Acer 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report32

Capital and Shares

Acer Incorporated 2008 Annual Report 33

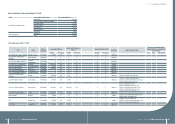

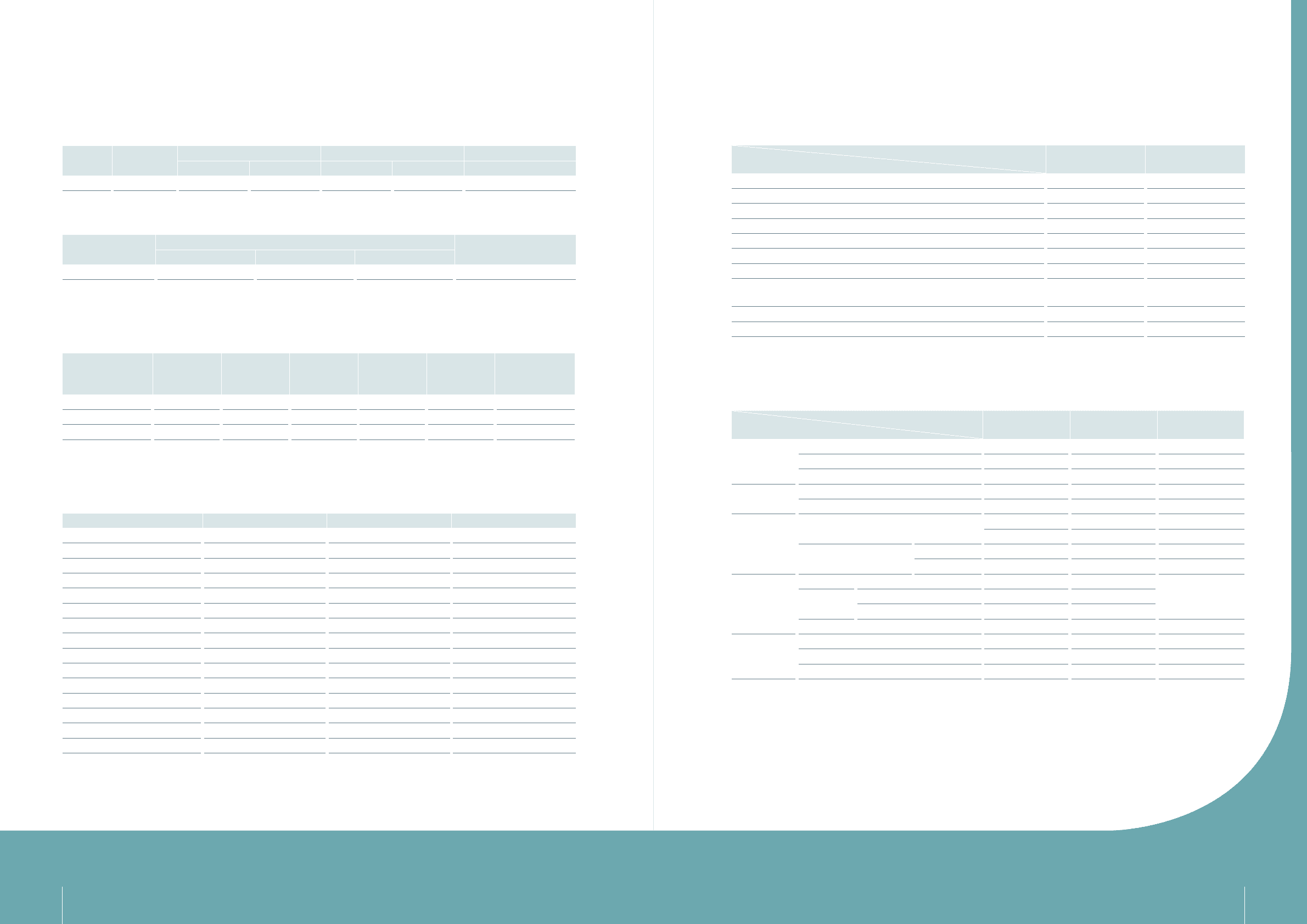

4.1 Sources of the Capital

4.1.1 Sources of the Capital (April 21, 2009)

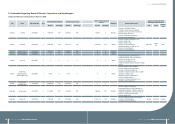

Unit: Share/NT$ Thousand

Date Price of

Issuance

Authorized Common stock Paid-in Common stock Notes

Shares Value Shares Value Source of the capital

April,2009 Share/NT$10 3,500,000,000 35,000,000 2,642,982,993 26,429,830

Unit: Share

Shares Category Authorized capital Notes

Issued shares Non-issued Total

Common shares 2,642,982,993 857,017,007 3,500,000,000

4.1.2 Shareholding Structure (April 21, 2009)

Category/Number Government

Institution

Financial

Institution Other Institution Individual

FINI and

Foreign

Investors

Total

No. of Shareholders 19 31 673 304,748 1,272 306,743

Shares 173,269,174 35,195,183 298,069,491 1,022,368,583 1,114,080,562 2,642,982,993

Percentage 6.56% 1.33% 11.28% 38.68% 42.15% 100.00%

4.1.3 The Distribution of Shareholdings (April 21, 2009)

Category No. of Shareholders Shares Percentage

1 ~ 999 161,687 52,264,493 1.977%

1,000 ~ 5,000 108,926 231,996,525 8.778%

5,001 ~ 10,000 19,637 135,499,093 5.127%

10,001 ~ 15,000 6,776 79,792,333 3.019%

15,001 ~ 20,000 2,806 48,441,115 1.833%

20,001 ~ 30,000 2,598 61,991,711 2.346%

30,001 ~ 50,000 1,734 65,920,573 2.494%

50,001 ~ 100,000 1,155 79,631,458 3.013%

100,001 ~ 200,000 505 69,801,481 2.641%

200,001 ~ 400,000 342 96,360,504 3.646%

400,001 ~ 600,000 166 81,629,152 3.089%

600,001 ~ 800,000 79 55,324,451 2.093%

