Acer 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acer Incorporated 2008 Annual Report110

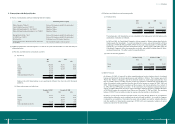

Financial Standing

Acer Incorporated 2008 Annual Report 111

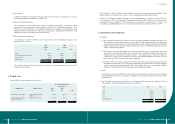

5. Transactions with Related Parties

(1) Names of related parties and their relationship with the Company

Name Relationship with the Company

Wistron Corporation (“Wistron”) Investee of the Company accounted for by equity method

Cowin Worldwide Corporation (“COWIN”) Subsidiary of Wistron

Wistron InfoComm (Kunshan) Co., Ltd. (“WKS”) Subsidiary of Wistron

Wistron InfoComm Technology (Kunshan) Co., Ltd. (“WIKS”) Subsidiary of Wistron

Bluechip Infotech Pty Ltd. (“SAL”) Investee of the Company accounted for by equity method

e-Life Mall Corp. (“eLIFE”) Investee of the Company accounted for by equity method

iD Softcapital Inc. Its chairman is one of the Company’s supervisors

All directors, supervisors, chief executive ofcers and executive

vice presidents The Consolidated Companies’ main management

(2) Signicant transactions with related parties as of and for the years ended December 31, 2007 and 2008, are

summarized below:

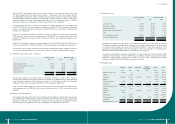

(a) Net sales, and related notes and accounts receivable

(i) Net sales to:

2007 2008

NT$ NT$ US$

SAL 1,088,886 758,797 23,121

eLIFE 992,647 885,662 26,987

COWIN 153,920 462,430 14,091

WKS 358,247 - -

WIKS 185,804 - -

Other (individually less than 5%) 266,334 114,486 3,489

3,045,838 2,221,375 67,688

Trading terms with related parties are not significantly different from the terms with third-party

customers.

(ii) Notes and accounts receivable from:

December 31, 2007 December 31, 2008

NT$ NT$ US$

eLIFE 190,277 159,182 4,850

COWIN 86,676 329,848 10,051

Wistron - 248,930 7,585

SAL 82,230 64,529 1,966

Others (individually less than 5%) 89,298 38,976 1,188

448,481 841,465 25,640

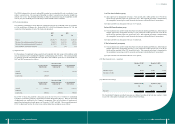

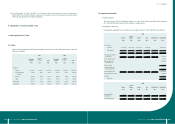

(b) Purchases and related notes and accounts payable

(i) Purchases from:

2007 2008

NT$ NT$ US$

Wistron 14,788,985 25,228,683 768,745

Others 296,079 270 8

15,085,064 25,228,953 768,753

The trading terms with related parties are not comparable to the trading terms with third parties as the

specications of products are different.

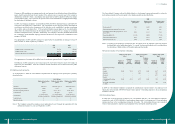

In 2007 and 2008, the Consolidated Companies sold raw material to Wistron and purchased back the

nished goods after manufacture. To avoid overstating the revenues, sales of raw material to Wistron

amounting to NT$58,666,096 and NT$88,579,887 for the years ended December 31, 2007 and 2008,

respectively, were excluded from the consolidated revenues. Having legally enforceable rights, the

Consolidated Companies offset the outstanding receivables and payables resulting from the above-

mentioned transactions. The offset resulted in a payable balance.

(ii) Notes and accounts payable to:

December 31, 2007 December 31, 2008

NT$ NT$ US$

Wistron 4,510,376 7,681,059 234,050

Others 73,239 69,161 2,108

4,583,615 7,750,220 236,158

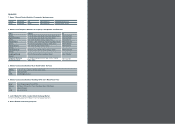

(c) Spin-off of assets

On February 28, 2002, AI spun off its design, manufacturing and services business from its Acer-brand

business and transferred the related operating assets and liabilities to Wistron. The Company agreed with

Wistron that Wistron is obligated to pay for the deferred income tax assets being transferred only when

they are actually utilized. In 2006, the ROC income tax authorities examined and rejected Wistron’s

claim of investment credits transferred from the spin-off in the income tax returns for 2002, 2003, and

2004. Wistron disagreed with the assessment and led a request with the tax authorities for a recheck of

its 2002, 2003 and 2004 income tax returns. To be conservative, the Company recognized income tax

expense of NT$875,802 based on total tax impact estimated in 2006 and provided a valuation allowance

of NT$385,043 against the receivables from Wistron as of December 31, 2007 and 2008. The remaining

balance of $490,759 was recorded as income tax expense and other payables to related parties.

In 2008, as a result of the recheck on the 2002 income tax returns led by Wistron, the tax authorities

decided that the deferred tax assets resulting from the spin-off could be utilized. As a result, the Company

revaluated the recoverability of the deferred tax assets and accordingly reversed the valuation allowance

and other payables to related parties amounting to NT$511,425, and recognized a reduction of current

income tax expense by the same amount.