Acer 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

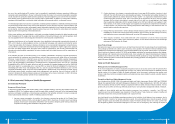

Acer Incorporated 2008 Annual Report66

Financial Standing

Acer Incorporated 2008 Annual Report 67

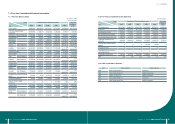

ACER INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Cash Flows

Years ended December 31, 2007 and 2008

(Expressed in thousands of New Taiwan dollars and US dollars)

2007 2008

NT$ NT$ US$

Cash ows from operating activities:

Consolidated net income 12,960,925 11,737,124 357,643

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation 591,189 955,880 29,127

Amortization 551,280 1,245,561 37,954

Gain on disposal of property and equipment, net (121,418) (515,272) (15,701)

Other expenses reclassied from property and equipment 4,369 - -

Gain on disposal of investments, net (4,476,991) (2,709,524) (82,562)

Net investment gain on long-term equity investments accounted for by equity

method, net of cash dividends received

(875,415) (146,392) (4,461)

Other investment loss - 416,404 12,688

Asset impairment loss - 221,931 6,762

Restructuring cost - 1,582,408 48,218

Stock-based compensation cost -37,856 1,153

Deferred income tax expense (benet) (61,297) 786,086 23,953

Changes in operating assets and liabilities:

Notes and accounts receivable (20,253,180) 452,252 13,781

Receivables from related parties (335,002) (327,579) (9,981)

Inventories (6,921,700) (4,882,424) (148,773)

Other nancial assets, prepayments and other current assets (1,055,734) (2,070,311) (63,084)

Noncurrent receivable 224,925 186,604 5,686

Notes and accounts payable (1,826,219) (16,097,164) (490,498)

Payables to related parties 3,409,436 2,447,835 74,588

Royalties payable, accrued expenses and other current liabilities 12,015,179 1,831,291 55,801

Other liabilities (391,122) (319,014) (9,721)

Cash used in operating activities (6,560,775) (5,166,448) (157,427)

Cash ow from investing activities:

Change in available-for-sale nancial assets ‒ current, net 12,332,596 2,891,868 88,118

Proceeds from sale of long-term equity investments and available for-sale nancial assets 7,018,429 3,449,388 105,107

Proceeds from sale of discontinued operations 868,222 - -

Increase in long-term investments (217,140) (171,717) (5,232)

Return of capital from investees 495,253 462,551 14,094

Proceeds from disposal of property and equipment and property not used in operations 1,220,389 2,068,099 63,017

Additions to property and equipment (534,626) (597,526) (18,207)

Increase in intangible assets and other assets (1,427,547) (435,746) (13,278)

Decrease (increase) in advances to related parties 14,771 (14,230) (434)

Decrease (increase) in restricted assets (1,958,585) 1,813,448 55,258

Acquisition of business, net of cash acquired (15,070,542) (719,026) (21,909)

Cash provided by investing activities 2,741,220 8,747,109 266,534

Cash ows from nancing activities:

Decrease in short-term borrowings (968,414) (4,285,258) (130,576)

Increase in long-term debt 16,500,000 - -

Payment of long-term debt (9,739,562) (4,423,321) (134,783)

Payment of cash dividends, employee bonuses, and directors’ and supervisors’ remuneration (9,395,445) (9,206,292) (280,526)

Exercise of employee stock options - 2,101 64

Change in minority interests (296,018) (42,353) (1,291)

Cash used in nancing activities (3,899,439) (17,955,123) (547,112)

Net decrease in cash and cash equivalents (7,718,994) (14,374,462) (438,005)

Effects of exchange rate changes 979,122 (1,429,152) (43,548)

Cash and cash equivalents at beginning of year 44,685,211 37,945,339 1,156,235

Cash and cash equivalents at end of year 37,945,339 22,141,725 674,682

Supplemental disclosures of cash ow information

Interest paid 1,052,609 1,275,330 38,861

Income taxes paid 1,395,005 1,977,802 60,266

Cash acquired from acquisition of subsidiaries: Gateway Inc. Parkard Bell BV Parkard Bell BV

Cash consideration 23,507,016 3,172,080 96,657

Non-cash assets acquired (35,589,573) (10,560,058) (321,776)

Liabilities assumed 37,173,295 10,704,787 326,186

Goodwill (16,654,264) (1,774,172) (54,061)

Cash acquired from acquisition 8,436,474 1,542,637 47,006

E-Ten

Information

Systems Co., Ltd.

