2K Sports 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

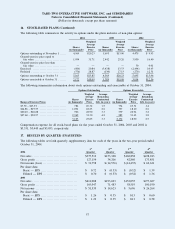

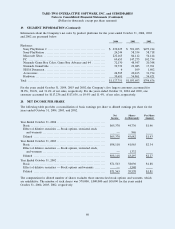

Under accounting principles generally accepted in the United States of America, quarterly computations of

earnings per share must stand on their own and, therefore, the sum of basic and diluted EPS numbers for each

of the four quarters of 2004 and 2003 may not equal full year basic and diluted EPS. Basic and diluted EPS

for each quarter of 2004 and 2003 is computed using the weighted average number of shares outstanding

during the quarter, while basic and diluted EPS for the full year is computed using the weighted average

number of shares outstanding during the more extended period of time.

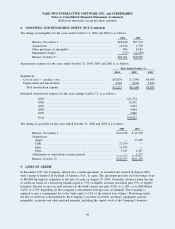

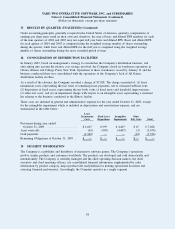

18. CONSOLIDATION OF DISTRIBUTION FACILITIES

In January 2003, based on management’s strategy to consolidate the Company’s distribution business, and

after taking into account the relative cost savings involved, the Company closed its warehouse operations in

Ottawa, Illinois and College Point, New York. Operations at these warehouses ceased by January 31 and the

business conducted there was consolidated with the operations of the Company’s Jack of All Games

distribution facility in Ohio.

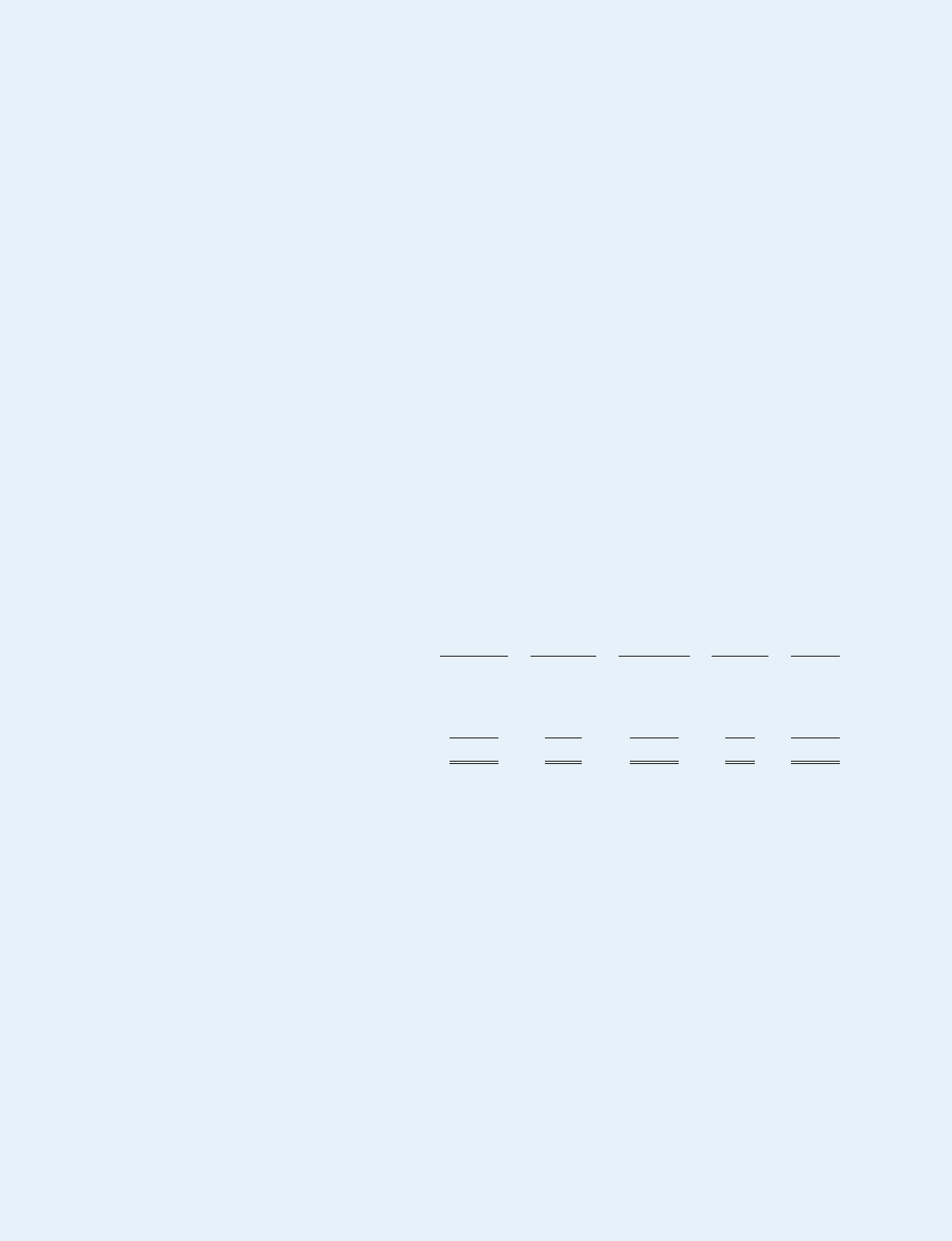

As a result of the closures, the Company recorded a charge of $7,028. The charge consisted of: (1) lease

termination costs, representing the fair value of remaining lease payments, net of estimated sublease rent;

(2) disposition of fixed assets, representing the net book value of fixed assets and leasehold improvements;

(3) other exit costs; and (4) an impairment charge with respect to an intangible asset, representing a customer

list relating to the business conducted at the Illinois facility.

These costs are included in general and administrative expense for the year ended October 31, 2003, except

for the intangibles impairment which is included in depreciation and amortization expense, and are

summarized in the table below:

Lease

Termination

Costs

Fixed Asset

Dispositions

Intangibles

Impairments

Other

Exit Costs Total

Provisions during year ended

October 31, 2003 ........................... $ 1,607 $ 999 $ 4,407 $ 15 $ 7,028

Asset write-offs ............................... (65) (999) (4,407) (3) (5,474)

Cash payments ................................ (1,542) — — (12) (1,554)

Remaining Obligations at October 31, 2003 . . $ — $ — $ — $ — $ —

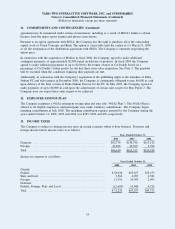

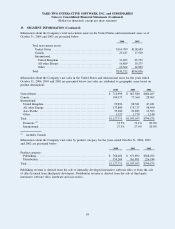

19. SEGMENT INFORMATION

The Company is a publisher and distributor of interactive software games. The Company’s operations

involve similar products and customers worldwide. The products are developed and sold domestically and

internationally. The Company is centrally managed and the chief operating decision makers, the chief

executive and chief operating officers, use consolidated financial information supplemented by sales

information by product category, major product title and platform for making operational decisions and

assessing financial performance. Accordingly, the Company operates in a single segment.

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

17. RESULTS BY QUARTER (UNAUDITED) (Continued)

58