Acer 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report82

Financial Standing

Acer Incorporated 2008 Annual Report 83

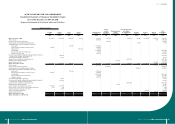

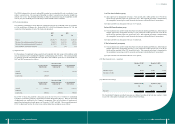

(3) Other receivable

December 31,

2007

December 31,

2008

NT$ NT$ US$

Refundable income tax and VAT receivable 2,780,212 2,001,212 60,979

Other receivable 4,595,357 6,806,242 207,394

7,375,569 8,807,454 268,373

(4) Available-for-sale nancial assets ‒ current

December 31,

2007

December 31,

2008

NT$ NT$ US$

Mutual funds 662,096 - -

Publicly traded equity securities 2,112,196 145,147 4,423

Others 77,769 446,297 13,599

2,852,061 591,444 18,022

In 2007 and 2008, the Consolidated Companies disposed of portions of these investments and recognized

gains on disposal thereof of NT$2,057,447 and NT$1,187,156, respectively. The gains were recorded as “gain

on disposal of investments” in the accompanying consolidated statements of income.

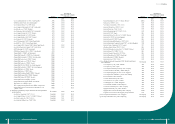

(5) Financial assets and liabilities at fair value through prot or loss

December 31,

2007

December 31,

2008

NT$ NT$ US$

Financial assets at fair value through prot or loss ‒ current:

Foreign currency forward contracts 14,999 339,817 10,355

Foreign currency options 4,983 - -

Cross currency swaps - 7,821 238

Foreign exchange swaps - 7,113 217

19,982 354,751 10,810

December 31,

2007

December 31,

2008

NT$ NT$ US$

Financial liability at fair value through prot or loss ‒ current:

Foreign currency forward contracts (1,394,549) (1,011,739) (30,829)

Foreign currency options (593) - -

(1,395,142) (1,011,739) (30,829)

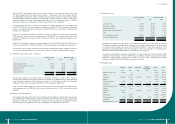

As of December 31, 2007 and 2008, unrealized loss resulting from the changes in fair value of these derivative

contracts amounted to NT$(272,939) and NT$718,172, respectively.

As of December 31, 2007 and 2008, the Consolidated Companies entered into foreign currency forward

contracts and foreign currency options to hedge their exposure to the foreign currency exchange rate risk

generated by operating activities. The derivative nancial instruments that did not meet the criteria for hedge

accounting (classied as nancial assets and liabilities at fair value through prot or loss) were as follows:

(a) Foreign currency options:

(i) Long options:

December 31, 2007

Notional amount

(in thousands)

Maturity date

EUR CALL/GBP PUT EUR 3,487 2008/02/27

(ii) Short options

December 31, 2007

Notional amount Maturity date

(in thousands)

GBP CALL/EUR PUT EUR 3,835 2008/02/27

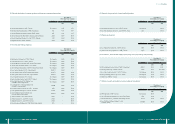

(b) Foreign currency forward contracts:

December 31, 2007

Notional amount

(in thousands)

Settlement date

Buy Sell

USD / ZAR USD 24,222 2008/01/02~2008/02/29

USD /SGD USD 15,000 2008/01/16~2008/03/31

USD / EUR EUR 663,000 2008/01/16~2008/02/29

USD / INR USD 50,536 2008/01/16~2008/05/30

USD /JPY USD 16,500 2008/01/15~2008/05/16

USD / RMB USD 15,000 2008/01/30~2008/03/31

USD / THB USD 18,000 2008/01/15~2008/02/15

USD / MYR USD 21,865 2008/01/15~2008/03/17

USD / NTD USD 24,000 2008/01/09~2008/01/31