2K Sports 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

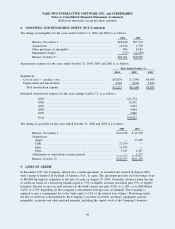

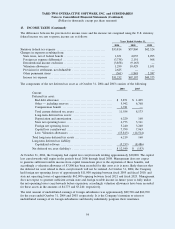

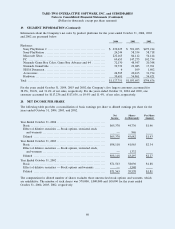

Restricted shares granted under the plan and the weighted average fair value of the shares for the years ending

October 31, 2004, 2003 and 2002 was as follows:

2004 2003 2002

Restricted common stock (in thousands) .............................. 160 235 50

Weighted average share price ......................................... $31.22 $23.11 $21.00

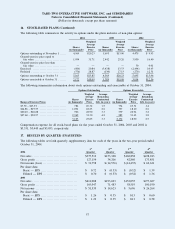

Stock Option Plans

In June 2002, the stockholders of the Company approved the Company’s 2002 Stock Option Plan, as

previously adopted by the Company’s Board of Directors (the “2002 Plan”), pursuant to which officers,

directors, employees and consultants of the Company may receive stock options to purchase shares of

Common Stock. In June 2004, the stockholders approved an increase in the aggregate amount of shares to

6,000,000 shares from 3,000,000 shares.

In January 1997, the stockholders of the Company approved the Company’s 1997 Stock Option Plan, as

amended, as previously adopted by the Company’s Board of Directors (the “1997 Plan”), pursuant to which

officers, directors, employees and consultants of the Company may receive options to purchase up to an

aggregate of 6,500,000 shares of the Company’s Common Stock. As of April 30, 2002, there are no options

available for grant under the 1997 Plan.

Subject to the provisions of the plans, the Board of Directors or any Committee appointed by the Board of

Directors, has the authority to determine the individuals to whom the stock options are to be granted, the

number of shares to be covered by each option, the option price, the type of option, the option period,

restrictions, if any, on the exercise of the option, the terms for the payment of the option price and other terms

and conditions.

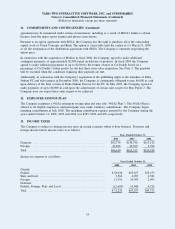

As of October 31, 2004 and 2003, the plans had outstanding stock options for an aggregate of 3,651,000 and

3,066,000 shares of the Company’s Common Stock, respectively, vesting at various times from 1998 to 2008

and expiring at various times from 2002 to 2009. Options granted generally vest over a period of three to

five years.

Non-Plan Stock Options

As of October 31, 2004 and 2003, there are non-plan stock options outstanding for an aggregate of 1,512,000

and 1,503,000 shares of the Company’s Common Stock, respectively, vesting from 1999 to 2007 and expiring

at various times from 2003 to 2009.

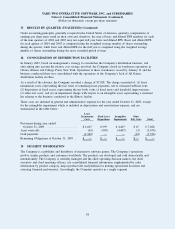

For those options with exercise prices less than fair value of the underlying shares at the measurement date,

the difference is recorded as deferred compensation and is amortized on a straight-line basis over the

vesting period.

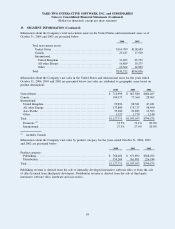

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

16. STOCK-BASED PLANS (Continued)

56