Acer 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report60

Financial Standing

Acer Incorporated 2008 Annual Report 61

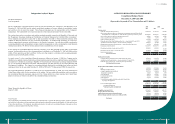

Independent Auditors’ Report

The Board of Directors

Acer Incorporated:

We have audited the consolidated balance sheets of Acer Incorporated (the “Company”) and subsidiaries as of

December 31, 2007 and 2008, and the related consolidated statements of income, changes in stockholders’ equity,

and cash flows for the years then ended. These financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on these nancial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the Republic of China and with

the “Regulations Governing Auditing and Certication of Financial Statements by Certied Public Accountants”.

Those standards and regulations require that we plan and perform the audit to obtain reasonable assurance about

whether the nancial statements are free of material misstatement. An audit includes examining, on a test basis,

evidence supporting the amounts and disclosures in the nancial statements. An audit also includes assessing the

accounting principles used and signicant estimates made by management, as well as evaluating the overall nancial

statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated nancial statements referred to in the rst paragraph present fairly, in all material

respects, the nancial position of Acer Incorporated and subsidiaries as of December 31, 2007 and 2008, and the

results of their operations and their cash ows for the years then ended, in conformity with accounting principles

generally accepted in the Republic of China.

As stated in note 3 to the consolidated financial statements, effective on January 1, 2008, the Company and its

subsidiaries recognized, measured and disclosed share-based payment transactions, employee bonuses, and directors’

and supervisors’ emoluments according to Republic of China Statement of Financial Accounting Standards (SFAS)

No. 39 “Accounting for Share-based Payment” and Interpretation (96) 052 issued by the Accounting Research and

Development Foundation. The changes in accounting principle decreased the consolidated net income and basic

earnings per share for the year ended December 31, 2008, by NT$1,483,776 thousand and NT$0.60, respectively.

The consolidated nancial statements as of and for the year ended December 31, 2008, have been translated into

United States dollars solely for the convenience of the readers. We have audited the translation, and in our opinion,

the consolidated financial statements expressed in New Taiwan dollars have been translated into United States

dollars on the basis set forth in note 2(26) to the consolidated nancial statements.

Taipei, Taiwan (the Republic of China)

March 27, 2009

Note to Readers

The accompanying consolidated nancial statements are intended only to present the nancial position, results of operations

and cash ows in accordance with accounting principles and practices generally accepted in the Republic of China and not those

of any other jurisdictions. The standards, procedures and practices to audit such consolidated financial statements are those

generally accepted and applied in the Republic of China.

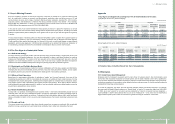

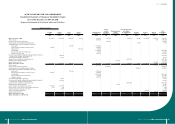

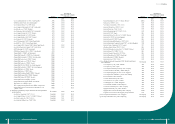

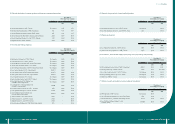

ACER INCORPORATED AND SUBSIDIARIES

Consolidated Balance Sheets

December 31, 2007 and 2008

(Expressed in thousands of New Taiwan dollars and US dollars)

Assets 2007 2008

NT$ NT$ US$

Current assets:

Cash and cash equivalents (note 4(1)) 37,945,339 22,141,725 674,682

Notes and accounts receivable, net of allowance for doubtful accounts of NT$2,356,672

and NT$898,972 as of December 31, 2008 and 2007, respectively (notes 4(2) and 6)

101,898,281

107,826,311

3,285,584

Notes and accounts receivable from related parties (note 5) 448,481 841,465 25,640

Other receivable from related parties (note 5) 59,403 45,173 1,376

Other receivables (note 4(3)) 7,375,569 8,807,454 268,373

Financial assets at fair value through prot or loss ‒ current (notes 4(5) and 4(25)) 19,982 354,751 10,810

Available-for-sale nancial assets ‒ current (notes 4(4) and 4(25)) 2,852,061 591,444 18,022

Hedging-purpose derivative nancial assets ‒ current (notes 4(6) and 4(25)) 235,198 1,022,782 31,165

Inventories (notes 4(7) and 6) 33,815,697 40,028,195 1,219,702

Prepayments and other current assets (note 4(8)) 2,828,601 1,525,555

46,485

Deferred income tax assets ‒ current (note 4(19)) 1,914,006 2,282,943 69,564

Restricted assets (note 6) 2,233,583 922,794 28,119

Total current assets 191,626,201 186,390,592 5,679,522

Funds and investments:

Long-term equity investments under equity method (note 4(10)) 4,689,684 2,928,790 89,243

Available-for-sale nancial assets ‒ noncurrent (notes 4(11) and 4(25)) 3,370,847 1,160,487 35,361

Financial assets carried at cost ‒ noncurrent (notes 4(9) and 4(25)) 3,142,121 2,684,270 81,793

Total funds and investments 11,202,652 6,773,547 206,397

Property, plant and equipment (notes 4(12) and 6):

Land 1,560,568 2,678,408 81,614

Buildings and improvements 3,627,214 5,294,056 161,316

Computer equipment and machinery 4,367,924 3,348,086 102,020

Transportation equipment 114,923 120,069 3,659

Ofce equipment 985,679 1,128,167 34,376

Leasehold improvements 487,647 816,904 24,892

Other equipment 723,029 1,136,428 34,628

Construction in progress and advance payments for purchases

of property and equipment 490,749 30,692 935

12,357,733 14,552,810 443,440

Less: accumulated depreciation (3,446,629) (4,922,662) (149,999)

accumulated impairment (274,663) (293,927) (8,956)

Net property, plant and equipment 8,636,441 9,336,221 284,485

Intangible assets (note 4(14)) 25,926,493 34,746,765 1,058,772

Property not in use (note 4(13)) 3,806,103 2,996,721 91,313

Other nancial assets (notes 4(15), 4(25) and 6) 961,393 868,760 26,472

Deferred charges and other assets (notes 4(18) and 4(19)) 1,124,059 2,329,619 70,986

Total assets 243,283,342 243,442,225 7,417,947