2K Sports 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reduction in connection with its former warehouse space and will seek to sublease this space in April 2005.

Both the rent reduction and leasehold payments will be amortized over the life of the new lease. The

transition to the new facility is planned to be completed by the end of May 2005.

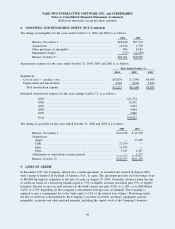

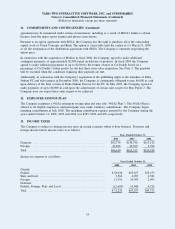

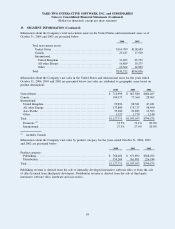

Future minimum rental payments required as of October 31, 2004 are as follows:

Years ending October 31:

2005 .................................................................... $ 9,997

2006 .................................................................... 8,206

2007 .................................................................... 7,754

2008 .................................................................... 7,285

2009 .................................................................... 13,434

Thereafter ............................................................... 15,302

Total minimum lease payments ......................................... 61,978

Less minimum rentals to be received under subleases .................. 130

Total .................................................................... $61,848

Rent expense amounted to $9,713, $7,445 and $5,090, for the years ended October 31, 2004, 2003, and

2002, respectively.

Legal and Other Proceedings

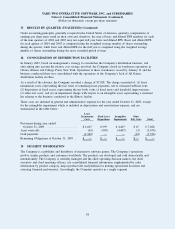

In November 2004, the Company submitted an offer of settlement of the previously announced investigation

by the Enforcement Division of the Securities and Exchange Commission to the Staff of the Commission. The

Staff has agreed to recommend the offer of settlement to the Commission. If approved by the Commission,

the proposed settlement, under which the Company would neither admit nor deny the allegations of a

Complaint, would fully resolve all claims relating to the investigation that commenced in December 2001.

Pursuant to the offer of settlement, the Company would pay a civil penalty of $7.5 million, which has been

accrued in the accompanying financial statements, and would be enjoined from future violations of the federal

securities laws.

The Company is involved in routine litigation in the ordinary course of its business, which in management’s

opinion will not have a material adverse effect on the Company’s financial condition, cash flows or results

of operations.

Other

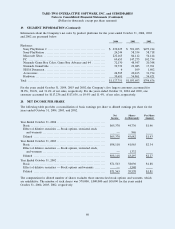

The Company periodically enters into distribution agreements to purchase various software games that require

the Company to make minimum guaranteed payments. These agreements, which expire between March 15,

2005 and December 31, 2005, require remaining aggregate minimum guaranteed payments of $7,487 at

October 31, 2004. Additionally, assuming performance by third-party developers, the Company has

outstanding commitments under various software development agreements to pay developers an aggregate of

$82,342 during fiscal 2005. The Company also expects to spend $3,500 in fiscal 2005 in connection with the

continued improvement of our software systems for its domestic and international operations. In addition, the

Company expects to spend $4,500 in fiscal 2005 on leasehold improvements and equipment for the warehouse

in Ohio.

Effective May 2004, the Company entered into a three-year agreement with SEGA Corporation, whereby it

co-publishes and exclusively distributes SEGA’s sports titles. Under the current arrangement, the Company is

entitled to receive all of the revenue and profit, if any, from the sale of the sports titles developed by Visual

Concepts and Kush, and it is obligated to pay for development and marketing costs of the sports titles. The

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

11. COMMITMENTS AND CONTINGENCIES (Continued)

52