2K Sports 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

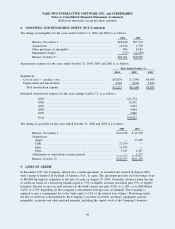

Had compensation cost for the Company’s stock option plans been determined based on the fair value at the

grant date for awards consistent with the provisions of SFAS No. 123, the Company’s net income and the net

income per share would have been reduced to the proforma amounts indicated below:

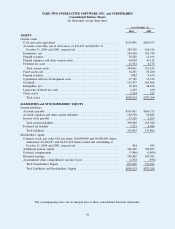

Years Ended October 31,

2004 2003 2002

Net income, as reported .......................................... $ 65,378 $ 98,118 $ 71,563

Add: Stock-based employee compensation expense included in

reported net income, net of related tax effects ................. 2,036 2,123 1,878

Deduct: Total stock-based employee compensation expense

determined under fair value based method for all awards, net

of related tax effects .......................................... (15,946) (18,194) (16,415)

Performa net income ............................................. $ 51,468 $ 82,047 $ 57,026

Earnings per share: ............................................

Basic — as reported ........................................... $ 1.46 $ 2.34 $ 1.88

Basic — proforma ............................................. 1.15 1.96 1.50

Diluted — as reported ......................................... 1.43 2.27 1.81

Diluted — proforma ........................................... 1.13 1.90 1.44

The proforma disclosures shown are not representative of the effects on net income and the net income per

share in future periods.

The weighted average fair values of options granted are $18.39, $15.05 and $9.13 for the years ended

October 31, 2004, 2003 and 2002. The fair value of the Company’s stock options used to compute proforma

net income and the net income per share disclosures is the estimated present value at the grant date using the

Black-Scholes option-pricing model with the following assumptions:

2004 2003 2002

Risk free interest rate ....................................... 3.4% 2.6% 1.8%

Expected stock price volatility .............................. 71.9% 78.0% 74.0%

Expected term until exercise (years) ........................ 4.4 4.2 4.1

Dividends ................................................... None None None

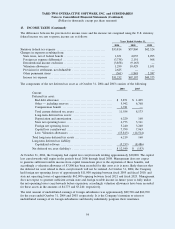

Net Income per Share

Basic earnings per share (“EPS”) is computed by dividing the net income applicable to common stockholders

for the year by the weighted-average number of common shares outstanding during the year. Diluted EPS is

computed by dividing the net income applicable to common stockholders for the year by the weighted-average

number of common and common stock equivalents, which include common shares issuable upon the exercise

of stock options, restricted stock (for fiscal 2004 and 2003) and warrants outstanding during the year.

Common stock equivalents are excluded from the computation if their effect is antidilutive.

Foreign Currency Translation

The functional currency for the Company’s foreign operations is primarily the applicable local currency.

Accounts of foreign operations are translated into U.S. dollars using exchange rates for assets and liabilities at

the balance sheet date and average prevailing exchange rates for the period for revenue and expense accounts.

Adjustments resulting from translation are included in other comprehensive income (loss). Realized and

unrealized transaction gains and losses are included in income in the period in which they occur, except on

intercompany balances considered to be long term. Transaction gains and losses on intercompany balances

considered to be long term are recorded in other comprehensive income, net of taxes. Foreign exchange

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

45