated Companies concluded that the possibility for the damaged ofce premises to be fully repaired

was remote; hence, the repair cost accrual of NT$161,308, recorded in “other current liabilities” in the

accompanying consolidated balance sheet as of December 31, 2007, was reclassied as accumulated asset

impairment, and an additional impairment loss of NT$221,931 was recognized.

For certain land acquired, the registered ownership has not been transferred to the land acquirer, APDI,

a subsidiary of the Company. To protect APDI’s interests, APDI has obtained signed contracts from the

titleholders assigning all rights and obligations related to the land to APDI. Additionally, the land title

certicates are held by APDI, and APDI has registered its liens thereon.

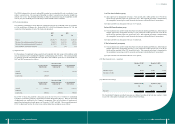

(14) Intangible assets

Goodwill Patents Trademarks Customer

Relationships Others Total

NT$ NT$ NT$ NT$ NT$ NT$

Balance at January 1, 2007 244,328 171 - - 152,183 396,682

Additions - 415,701 - - 78,168 493,869

Acquisitions 16,654,264 1,116,481 5,504,220 1,551,042 570,729 25,396,736

Disposal - (120) - - (3,410) (3,530)

Translation adjustment (7,876) 553 73 494 3,356 (3,400)

Amortization -(59,074) (6,054) (40,457) (248,279) (353,864)

Balance at December 31, 2007 16,890,716 1,473,712 5,498,239 1,511,079 552,747 25,926,493

Additions - 89,177 - - 80,147 169,324

Acquisitions 5,520,031 -2,634,244 151,100 1,871,300 10,176,675

Disposal (32,532) - - - (4,339) (36,871)

Reclassication - (727,381) - - (453,200) (1,180,581)

Translation adjustment 195,825 (20,326) (32,122) 11,722 (14,327) 140,772

Amortization - (122,344) (32,805) (156,552) (137,346) (449,047)

Balance at December 31, 2008 22,574,040 692,838 8,067,556 1,517,349 1,894,982 34,746,765