Acer 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report106

Financial Standing

Acer Incorporated 2008 Annual Report 107

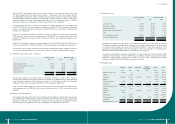

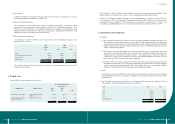

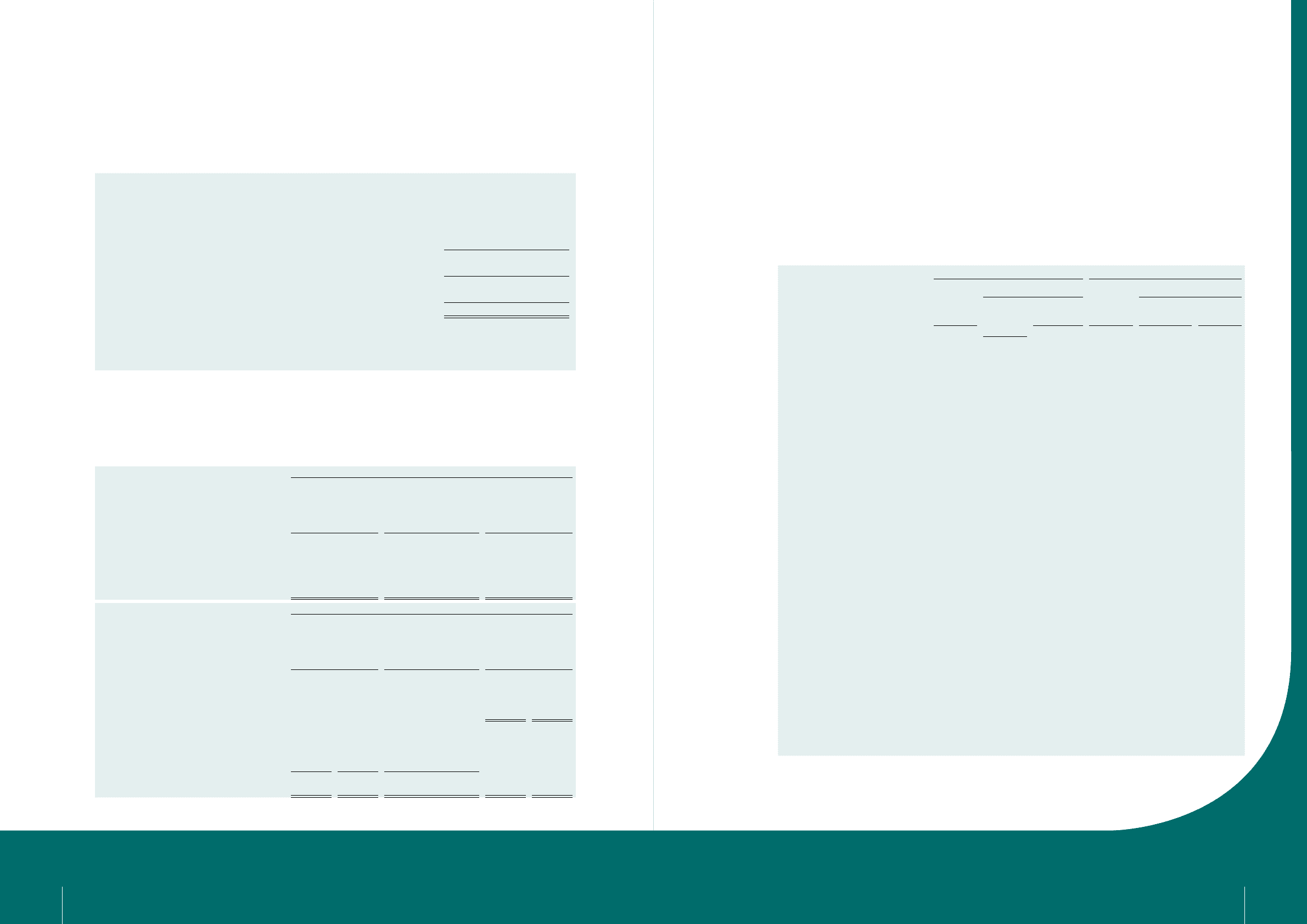

(23) Net income from discontinued operations

On July 1, 2007, the Company disposed of all its ownership interest in a subsidiary, Sertek Inc. The

operations of Sertek Inc. are classied as discontinued operations. The relevant income (loss) and cash ows

of the discontinued operations were as follows:

