Acer 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report94

Financial Standing

Acer Incorporated 2008 Annual Report 95

The ETEN trademark for the stock trading PDA product has an indenite life and, accordingly, is not

subject to amortization. The customer relationship is subject to amortization using the straight-line

method over 7 years. The developed technology is subject to amortization using the straight-line method

over 10 years, the estimated period in which the economic benets will be consumed.

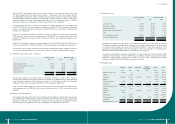

(b) Pro forma information

The following unaudited pro forma financial information presents the combined results of operations

as if the acquisitions of Gateway Inc., Packard Bell B.V., and E-Ten Information Systems Co., Ltd. had

occurred as of the beginning of each of the scal years presented:

2007 2008

NT$ NT$ US$

Revenue 574,749,174 550,172,239 16,764,344

Net income from continuing operations before income tax 17,498,019 14,676,395 447,206

Net income from continuing operations after income tax 14,343,978 11,521,166 351,062

Basic earnings per common share (in dollars) 5.72 4.44 0.14

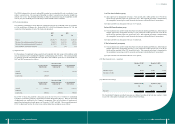

(c) Impairment test

For the purpose of impairment testing, goodwill and trademarks and trade names with indenite useful

lives are allocated to the Consolidated Companies’ cash-generating units (CGUs). The carrying amounts

of signicant goodwill and trademarks and trade names with indenite useful lives as of December 31,

2007 and 2008, are presented as follows:

December 31, 2007

Acer Pan-America

business group

Packard Bell brand

business group

E-Ten Information

System group

Goodwill $ 16,654,264 -166,604

Trademarks

& trade names 4,930,120 - -

December 31, 2008

Acer Pan-America

business group

Packard Bell brand

business group

E-Ten Information

System group

Goodwill $ 18,768,929 1,699,593 1,901,821

Trademarks

& trade names 4,988,336 2,067,836 450,900

Each CGU to which the goodwill is allocated represents the lowest level within the Consolidated

Companies at which the goodwill is monitored for internal management purposes. Based on the results

of impairment tests conducted by the Company’s management, there was no evidence of impairment of

goodwill and trademarks and trade names as of December 31, 2007 and 2008. The recoverable amount of

a CGU is determined based on the value in use, and the related key assumptions are as follows:

Acer Pan-America business group

(i) dgets approved by management covering a 5-year period, and a stable growth rate of 3% for the

future earnings potential of the CGU beyond ve years. This expected growth rate is determined by

the assumptions concerning the overall economic environment and introduction of new products.

(ii) Future cash ows are discounted at the rate of 13.7 percent.

Packard Bell brand business group

(i) The assessment used cash ow projections based on historical operating performance, future nancial

budgets approved by management covering a 5-year period, and a stable growth rate of 2% for the

future earnings potential of the CGU beyond ve years. This expected growth rate is determined by

the assumptions concerning the overall economic environment and introduction of new products.

(ii) Future cash ows are discounted at the rate of 11.8 percent.

E-Ten Information System group

(i) The assessment used cash ow projections based on historical operating performance, future nancial

budgets approved by management covering a 5-year period, and a stable growth rate of 3% for the

future earnings potential of the CGU beyond ve years. This expected growth rate is determined by

the assumptions concerning overall the economic environment and introduction of new products.

(ii) Future cash ows are discounted at the rate of 18.7 percent.

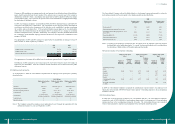

(15) Other nancial assets ‒ noncurrent

December 31, 2007 December 31, 2008

NT$ NT$ US$

Refundable deposits 687,109 781,080 23,800

Noncurrent receivables 274,284 87,680 2,672

961,393 868,760 26,472

(16) Short-term borrowings

December 31, 2007 December 31, 2008

NT$ NT$ US$

Bank loans 5,372,109 1,086,851 33,117

The Consolidated Companies provided some assets as collateral according to the bank loan contracts. Refer

to note 6 for a description of pledged assets related to these borrowings.