2K Sports 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Mobius (Rockstar Leeds). In March 2004, we acquired all the outstanding capital stock of Mobius, a UK-

based developer of titles for handheld platforms, including Sony’s PSP platform. The purchase price was

approximately $4,549, of which $3,627 was paid in cash at closing and approximately $922 is due March

2005. In connection with the acquisition, we recorded identifiable intangibles of $96 (non-competition

agreements) and goodwill of $4,681. We also agreed to make additional contingent payments of approximately

$2,000 based on delivery of products, which will be recorded as additional purchase price when the conditions

requiring their payment are met.

TDK. In December 2003, we acquired all of the outstanding capital stock and assumed certain liabilities of

TDK Mediactive, Inc. (“TDK”). The purchase price consisted of $16,827 in cash (which is net of $8,051

previously due to TDK under a distribution agreement) and the issuance of 163,641 shares of restricted stock

valued at $5,160. In connection with the acquisition, we recorded identifiable intangibles of $7,690, goodwill

of $17,079 and net liabilities of $10,833. The proforma impact of this acquisition on the financial statements

in fiscal 2004 was not material as the acquisition was made near the beginning of the year. The proforma

impact on fiscal 2003 reduced net income by $17,715 to $80,403.

Frog City and Cat Daddy. During fiscal 2003, we acquired the assets of Frog City, Inc. (“Frog City”), the

developer of Tropico 2:Pirate Cove, and all of the outstanding membership interests of Cat Daddy Games

LLC (“Cat Daddy”), another development studio. The total purchase price for both studios consisted of $757

in cash and $319 of prepaid royalties previously advanced to Frog City. We also agreed to make additional

payments of up to $2,500 to the former owners of Cat Daddy, based on a percentage of Cat Daddy’s profits

for the first three years after acquisition, which will be recorded as compensation expense if the targets are

met. In connection with the acquisitions, we recorded goodwill of $1,267 and net liabilities of $191.

Angel (Rockstar San Diego). In November 2002, we acquired all of the outstanding capital stock of Angel

Studios, Inc. (“Angel”), the developer of Midnight Club and Smuggler’s Run. The purchase price consisted of

235,679 shares of restricted stock (valued at $6,557), $28,512 in cash and $5,931 (net of $801 of royalties

payable to Angel) of prepaid royalties previously advanced to Angel. In connection with the acquisition, we

recorded identifiable intangibles of $4,720 (comprised of intellectual property of $2,810, technology of $1,600

and non-competition agreements of $310), goodwill of $37,425 and net liabilities of $1,145.

Barking Dog (Rockstar Vancouver). In August 2002, we acquired all of the outstanding capital stock of

Barking Dog Studios Ltd. (“Barking Dog”), a Canadian-based development studio. The purchase price

consisted of 242,450 shares of restricted common stock (valued at $3,801), $3,000 in cash, $825 of prepaid

royalties previously advanced to Barking Dog and assumed net liabilities of $70. In connection with the

acquisition, we recorded identifiable intangibles of $1,800, comprised of non-competition agreements of

$1,600 and intellectual property of $200, and goodwill of $6,772.

The acquisitions have been accounted for as purchase transactions and, accordingly, the results of operations

and financial position of the acquired businesses are included in our Consolidated Financial Statements from

the respective dates of acquisition.

In addition, our agreement with Destineer Publishing Corp. (“Destineer”), a publisher of PC games,

requires us to consolidate Destineer’s operating results under FIN 46 (R). See Note 3 to Consolidated

Financial Statements.

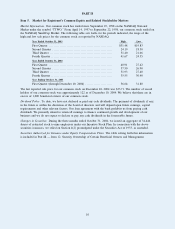

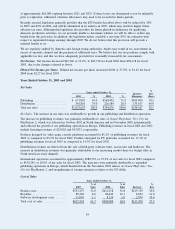

Years Ended October 31, 2004 and 2003

Net Sales

Years ended October 31,

2004 % 2003 %

Increase

(Decrease)

%

Incr

(Decr)

Publishing ........................... $ 768,482 68.1 $ 671,892 65.0 $96,590 14.4

Distribution .......................... 359,269 31.9 361,801 35.0 (2,532) (0.7)

Total net sales ....................... $1,127,751 100.0 $1,033,693 100.0 $94,058 9.1

16