800,001 ~ 1,000,000 58 51,599,391 1.952%

1,000,001 and above 274 1,532,730,713 57.992%

Total 306,743 2,642,982,993 100.000%

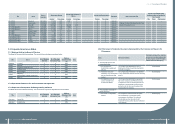

4.1.4 The List of Major Shareholders (April 21, 2009)

Item

Name Shares Percentage

National Financial Stabilization Fund 74,850,000 2.83%

Stan Shih 74,021,741 2.80%

Hong Rong Investment Corp. 67,060,863 2.54%

Management Board of Public Service Pension Fund 52,154,978 1.97%

Acer Incorporated Global Depositary Receipt 51,659,897 1.95%

Government of Singapore Fund 43,142,880 1.63%

Saudi Arabian Monetary Agency 36,790,290 1.39%

JPMorgan Chase Bank N.A. Taipei Branch in custody for

Capital World Growth and Income Fund Inc. 31,753,338 1.20%

Capital Income Builder, Inc. 31,631,866 1.20%

Bureau of Labor Insurance 30,051,891 1.14%

4.1.5 Market Price Per Share, Net Value, Earning& Dividend For Latest Two Years

Unit: NT$

Period

Item 2007 2008 Until Mar. 31st,

2009

Market Price

Per Share

Highest 75.96 70.20 51.00

Lowest 53.59 39.75 39.65

Average 62.35 55.51 45.48

Net Value Per

Share

Before Distribution 32.49 31.70 32.99

After Distribution 28.55 Un-appropriated Un-appropriated

Earning Per

Share

Weighted Average Share Numbers 2,432,594 2,487,238 2,596,619

Thousand shares Thousand shares thousand shares

Earning Per Share Current 5.48 4.72 0.78

Adjusted 5.33 Un-appropriated Un-appropriated

Dividend Per

Share

Cash Dividend (NT$) 3.6 2

Un-appropriated

Stock

Dividend

Retained Earning (%) 0.15 0.1

Capital Surplus (%) - -

Accumulated Unpaid Dividends - - -

Return on

Investment

Analysis

P/E Ratio 11.70 11.76 -

P/D Ratio 17.32 27.76 -

Cash Dividend Yield 5.77% 3.60% -