2K Sports 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based on our currently proposed operating plans and assumptions, we believe that projected cash flow from

operations and available cash resources will be sufficient to satisfy our cash requirements for the reasonably

foreseeable future.

Contractual Obligations and Contingent Liabilities and Commitments

Our offices and warehouse facilities are occupied under non-cancelable operating leases expiring at various

times from December 2004 to September 2014. We also lease certain furniture, equipment and automobiles

under non- cancelable leases expiring through March 2008. Our future minimum rental payments for the fiscal

2005 are $9,875 and aggregate minimum rental payments through applicable lease expirations are $61,848.

We have entered into distribution agreements under which we purchase various software games. These

agreements, which expire between March 2005 and December 2005, require remaining aggregate minimum

guaranteed payments of $7,487 at October 31, 2004. Additionally, assuming performance by third-party

developers, we have outstanding commitments under various software development agreements to pay

developers an aggregate of $82,342 during fiscal 2005.

In connection with the acquisition of Mobius in fiscal 2004, we agreed to make additional contingent

payments of approximately $2,000 based on delivery of products. In fiscal 2003 we agreed to make payments

of up to $2,500 to the former owners of Cat Daddy based on a percentage of Cat Daddy’s profits for the

first three years after acquisition. The payables will be recorded when the conditions requiring their payment

are met.

In connection with our acquisition of the publishing rights to the Duke Nukem franchise for PC and video

games we are obligated to pay $6,000 contingent upon delivery of the final version of Duke Nukem Forever

for the PC. In May 2003, we agreed to make payments of up to $6,000 in cash upon the achievement of

certain sales targets for Max Payne 2. We do not expect that these sales targets will be achieved.

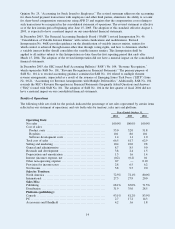

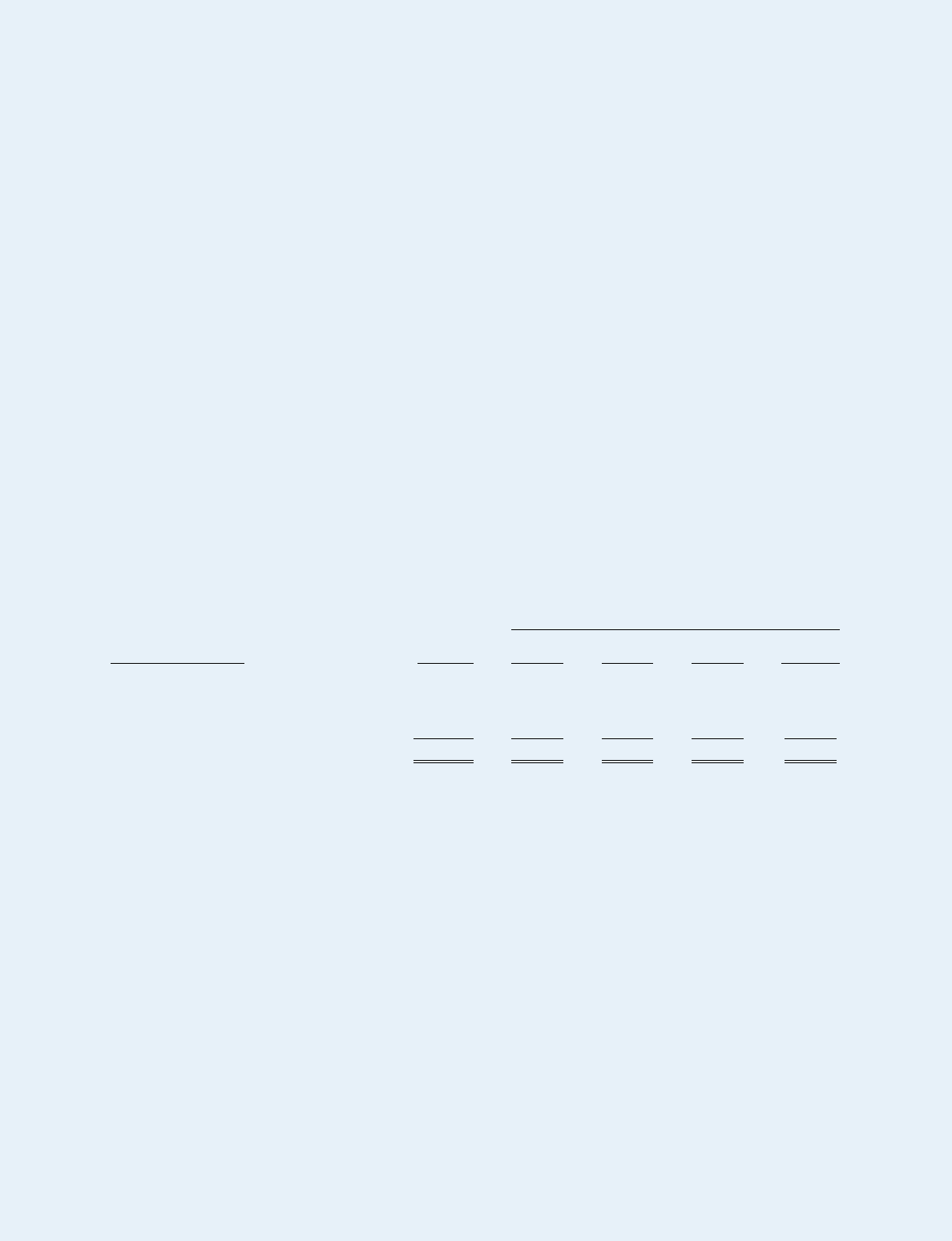

The following table summarizes our minimum contractual obligations (excluding obligations under

employment agreements) and commercial commitments as of October 31, 2004:

Payments due by periods ended October 31,

Contractual Obligations Total 2005

2006 to

2007

2008 to

2009

2010 and

Thereafter

Operating Lease Obligations ............... $ 61,848 $ 9,875 $15,952 $20,719 $15,302

Letters of Credit ........................... 1,560 1,560 — — —

Publishing Arrangements .................. 123,706 82,342 41,364 — —

Distribution Arrangements ................. 7,487 6,149 1,338 — —

Total ....................................... $194,601 $99,926 $58,654 $20,719 $15,302

Fluctuations in Operating Results and Seasonality

We have experienced fluctuations in quarterly operating results as a result of the timing of the introduction

of new titles; variations in sales of titles developed for particular platforms; market acceptance of our titles;

development and promotional expenses relating to the introduction of new titles; sequels or enhancements of

existing titles; projected and actual changes in platforms; the timing and success of title introductions by our

competitors; product returns; changes in pricing policies by us and our competitors; the size and timing of

acquisitions; the timing of orders from major customers; order cancellations; and delays in product shipment.

Sales of our titles are also seasonal, with peak shipments typically occurring in the fourth calendar quarter

(our fourth and first fiscal quarters) as a result of increased demand for titles during the holiday season.

Quarterly comparisons of operating results are not necessarily indicative of future operating results.

International Operations

Sales in international markets, principally in the United Kingdom and other countries in Europe, have

accounted for a significant portion of our net sales. For fiscal 2004 and 2003, sales in international markets

accounted for approximately 27.5% and 27.9%, respectively, of our net sales. We are subject to risks inherent

in foreign trade, including increased credit risks, tariffs and duties, fluctuations in foreign currency exchange

23