2K Sports 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

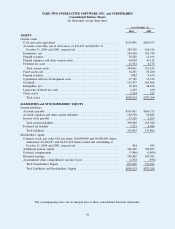

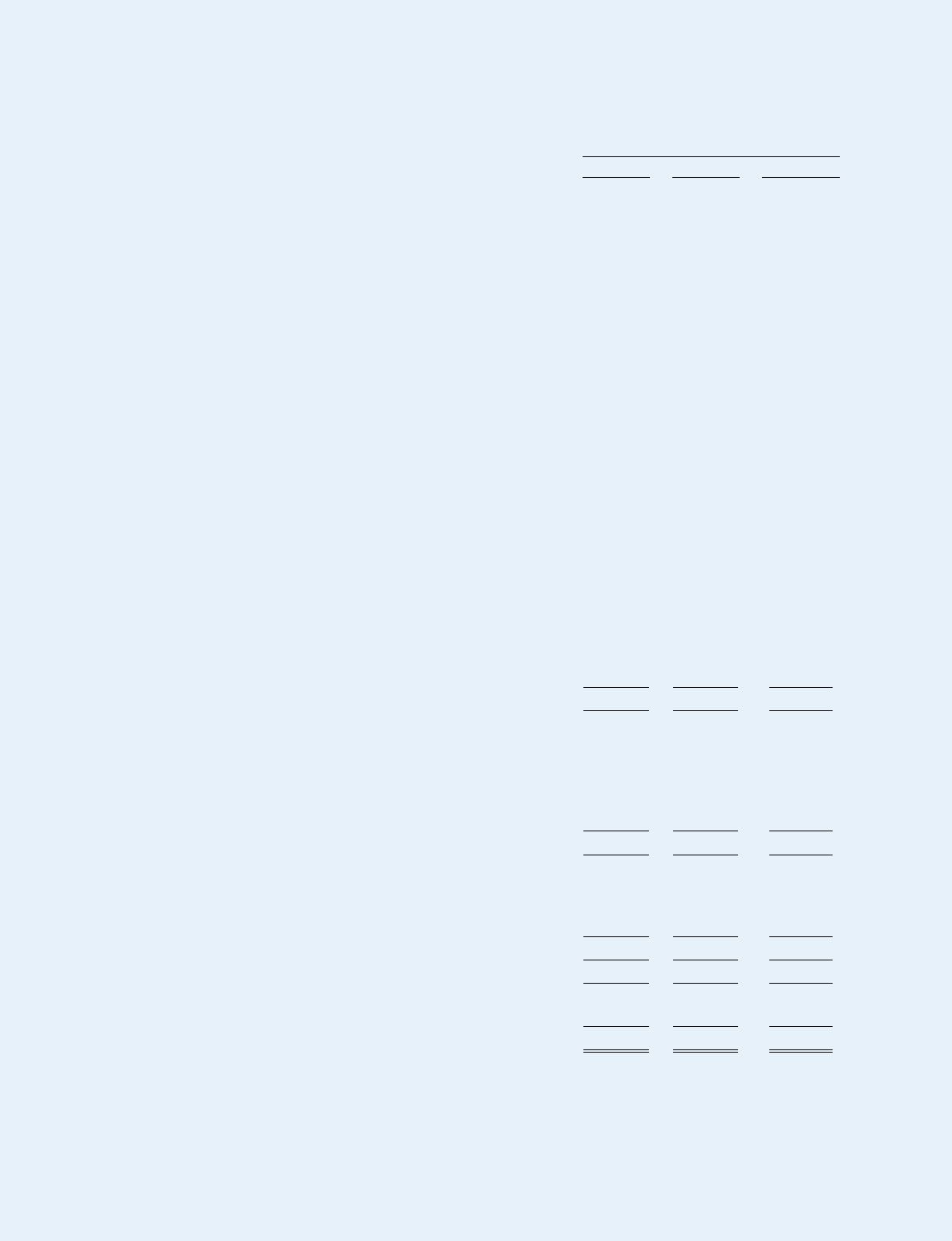

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Consolidated Statements of Cash Flows

(In thousands)

Years Ended October 31,

2004 2003 2002

Cash flows from operating activities:

Net income ....................................................... $ 65,378 $ 98,118 $ 71,563

Adjustment to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization ................................. 16,846 12,516 10,829

Impairment of intellectual property and technology ............ — 7,892 —

Non-cash charges for consolidation of distribution facilities .... — 5,474 —

Provision for deferred taxes .................................... (12,693) 13,040 6,726

Provision for sales allowances ................................. 196,287 120,329 72,096

Provision for doubtful accounts ................................ 4,395 4,322 2,405

Amortization of various expenses and discounts ............... 19,801 9,301 6,262

Write off of prepaid royalties and capitalized software ......... 8,772 9,588 15,616

Tax benefit from exercise of stock options ...................... 4,136 20,858 10,700

Compensatory stock and stock options ......................... 3,331 3,445 3,053

Other ........................................................... (1,899) (2,260) (895)

Changes in operating assets and liabilities, net of effects

of acquisitions:

Increase in accounts receivable ................................. (322,438) (185,611) (87,100)

Increase in inventories ......................................... (50,532) (25,146) (12,852)

Increase in prepaid royalties ................................... (27,865) (10,764) (8,157)

Increase in prepaid expenses and other current assets .......... (11,397) (7,423) (3,034)

Increase in capitalized software development costs ............. (12,802) (5,152) (895)

(Increase) decrease in other non-current assets ................. (1,301) — 257

Increase in accounts payable ................................... 62,277 20,148 23,019

Increase in accrued expenses and other current liabilities ...... 57,614 4,445 33,834

Increase (decrease) in income taxes payable ................... 22,548 (12,492) 1,571

Net cash provided by operating activities ...................... 20,458 80,628 144,998

Cash flows from investing activities:

Purchase of fixed assets ........................................ (21,586) (15,464) (10,466)

Sale of investments ............................................ — 114 6,170

Acquisitions, net of cash acquired .............................. (39,336) (27,973) (3,788)

Acquisition of intangible assets ................................ (3,500) (2,075) (10,000)

Other investing activities ....................................... — (483) —

Net cash used in investing activities ........................... (64,422) (45,881) (18,084)

Cash flows from financing activities:

Net repayments under lines of credit ........................... — — (54,284)

Proceeds from exercise of stock options and warrants ......... 16,683 44,865 23,308

Other financing activities ....................................... (368) (303) (1,012)

Net cash provided by (used in) financing activities ............... 16,315 44,562 (31,988)

Effect of foreign exchange rates .................................... (733) (4,201) 7,387

Net (decrease) increase in cash for the period .................... (28,382) 75,108 102,313

Cash and cash equivalents, beginning of the period.................. 183,477 108,369 6,056

Cash and cash equivalents, end of the period ....................... $ 155,095 $ 183,477 $ 108,369

The accompanying notes are an integral part of these consolidated financial statements.

38