Acer 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report96

Financial Standing

Acer Incorporated 2008 Annual Report 97

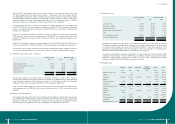

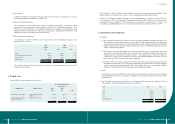

(17) Long-term debt

December 31, 2007 December 31, 2008

NT$ NT$ US$

Citibank syndicated loan 16,500,000 12,200,000 371,747

Other bank loans 308,242 184,920 5,634

Less: current installments (17,366) (8,250,000) (251,386)

16,790,876 4,134,920 125,995

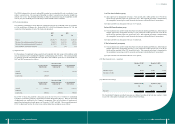

The Company entered into a syndicated loan agreement with Citibank, the managing bank of the syndicated

loan, on October 11, 2007, and the terms were as follows:

December 31,

2007

December 31,

2008

Type of Loan Creditor Credit Line Term NT$ NT$

Unsecured

loan

Citibank and

other banks

(1) Term tranche of

NT$16.5 billion;

three-year limit

during which

revolving credits

disallowed

(1) Repayable in 4 semi-

annual installments

starting from April 2009.

An advance repayment

of $4,300,000 was made

in the rst quarter of

2008.

16,500,000 12,200,000

(2) Revolving tranche of

NT$3.3 billion; three-

year limit

(2) One-time repayment in

full in October 2010.

- -

Less: current installment -(8,250,000)

16,500,000 3,950,000

The interest rate of the above-mentioned syndicated loan was 3.02% in 2007 and 3.06% in 2008. According

to the loan agreement, the Company is required to maintain certain nancial ratios based on annual and semi-

annual audited nancial statements. If the Company fails to meet any of the nancial ratios, the managing

bank will request in writing that the Company take action to improve within 30 days. No assertion of

breach of contract will be tenable if the nancial ratios are met within 30 days. Based on the 2008 nancial

statements, the Company has complied with the aforementioned debt covenants.

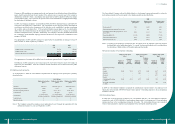

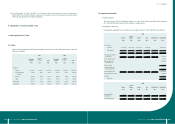

(18) Retirement plans

The following table sets forth the benet obligation and accrued pension liabilities related to the Consolidated

Companies’ dened benet retirement plans:

2007

Plan assets in excess

of accumulated benet

obligation

Accumulated benet

obligation in excess

of plan assets

NT$ NT$

Benet obligation:

Vested benet obligation - (108,087)

Nonvested benet obligation - (491,318)

Accumulated benet obligation -(599,405)

Projected compensation increases -(559,351)

Projected benet obligation -

(1,158,756)

Plan assets at fair value - 507,358

Funded status -(651,398)

Unrecognized pension loss - 730,346

Unrecognized prior service cost - 558

Unrecognized transition (assets) obligation - 1,829

Minimum pension liability adjustment - (172,784)

Accrued pension liabilities - (91,449)

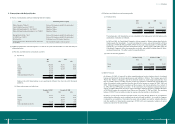

2008

Plan assets in excess

of accumulated

benet obligation

Accumulated benet

obligation in excess

of plan assets

NT$ US$ NT$ US$

Benet obligation:

Vested benet obligation (124,967) (3,808) (33,041) (1,007)

Nonvested benet obligation (469,607) (14,309) (100,237) (3,054)

Accumulated benet obligation (594,574) (18,117) (133,278) (4,061)

Projected compensation increases (335,873) (10,235) (52,666) (1,605)

Projected benet obligation (930,447) (28,351) (185,944) (5,666)

Plan assets at fair value 643,793 19,617 59,610 1,816

Funded status (286,654) (8,734) (126,334) (3,850)

Unrecognized pension loss 459,393 13,998 39,982 1,218

Unrecognized prior service cost - - 6,596 201

Unrecognized transition (assets) obligation (2,187) (67) 25,426 775

Minimum pension liability adjustment - - 659 21

Prepaid pension cost (Accrued pension liabilities) 170,552 5,197 (53,671) (1,635)