2K Sports 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

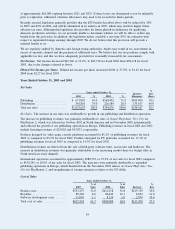

lower allowances were required. We had accounts receivable days outstanding of 59 days for the three months

ended October 31, 2004, as compared to 56 days for the three months ended October 31, 2003. Receivable

days outstanding increased primarily as a result of the significant amount of sales of a major product release

at year end. Our receivable days outstanding fluctuate from period to period depending on the timing of

product releases.

Generally, we have been able to collect our receivables in the ordinary course of business. We do not hold any

collateral to secure payment from customers and our receivables are generally not covered by insurance. As

a result, we are subject to credit risks, particularly in the event that any of the receivables represent a limited

number of retailers or are concentrated in foreign markets. If we are unable to collect our accounts receivable

as they become due, it could adversely affect our liquidity and working capital position and we would be

required to increase our provision for doubtful accounts.

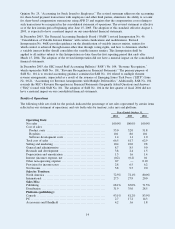

Inventories of $154,345 at October 31, 2004 increased $52,597 from October 31, 2003, reflecting higher

levels of distribution products. Accounts payable of $163,961 at October 31, 2004 increased $57,789 primarily

due to the increase in inventory levels. Accrued expenses increased as a result of an increase in royalties

payable under a royalty program based on product sales for certain of our internal development personnel and

the provision for the offer of settlement with the SEC.

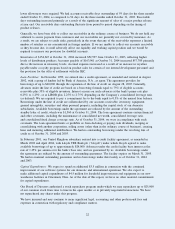

Loan Facilities: In December 1999, we entered into a credit agreement, as amended and restated in August

2002, with a group of lenders led by Bank of America, N.A., as agent. The agreement provides for

borrowings of up to $40,000 through the expiration of the line of credit on August 28, 2005. Generally,

advances under the line of credit are based on a borrowing formula equal to 75% of eligible accounts

receivable plus 35% of eligible inventory. Interest accrues on such advances at the bank’s prime rate plus

0.25% to 1.25%, or at LIBOR plus 2.25% to 2.75% depending on the Company’s consolidated leverage ratio

(as defined). We are required to pay a commitment fee to the bank equal to 0.5% of the unused loan balance.

Borrowings under the line of credit are collateralized by our accounts receivable, inventory, equipment,

general intangibles, securities and other personal property, including the capital stock of our domestic

subsidiaries. Available borrowings under the agreement are reduced by the amount of the outstanding

standby letter of credit, which was $1,560 at October 31, 2004. The loan agreement contains certain financial

and other covenants, including the maintenance of consolidated net worth, consolidated leverage ratio

and consolidated fixed charge coverage ratio. As of October 31, 2004, we were in compliance with such

covenants. The loan agreement limits or prohibits us from declaring or paying cash dividends, merging or

consolidating with another corporation, selling assets (other than in the ordinary course of business), creating

liens and incurring additional indebtedness. We had no outstanding borrowings under the revolving line of

credit as of October 31, 2004 and 2003.

In February 2001, our United Kingdom subsidiary entered into a credit facility agreement, as amended in

March 2002 and April 2004, with Lloyds TSB Bank plc (“Lloyds”) under which Lloyds agreed to make

available borrowings of up to approximately $24,000. Advances under the credit facility bear interest at the

rate of 1.25% per annum over the bank’s base rate, and are guaranteed by us. Available borrowings under

the agreement are reduced by the amount of outstanding guarantees. The facility expires on March 31, 2005.

We had no material outstanding guarantees and no borrowings under this facility as of October 31, 2004

and 2003.

Capital Expenditures: We expect to spend an additional $3.5 million in connection with the continued

improvement of our software systems for our domestic and international operations. We also expect to

make additional capital expenditures of $4.5 million for leasehold improvements and equipment in our new

warehouse facilities in Cincinnati, Ohio. As of the date of this report, we have no other material commitments

for capital expenditures.

Our Board of Directors authorized a stock repurchase program under which we may repurchase up to $25,000

of our common stock from time to time in the open market or in privately negotiated transactions. We have

not repurchased any shares under this program.

We have incurred and may continue to incur significant legal, accounting and other professional fees and

expenses in connection with regulatory and compliance matters.

22