E-Ten

Information

Systems Co., Ltd.

Issuance of shares for acquisition 8,837,267 269,281

Non-cash assets acquired (7,288,921) (222,101)

Liabilities assumed 1,263,892 38,512

Goodwill (1,901,821) (57,951)

Cash acquired from acquisition 910,417 27,741

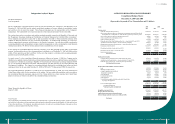

ACER INCORPORATED AND SUBSIDIARIES

Notes to Consolidated Financial Statements

As of and for the years ended

December 31, 2007 and 2008

(amounts expressed in thousands of New Taiwan dollars and US dollars,

except for earnings per share information and unless otherwise noted)

1. Reporting Entities of the Consolidated Financial Statements and Their Business Scopes

Acer Sertek Inc. (the “Company”) was incorporated on August 1, 1976, as a company limited by shares under

the laws of the Republic of China (“ROC”). The Company merged with Acer Incorporated (“AI”) on March 27,

2002, with the Company as the surviving entity from the merger but renaming itself Acer Incorporated. After

the merger, the principal activities of the Company focus on globally marketing its brand-name IT products, and

promoting E-commerce solutions to clients.

The reporting entities of the consolidated financial statements include the Company and its subsidiaries

(hereinafter referred to collectively as the “Consolidated Companies”). On December 31, 2007 and 2008, the

number of employees of the Consolidated Companies was 6,271 and 6,727, respectively. The Consolidated

Companies are summarized below according to their primary business activity.

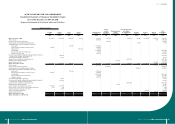

(1) Sale of “Acer”, “Gateway”, “eMachine”, and “Packard Bell” brand-name information technology products:

Percentage of

Ownership by the Company

Investor at December 31,

2007 2008

(a) Acer Incorporated

(b) Acer Greater China (B.V.I.) Corp. (“AGC”, British Virgin Islands)

and its subsidiaries The Company 100.00 100.00

‧Acer Market Services Limited (“AMS”, Hong Kong) AGC 100.00 100.00

‧Acer Computer (Far East) Limited (“AFE”, Hong Kong) AGC 100.00 100.00

‧Acer Information (Zhong Shan) Co., Ltd. (“AIZS”, China) AMS 100.00 100.00

‧Beijing Acer Information Co., Ltd. (“BJAI”, China) AMS 100.00 100.00

‧Acer Computer (Shanghai) Ltd. (“ACCN”, China) AMS 100.00 100.00

(c) Acer European Holding N.V. (“AEH”, Netherlands Antilles )

and its subsidiaries The Company 100.00 100.00

‧Acer Europe B.V. (“AHN”, the Netherlands) AEH 100.00 100.00

‧Acer Computer B.V. (“ACH”, the Netherlands) AEH 100.00 100.00

‧Acer Computer France S.A.R.L. (“ACF”, France) AHN 100.00 100.00

‧Acer U.K. Limited (“AUK”, the United Kingdom) AHN 100.00 100.00

‧Acer Italy S.R.L. (“AIT”, Italy) AHN 100.00 100.00

‧Acer Computer GmbH (“ACG”, Germany) AHN 100.00 100.00

‧Acer Austria GmbH (“ACV”, Austria) AHN 100.00 100.00

‧Acer Europe Services S.R.L. (“AES”, Italy) AHN 100.00 100.00

‧Acer Europe AG (“AEG”, Switzerland) AHN 100.00 100.00