2K Sports 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Class Action Settlement Costs. During fiscal 2002, we recorded $1,468 of class action settlement costs, which

represents a settlement of $7,500 and related legal fees, net of $6,145 of insurance proceeds.

Provision for Income Taxes. Income tax expense was $67,197 for fiscal 2003 as compared to $49,375 for

fiscal 2002. The increase was primarily attributable to increased taxable income. The effective tax rate was

40.6% for fiscal 2003, as compared to an effective tax rate of 40.8% for fiscal 2002. The fiscal 2003 tax

provision included the effect of a valuation allowance in the amount of $10,429 attributable to capital and

other loss carryforwards. The effective income tax rate differs from the statutory rate primarily as a result of

non-taxable foreign income, non-deductible expenses, valuation allowances for deferred tax assets and the mix

of foreign and domestic taxes as applied to the income. This resulted in a lower effective tax rate in fiscal

2003, which was offset by a $10,429 valuation allowance primarily related to capital loss carryforwards.

Net Income. Net income increased $26,555 or 37.1%, to $98,118 for fiscal 2003 from $71,563 for fiscal

2002, due to the changes referred to above.

Diluted Net Income per Share. Diluted net income per share increased $0.46, or 25.4%, to $2.27 for

fiscal 2003 from $1.81 for fiscal 2002. The increase in net income was partly offset by the higher weighted

average shares outstanding. The increase in weighted shares outstanding resulted from the issuance of

shares underlying stock options and to the acquisitions of the Max Payne intellectual property and the

development studios.

Liquidity and Capital Resources

Our primary cash requirements are to fund the development and marketing of our products. We satisfy our

working capital requirements primarily through cash flow from operations. At October 31, 2004, we had

working capital of $395,131 as compared to working capital of $347,922 at October 31, 2003.

Our cash and cash equivalents decreased $28,382 during fiscal 2004 as follows:

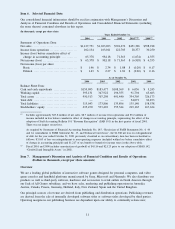

Years ended October 31,

2004 2003 2002

Cash provided by operations ................................................ $ 20,458 $ 80,628 $144,998

Cash used in investing activities ............................................ (64,422) (45,881) (18,084)

Cash provided (used) by financing activities ................................ 16,315 44,562 (31,988)

Effect of foreign exchange rates on cash and cash equivalents .............. (733) (4,201) 7,387

Net (decrease) increase in cash and cash equivalents ....................... $(28,382) $ 75,108 $102,313

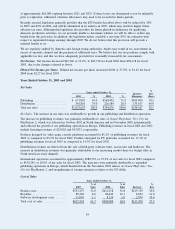

Operating Activities: Cash provided by operations decreased by 75% or $60,170 to $20,458 reflecting an

increase in working capital, primarily due to increased levels of accounts receivables and inventories, offset by

higher net income adjusted for non-cash items.

Investing Activities: Over the last three years we have acquired several development studios and used cash as

part of the purchase price. In fiscal 2004, we used $39,336 in cash to acquire Indie, TDK, Mobius and Venom

compared to $27,973 and $3,788 in cash for acquisitions in fiscal 2003 and 2002. In 2004, we incurred capital

expenditures associated with the build-out of our new corporate offices and the continued improvement of our

software systems.

Financing Activities: We continue to generate cash from the exercise of stock options by employees. The

amounts can vary significantly by year. Proceeds from exercise of stock options decreased by $28,182 in fiscal

2004 to $16,683. In fiscal 2002, we repaid all amounts outstanding, totaling $54,284, under our line of credit.

Significant Balance Sheet Changes: The increase of $128,571 in gross accounts receivable, before allowances,

at October 31, 2004 is attributable primarily to sales from a major product release at the end of fiscal 2004.

Our allowances, which include doubtful accounts, returns, price concessions, rebates and other sales

allowances, increased to $72,215 at October 31, 2004 from $62,817 at October 31, 2003 and decreased as a

percentage of receivables to 20.2% at October 31, 2004 from 27.4% at October 31, 2003. The dollar increase

in allowances is consistent with the volume of products launched at year end. The decrease in the allowance

as a percentage of gross receivables was primarily the result of sales from a major product release on which

21