Acer 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report98

Financial Standing

Acer Incorporated 2008 Annual Report 99

Accrued pension liabilities are included in “other liabilities” in the accompanying consolidated balance

sheets. Prepaid pension cost is included in “other assets” in the accompanying consolidated balance sheets.

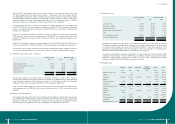

The components of the net periodic pension cost for 2007 and 2008 were as follows:

2007 2008

NT$ NT$ US$

Service cost 32,894 49,808 1,518

Interest cost 20,671 34,453 1,050

Actual return on plan assets (12,147) (18,586) (566)

Amortization and deferral 17,133 31,937 973

Net periodic pension cost 58,551 97,612 2,975

Signicant actuarial assumptions used in the above calculations were as follows:

2007 2008

Discount rate 2.75% 2.50%

Rate of increase in future compensation 3.00%-3.50% 3.00%

Expected rate of return on plan assets 2.75% 2.50%

In 2007 and 2008, pension cost under the dened contribution retirement plans amounted to NT$202,278 and

NT$367,627, respectively.

(19) Income taxes

(a) Each consolidated entity should le its own separate income tax return.

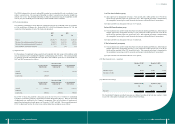

(b) The components of income tax expense from continuing operations for the years ended December 31,

2007 and 2008, were as follows:

2007 2008

NT$ NT$ US$

Current income tax expense 2,726,875 2,383,360 72,623

Deferred income tax (benet) expense (61,297) 786,086 23,953

2,665,578 3,169,446 96,576

(c) The income tax calculated on the pre-tax income from continuing operations at the Company’s statutory

income tax rate (25%) was reconciled with the income tax expense of continuing operations reported in

the accompanying consolidated statements of income as follows:

2007 2008

NT$ NT$ US$

Expected income tax expense 3,777,159 3,701,682 112,794

Effect of different tax rates applied to the

Company’s subsidiaries 1,786,743 720,278 21,948

Tax-exempt investment income from domestic investees (592,587) (154,526) (4,709)

Prior-year adjustments (53,756) (458,487) (13,971)

Gain on disposal of marketable securities not

subject to income tax

(1,226,553)

(697,934)

(21,267)

Investment tax credits 30,696 295,939 9,018

Change in valuation allowance (699,088) 225,493 6,871

Tax-exempt investment income resulting from

operational headquarters

(1,132,967) (1,386,033) (42,234)

Surtax on unappropniated retained earrings - 165,109 5,031

Gain on disposal of land not subject to income tax (29,476) - -

Alternative minimum tax 404,858 44,430 1,354

Others 400,549 713,495 21,741

Income tax expense 2,665,578 3,169,446 96,576

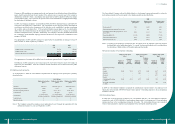

(d) The components of deferred income tax assets (liabilities) as of December 31, 2007 and 2008, were as

follows:

December 31, 2007 December 31, 2008

NT$ NT$ US$

Deferred income tax assets – current:

Accrued purchase discounts 631,360 1,093,887 33,332

Inventory provisions 394,505 620,737 18,915

Loss on valuation of nancial instruments 338,995 156,932 4,782

Accrued advertising expense 293,552 181,323 5,525

Warranty provision 267,102 894,085 27,244

Allowance for doubtful accounts 169,001 397,292 12,106

Accrued restructuring cost 149,637 - -

Accrued non-recurring engineering cost 102,485 111,826 3,407

Deferred revenue 40,742 34,904 1,064

Accrued royalty 707,937 82,975 2,528

Unrealized exchange gains (201,717) (386,944) (11,791)

Net operating loss carryforwards - 77,977 2,376

Others 571,195 553,783 16,874

3,464,794 3,818,777 116,362

Valuation allowance (1,550,788) (1,535,834) (46,798)

1,914,006 2,282,943 69,564