2K Sports 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

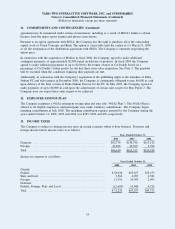

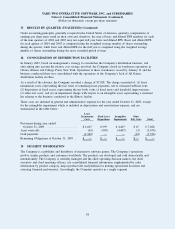

Accordingly, no provision has been made for foreign withholding taxes or United States income taxes which

may become payable if undistributed earnings of foreign subsidiaries are paid as dividends to the Company.

14. STOCKHOLDERS’ EQUITY

In November 2003, at a special meeting, the Company’s stockholders voted to amend the certificate

of incorporation to increase the Company’s authorized shares of common stock from 50,000,000 to

100,000,000 shares.

In January 2003, the Board of Directors authorized a stock repurchase program under which the Company

may repurchase up to $25,000 of its common stock from time to time in the open market or in privately

negotiated transactions. The Company has not repurchased any shares under this program.

In February 2002, the Company issued 20,000 shares of restricted common stock to a former employee in

connection with a separation agreement.

15. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

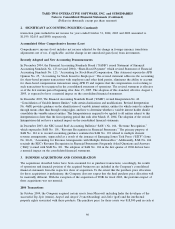

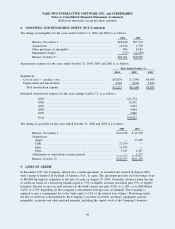

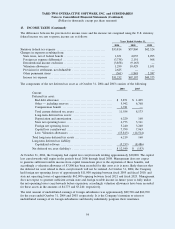

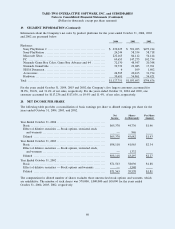

The components of and changes in accumulated other comprehensive income (loss) are:

Foreign

Currency

Translation

Adjustments

Net Unrealized

Gain (Loss)

on Investments

Accumulated

Other

Comprehensive

Income (Loss)

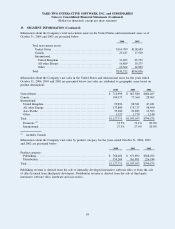

Balance at November 1, 2001 ....................... $(10,608) $ 156 $(10,452)

Comprehensive income (loss) changes during the

year, net of taxes of $ 87 ...................... 5,553 (142) 5,411

Balance at October 31, 2002 ........................ (5,055) 14 (5,041)

Comprehensive income (loss) changes during the

year, net of taxes of $9 ........................ 4,119 (14) 4,105

Balance at October 31, 2003 ........................ (936) — (936)

Comprehensive income changes during the year . . 7,290 — 7,290

Balance at October 31, 2004 ........................ $ 6,354 $ — $ 6,354

The taxes in the above table relate to the changes in the net unrealized gain (loss) on investments. The

foreign currency adjustments are not adjusted for income taxes as they relate to indefinite investments in

non-U.S. subsidiaries.

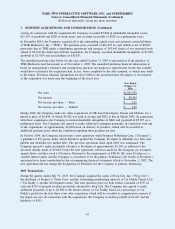

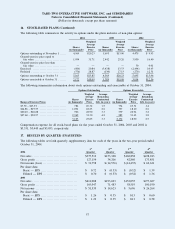

16. STOCK-BASED PLANS

Incentive Stock Plan

The Incentive Stock Plan (“Incentive Plan”) was adopted by the Board of Directors on June 12, 2003 and

approved by stockholders in June 2004. The Incentive Plan provides for the grant of restricted stock,

deferred stock and other stock-based awards of the Company’s common stock to directors, officers and other

employees of the Company. A maximum of 1,000,000 shares are authorized for grant under the Incentive

Plan. The cost of restricted shares granted is expensed on a straight-line basis over the vesting period, which

ranges from 1 to 4 years. The Incentive Plan is administered by the Compensation Committee of the Board

of Directors.

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

13. INCOME TAXES (Continued)

55