2K Sports 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

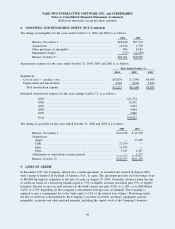

subsidiaries. Available borrowings under the agreement are reduced by the amount of the outstanding standby

letter of credit, which is $1,560 at October 31, 2004. The loan agreement contains certain financial and other

covenants, including the maintenance of consolidated net worth, consolidated leverage ratio and consolidated

fixed charge coverage ratio. As of October 31, 2004, the Company was in compliance with such covenants.

The loan agreement limits or prohibits the Company from declaring or paying cash dividends, merging or

consolidating with another corporation, selling assets (other than in the ordinary course of business), creating

liens and incurring additional indebtedness. The Company had no outstanding borrowings under the revolving

line of credit as of October 31, 2004 and 2003.

In February 2001, the Company’s United Kingdom subsidiary entered into a credit facility agreement, as

amended in March 2002 and April 2004, with Lloyds TSB Bank plc (“Lloyds”) under which Lloyds agreed

to make available borrowings of up to approximately $24,000. Advances under the credit facility bear interest

at the rate of 1.25% per annum over the bank’s base rate, and are guaranteed by the Company. Available

borrowings under the agreement are reduced by the amount of outstanding guarantees. The facility expires on

March 31, 2005. The Company had no material guarantees and no outstanding borrowings under this facility

as of October 31, 2004 and 2003.

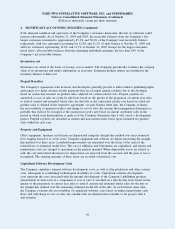

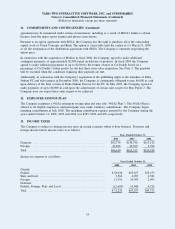

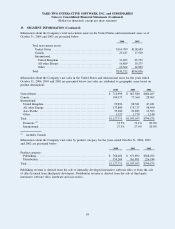

10. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities as of October 31, 2004 and 2003 consist of:

2004 2003

Accrued co-op advertising and product rebates .................... $ 3,487 $ 3,985

Accrued VAT and payroll taxes .................................... 16,865 11,593

Royalties payable .................................................. 70,113 16,502

Deferred revenue .................................................. 3,448 2,358

Sales commissions................................................. 2,238 2,400

Guarantee payable ................................................. 3,594 —

Provision for settlement ........................................... 7,500 —

Other .............................................................. 21,285 20,045

Total ............................................................... $128,530 $56,883

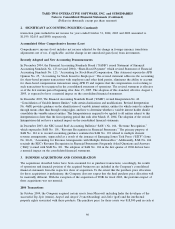

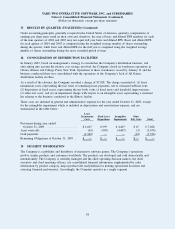

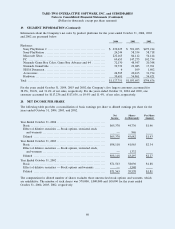

11. COMMITMENTS AND CONTINGENCIES

Lease Commitments

The Company leases 32 office and warehouse facilities. The offices are under non-cancelable operating leases

expiring at various times from December 2004 to September 2014. In addition, the Company has leased

certain equipment, furniture and auto leases under non-cancelable operating leases, which expire through

March 2008. Some of the leases have fixed rent increases and also include inducements to enter into the lease.

The effect of such amounts are deferred and recognized on a straight-line basis over the related lease term.

The Company’s principal executive offices are located at 622 Broadway, New York, New York. The Company

has recently leased additional space at 622 Broadway to accommodate its expanded operations. In connection

with signing a ten-year lease, the Company provided a standby letter of credit of $1,560.

The Company leases approximately 206,000 square feet of office and warehouse space in Cincinnati, Ohio

and pays $1,100 per annum, plus taxes and insurance, under the lease, which expires in May 2006. Effective

September 2004, the Company entered into a ten-year lease for 400,000 square feet of new office and

warehouse space and will pay approximately $1,000 per annum under the lease, plus taxes and insurance.

In addition, the Company will receive funds for leasehold improvements. The Company is entitled to a rent

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

9. LINES OF CREDIT (Continued)

51