Acer 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

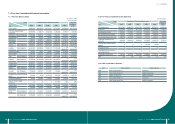

Acer Incorporated 2008 Annual Report72

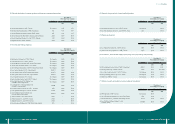

Financial Standing

Acer Incorporated 2008 Annual Report 73

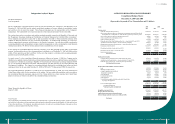

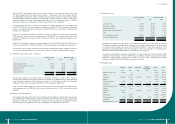

The Company completed the acquisition of 100% of the shares of Gateway, Inc. on October 15, 2007 (refer to

note 4(14)). Gateway, Inc. and its subsidiaries are included in the consolidated nancial statements from the date

of the acquisition.

In July and September 2007, the Company sold all its ownership interest in Sertek Incorporated (“SNX”)

and Digital Computer System Co. (“DCS”), respectively. As a result, SNX and DCS are excluded from the

consolidated nancial statements from the dates of sale.

In October 2007, the Company reduced its investment in AMT to an ownership interest of less than 50% and no

longer held a controlling interest in AMT. AMT is excluded from the consolidated nancial statements from the

date of sale.

In March and June of 2008, the Company completed its acquisition of 100% of the shares of PB Holding

Company S.A.R.L and its subsidiaries. In September 2008, the Company also completed its acquisition of 100%

of the shares of E-ten Information System Co., Ltd. and its subsidiaries. The Company has included the results

of operations of the acquired business in the consolidated nancial statements as of the date of each acquisition.

Additionally, the Company established new subsidiaries AGP and AAPH. In November 2008, ACCSI merged

with TWP and its subsidiaries.

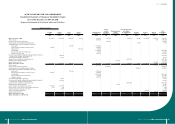

2. Summary of Signicant Accounting Policies

(1) Accounting principles and consolidation policy

The consolidated financial statements are prepared in accordance with accounting principles generally

accepted in the Republic of China. These consolidated nancial statements are not intended to present the

nancial position and the related results of operations and cash ows of the Consolidated Companies based on

accounting principles and practices generally accepted in countries and jurisdictions other than the ROC.

The consolidated financial statements include the accounts of the Company and subsidiaries in which the

Company is able to exercise control over the subsidiary’s operations and nancial policies. The operating

activity of the subsidiary is included in the consolidated statements of income from the date that control

commences until the date that control ceases. All significant inter-company balances and transactions are

eliminated in consolidation.

(2) Use of estimates

The preparation of the accompanying consolidated financial statements requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of

contingent assets and liabilities at the date of the consolidated nancial statements and reported amounts of

revenues and expenses during the reporting periods. Economic conditions and events could cause actual

results to differ signicantly from such estimates.

(3) Foreign currency transactions and translations

The Company’s reporting currency is the New Taiwan dollar. The Consolidated Companies record

transactions in their respective functional currencies, which generally are the local currency of the primary

economic environment in which these entities operate. Non-derivative foreign currency transactions are

recorded at the exchange rates prevailing at the transaction date. At the balance sheet date, monetary assets

and liabilities denominated in foreign currencies are translated into New Taiwan dollars using the exchange

rates on that date. The resulting unrealized exchange gains or losses from such translations are reflected

in the accompanying statements of income. Non-monetary assets and liabilities denominated in foreign

currency that are measured in terms of historical cost are translated using the exchange rate at the date of the

transaction. Non-monetary assets and liabilities denominated in foreign currency that are measured at fair

value are reported at the rate that was in effect when the fair values were determined. Subsequent adjustments

to carrying values of such non-monetary assets and liabilities, including the effects of changes in exchange

rates, are reported in prot or loss for the period, except that if movement in fair value of a non-monetary item

is recognized directly in equity, any foreign exchange component of that adjustment is also recognized directly

in equity.

In preparation of the consolidated nancial statements, a remeasurement of the foreign subsidiaries’ nancial

statements into the functional currency is performed rst, and the remeasuring differences are accounted for as

exchange gains or losses in the accompanying statements of income. Translation adjustments resulting from

the translation of foreign currency nancial statements into the Company’s reporting currency and a monetary

item that forms part of the Company’s net investment in a foreign operation are accounted for as translation

adjustment, a separate component of stockholders’ equity.

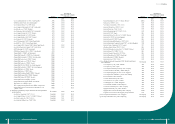

(4) Classication of current and non-current assets and liabilities

Cash or cash equivalents, and assets that will be held primarily for the purpose of being traded or are expected

to be realized within 12 months after the balance sheet date are classied as current assets; all other assets

shall be classied as non-current.

Liabilities that will be held primarily for the purpose of being traded or are expected to be settled within 12

months after the balance sheet date are classied as current liabilities; all other liabilities shall be classied as

non-current.

(5) Cash and cash equivalents

Cash and cash equivalents consist of cash on hand, cash in banks, miscellaneous petty cash, and other highly

liquid investments which do not have a signicant level of market or credit risk from potential interest rate

changes.

(6) Allowance for doubtful accounts

Allowance for doubtful accounts is provided based on the collectibility, aging and quality analysis of notes

and accounts receivable.

(7) Inventories

Inventories for the Acer brand information technology business group are stated at the lower of cost or market

value. Market value represents net realizable value. Costs of inventory are determined using the weighted-

average method. For channel business, costs of inventory are determined using the rst-in, rst-out method.

(8) Financial instruments

The Consolidated Companies adopted transaction-date accounting for nancial instrument transactions. Upon

initial recognition, nancial instruments are evaluated at fair value plus, in the case of a nancial instrument

not at fair value through prot or loss, transaction costs that are directly attributable to the acquisition or issue

of the financial instrument. Subsequent to initial recognition, financial instruments are classified into the

following categories in accordance with the purpose of holding or issuing of such nancial instruments: