2K Sports 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

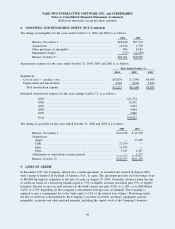

transaction gains included in net income for years ended October 31, 2004, 2003 and 2002 amounted to

$1,199, $2,015 and $840, respectively.

Accumulated Other Comprehensive Income (Loss)

Comprehensive income (loss) includes net income adjusted for the change in foreign currency translation

adjustments net of tax, if applicable, and the change in net unrealized gain (loss) from investments.

Recently Adopted and New Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards No. 123 (revised 2004), “Share-Based Payment” which revised Statement of Financial

Accounting Standards No. 123, “Accounting for Stock-Based Compensation. This statement supercedes APB

Opinion No. 25, “Accounting for Stock Issued to Employees.” The revised statement addresses the accounting

for share-based payment transactions with employees and other third parties, eliminates the ability to account

for share-based compensation transactions using APB 25 and requires that the compensation costs relating to

such transactions be recognized in the consolidated statement of operations. The revised statement is effective

as of the first interim period beginning after June 15, 2005. The adoption of this standard, effective August 1,

2005, is expected to have a material impact on the consolidated financial statements.

In December 2003, The Financial Accounting Standards Board (“FASB”) revised Interpretation No. 46

“Consolidation of Variable Interest Entities” with certain clarifications and modifications. Revised Interpretation

No. 46(R) provides guidance on the identification of variable interest entities, entities for which control is achieved

through means other than through voting rights, and how to determine whether a variable interest holder should

consolidate the variable interest entities. This Interpretation is required to be applied to all entities subject to this

Interpretation no later than the first reporting period that ends after March 15, 2004. The adoption of the revised

Interpretation did not have a material impact on the consolidated financial statements.

In December 2003, the SEC issued Staff Accounting Bulletin (“SAB”) No. 104, “Revenue Recognition,”

which supercedes SAB No. 101, “Revenue Recognition in Financial Statements.” The primary purpose of

SAB No. 104 is to rescind accounting guidance contained in SAB No. 101 related to multiple element

revenue arrangements, superceded as a result of the issuance of Emerging Issues Task Force (“EITF”) Issue

No. 00-21, “Accounting for Revenue Arrangements with Multiple Deliverables.” Additionally, SAB No. 104

rescinds the SEC’s Revenue Recognition in Financial Statements Frequently Asked Questions and Answers

(“FAQ”) issued with SAB No. 101. The adoption of SAB No. 104 in the first quarter of 2004 did not have

a material impact on the consolidated financial statements.

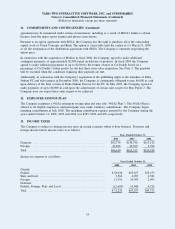

3. BUSINESS ACQUISITIONS AND CONSOLIDATION

The acquisitions described below have been accounted for as purchase transactions, accordingly, the results

of operations and financial position of the acquired businesses are included in the Company’s consolidated

financial statements from the respective dates of acquisition. To the extent that the purchase price allocation

for these acquisitions is preliminary, the Company does not expect that the final purchase price allocation will

be materially different. With the exception of the acquisition of TDK for fiscal 2003, the proforma impact of

these acquisitions was not material.

2004 Transactions

In October 2004, the Company acquired certain assets from Microsoft including Indie the developer of the

successful Top Spin (tennis), Amped and Amped 2 (snowboarding) and Links (golf) and the intellectual

property rights associated with these products. The purchase price for these assets was $18,500 paid in cash at

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

46