2007

NT$

Net revenues 9,398,700

Cost of revenues and operating expenses (9,224,222)

Non-operating income and expenses (64,502)

Income before income taxes 109,976

Income tax expense (23,120)

Net income from discontinued operations 86,856

Gain from disposal of discontinued operations 431,010

Total net income from discontinued operations 517,866

Discontinued operations’ cash ows:

Cash provided by (used in) operating activities (69,408)

Cash used in investing activities (645)

Cash used in nancing activities (118,307)

According to the sales agreement, if Sertek Inc. was able to achieve the stipulated profit in 2007, the

Company would be entitled to a contingent consideration. Accordingly, the Company obtained the

contingent consideration in cash amounting to NT$99,843 in 2008.

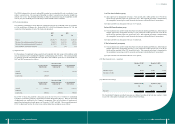

(24) Earnings per common share (“EPS”)

2007

Amount

Weighted-

average number

of outstanding

shares of common stock

(in thousands)

EPS

(in dollars)

NT$ NT$

Basic EPS – after retroactive adjustments:

Net income attributable to shareholders of

parent company 12,958,933 2,432,594 5.33

2008

Amount

Weighted-

average number

of outstanding

shares of common stock

(in thousands)

EPS

(in dollars)

NT$ US$ NT$ US$

Basic EPS – after retroactive adjustments:

Net income attributable to shareholders of

parent company 11,742,135 357,796 2,487,238 4.72 0.14

Diluted EPS:

Effect of dilutive potential common shares:

Employee bonus - - 39,042

Employee stock option plan - - 1,286

Net income attributable to shareholders of

parent company 11,742,135 357,796 2,527,566 4.65 0.14

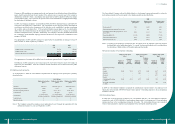

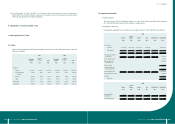

(25) Disclosure of nancial instruments

(a) Fair values of nancial instruments

The book value of short-term nancial instruments is considered to be the fair value because of the short-

term maturity of these instruments. Such method is applicable to cash and cash equivalents, notes and

accounts receivable (including receivables from related parties), other receivables (including receivables

from related parties), notes and accounts payables (including payables to related parties), short-term

borrowings, current installments of long-term debt and royalties payable.

The estimated fair values and carrying amounts of all other nancial assets and liabilities as of December

31, 2007 and 2008, were as follows:

2007 2008

Fair value Fair value

Carrying

amount

Public

quoted

price

Valuation

amount

Carrying

amount

Public quoted

price

Valuation

amount

NT$ NT$ NT$ NT$ NT$ NT$

Non-derivative nancial instruments

Financial assets:

Available-for-sale nancial assets –

current

2,852,061 2,852,061 -591,444 591,444 1

Financial assets carried at cost 3,142,121 - see below (b) 2,684,270 - see below

(b)

Available-for-sale nancial assets –

noncurrent

3,370,847 3,370,847 1,160,487 1,160,487 -

Refundable deposits (classied as

“other nancial assets”)

687,109 -687,109 781,080 - 781,080

Noncurrent receivables (classied

as “other nancial assets”)

274,284 - 274,284 87,680 -87,680

Financial liabilities:

Long-term debt 16,790,876 -16,790,876 4,134,920 - 4,134,920

Derivative nancial instruments

Financial assets:

Foreign currency forward contracts 250,197 -250,197 1,302,085 -1,302,085

Foreign currency options 4,983 - 4,983 60,514 -60,514

Cross currency swap - - - 7,821 - 7,821

Foreign exchange swap - - - 7,113 - 7,113

Financial liabilities:

Foreign currency forward contracts 1,461,335 -1,461,335 1,860,479 -1,860,479

Foreign currency options 593 -593 23,298 - 23,298