Acer 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report100

Financial Standing

Acer Incorporated 2008 Annual Report 101

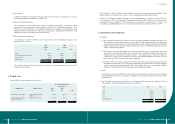

December 31, 2007 December 31, 2008

NT$ NT$ US$

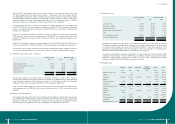

Deferred income tax liabilities – current:

Inventory provisions (88,624) (125,802) (3,833)

Allowance for doubtful accounts (473,449) (462,980) (14,108)

Others (147,624) (67,828) (2,067)

(709,697) (656,610) (20,008)

December 31, 2007 December 31, 2008

NT$ NT$ US$

Deferred income tax assets – non-current:

Difference in depreciation for tax and nancial purposes 12,042 20,638 629

Net operating loss carryforwards 624,286 773,919 23,582

Provision for asset impairment loss 293,190 - -

Investment tax credits 686,658 - -

Other 64,944 161,884 4,933

1,681,120 956,441 29,144

Valuation allowance (1,615,282) (826,526) (25,185)

65,838 129,915 3,959

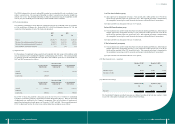

December 31, 2007 December 31, 2008

NT$ NT$ US$

Deferred income tax liabilities – non-current:

Difference in intangible assets for tax and nancial

purposes (3,101,316) (2,705,258) (82,432)

Investment income recognized by the equity method (2,697,304) (3,804,043) (115,913)

Net operating loss carryforwards 14,028,055 14,326,766 436,552

Difference in depreciation for tax and nancial purposes 939,410 1,026,013 31,263

Provision for asset impairment loss 293,190 313,148 9,542

Investment tax credits - 418,227 12,744

Software development cost - 731,804 22,299

Unrealized investment loss 241,569 244,421 7,448

Other 147,919 463,409 14,121

9,851,523 11,014,487 335,624

Valuation allowance (14,970,897) (17,288,586) (526,802)

(5,119,374) (6,274,099) (191,178)

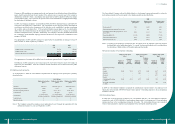

(e) The domestic Consolidated Companies were granted investment tax credits for investment in certain

high-tech industries, for the purchase of automatic machinery and equipment, for research and

development expenditures, and for employee training expenditures. These credits may be applied over

a period of ve years. The amount of the credit that may be applied in any year is limited to 50% of the

income tax payable for that year, but there is no limitation on the amount of investment tax credit that

may be applied in the nal year.

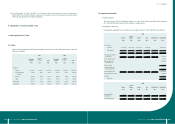

As of December 31, 2008, unused investment tax credits available to the Consolidated Companies were

as follows:

Expiration date NT$ US$

December 31, 2009 291,975 8,897

December 31, 2010 4,834 147

December 31, 2011 64,660 1,970

December 31, 2012 56,758 1,730

418,227 12,744

(f) The tax effects of net operating loss carryforwards available to the Consolidated Companies as of

December 31, 2008, were as follows:

Expiration date NT$ US$

December 31, 2009 144,655 4,408

December 31, 2010 10,737 327

December 31, 2011 992,846 30,253

December 31, 2012 1,088,663 33,173

Thereafter 12,941,761 394,349

15,178,662 462,510

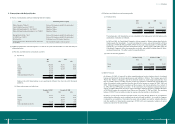

(g) Information about the integrated income tax system

Beginning in 1998, an integrated income tax system was implemented in the Republic of China. Under

the new tax system, the income tax paid at the corporate level can be used to offset Republic of China

resident stockholders’ individual income tax. The Company is required to establish an imputation credit

account (ICA) to maintain a record of the corporate income taxes paid and imputation credit that can

be allocated to each stockholder. The credit available to Republic of China resident stockholders is

calculated by multiplying the dividend by the creditable ratio. The creditable ratio is calculated as the

balance of the ICA divided by earnings retained by the Company since January 1, 1998.

Information related to the ICA is summarized below:

December 31, 2007 December 31, 2008

NT$ NT$ US$

Unappropriated earnings:

Earned before January 1, 1998 6,776 6,776 207

Earned after January 1, 1998 13,544,248 13,978,542 425,941

13,551,024 13,985,318 426,148

Balance of ICA 165,036 198,401 6,045

The Company’s estimated creditable ratio for the 2008 earnings distribution to ROC resident stockholders

is approximately 4.84%; and the actual creditable ratio for the 2007 earnings distribution to ROC resident

stockholders was 4.01%.