Acer 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report104

Financial Standing

Acer Incorporated 2008 Annual Report 105

Pursuant to SFB regulations, an amount equal to the total amount of any deduction items of shareholders’

equity shall be provided from the net income of the current year as a special reserve that cannot be

distributed as dividend or bonus. Accordingly, such special reserve shall be adjusted to reect the changes

in the deduction items. Any reversal of the special reserve can be added back to unappropriated earnings

for distribution of dividends or bonus.

In 2008, the Company estimated it would distribute NT$1,500,000 of employee bonuses and NT$85,763

of directors’ and supervisors’ remuneration. The computation for the employee bonuses distributed in

stock shares was based on the closing price of the day prior to the stockholders’ meeting, considering

the ex-rights and ex-dividend effect. If the actual distribution amount approved by the shareholders

differs from the estimated amount, the discrepancy shall be accounted for as a change in accounting

estimates and adjusted in the year 2009. Additionally, the Company’s subsidiary Weblink International

Inc. estimated it would distribute employee bonuses and directors’ and supervisors’ remuneration in the

amount of NT$800.

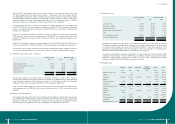

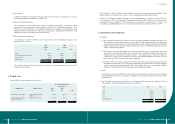

The appropriation of 2006 and 2007 earnings was approved by the shareholders at meetings on June 14,

2007, and June 13, 2008, respectively, as follows:

2006 2007

NT$ NT$

Employee bonus - stock (in par value) 333,708 330,000

Employee bonus - cash 424,719 544,728

Directors’ and supervisors’ remuneration 94,803 116,630

853,230 991,358

The appropriation of earnings did not differ from the resolutions approved by the Company’s directors.

Distribution of 2008 earnings has not been proposed by the board of directors and is still subject to

approval by the stockholders. After the resolutions, related information can be obtained from the public

information website.

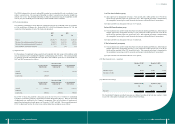

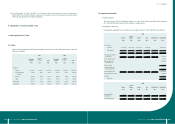

(21) Employee stock option plan

As of December 31, 2008, the Consolidated Companies had the employee stock option plans (“ESOP”)

described below:

Stock Options

Employee stock option

plan 1

Employee stock option

plan 2

Employee stock option

plan 3

Grant date 2008/11/31 2008/09/01 (note 1) 2008/09/01 (note 1)

Granted shares (in thousands) 14,000 8,717 1,067

Fair value of options granted ($) 25.124 25.47 ~ 26.11 42.20 ~ 42.58

Contractual life 3 years 4.97 years 2 years

Vesting period 2 years of service

subsequent to grant date

1~3 years of service

subsequent to grant date

2 years of service

subsequent to grant date

Actual exit rates 0 0 0

Expected exit rates 0 0 0

Note 1: The Company assumed the employee stock option plans 2 and 3 through the acquisition of E-Ten

Information Systems Co., Ltd. as of September 1, 2008.

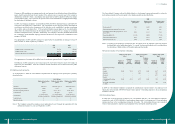

The Consolidated Company utilized the Black-Scholes or the binomial option pricing model to value the

stock options granted, and the main inputs to the valuation models are described below.

2008

Employee stock

option plan 1

Employee stock

option plan 2

Employee stock

option plan 3

Exercise price ($) 25.28 44.50 16.90

Expected remaining contractual life (in years) 3 4.26 0.56

Fair market value for underlying securities – Acer

shares (NT$) 45.95 59.10 59.10

Expected volatility (%) 45.01% 34.98% 37.35%

Expected dividend yield (%) note 2 note 2 note 2

Risk-free interest rate (%) 2.50% 2.40% 1.84%

Note 2: According to the employee stock option plan, the option prices are adjusted to take into account

dividends paid on the underlying security. As a result, the expected dividend yield is excluded from

the calculation of Black-Scholes or Binominal option pricing models.

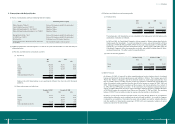

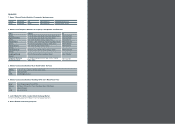

Movements in number of stock options outstanding:

Employee stock option

plan 1

Employee stock option

plan 2

Employee stock option

plan 3

Number of

options (in

thousands)

Weighted-

average

exercise

price (NT$)

Number of

options (in

thousands)

Weighted-

average

exercise

price

(NT$)

Number of

options (in

thousands)

Weighted-

average

exercise

price

(NT$)

Outstanding at January 1,

2008

- - - - - -

Granted 14,000 25.28 8,717 44.50 1,067 16.90

Forfeited - - (480) - (36) -

Exercised - - - - (173) 16.90

Expired - - - - - -

Outstanding at December

31, 2008

14,000 25.28 8,237 44.50 858 16.90

Exercisable at December

31, 2008

- - - - 406 16.90

In 2008, the Consolidated Companies recognized the compensation expense related to the employee stock

option plans in the amount of NT$37,856 under “salary expense” of operating expenses in the accompanying

statement of income.

(22) Restructuring charges

In 2008, due to the acquisition of Gateway Inc. and Packard Bell B.V., the Consolidated Companies

recognized a total of NT$15,800,000 of restructuring charges under “restructuring cost” of non-operating

expenses and loss in the accompanying statements of income. The restructuring charges were associated

with severance payments to employees and integration of the information technology system.