2K Sports 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

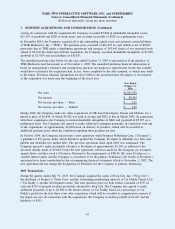

In November 2002, the Company acquired all of the outstanding capital stock of Angel Studios, Inc.

(“Angel”), the developer of Midnight Club and Smuggler’s Run. The purchase price consisted of 235,679

shares of restricted common stock (valued at $6,557), $28,512 in cash and $5,931 (net of $801 of royalties

payable to Angel) of prepaid royalties previously advanced to Angel. In connection with the acquisition, the

Company recorded identifiable intangibles of $4,720 (comprised of intellectual property of $2,810, technology

of $1,600 and non-competition agreements of $310), goodwill of $37,425 and net liabilities of $1,145.

2002 Transaction

In August 2002, the Company acquired all of the outstanding capital stock of Barking Dog Studios Ltd.

(“Barking Dog”), a Canadian-based development studio. The purchase price consisted of 242,450 shares of

restricted common stock (valued at $3,801), $3,000 in cash, $825 of prepaid royalties previously advanced to

Barking Dog and assumed net liabilities of $70. In connection with the acquisition, the Company recorded

identifiable intangibles of $1,800, comprised of non-competition agreements of $1,600 and intellectual

property of $200, and goodwill of $6,772.

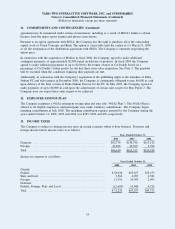

4. PREPAID ROYALTIES

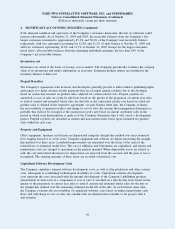

The following table provides the details of total prepaid royalties:

Years Ended October 31,

2004 2003 2002

Balance, November 1 ................................................. $ 20,635 $ 26,418 $ 33,149

Additions ............................................................. 66,055 30,034 28,555

Amortization .......................................................... (39,114) (19,065) (21,238)

Reclassification ....................................................... — (7,251) 1,419

Write down ........................................................... (5,752) (9,525) (15,126)

Foreign exchange ..................................................... 378 24 (341)

Ending balance ....................................................... 42,202 20,635 26,418

Less current balance ................................................... 38,220 12,196 14,215

Balance, October 31 .................................................. $ 3,982 $ 8,439 $ 12,203

Included in prepaid royalties at October 31, 2004 and 2003, respectively, are $35,124 and $14,241 related to

titles that have not been released yet.

The reclassification for the year ended October 31, 2003 principally reflects the transfer of prepaid royalties

paid to Angel Studios, Inc. and Frog City, Inc. prior to their acquisition by the Company as a component of

the purchase price of the acquisitions.

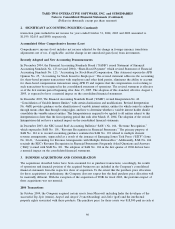

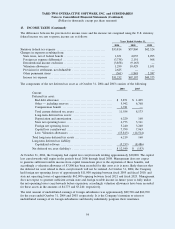

5. INVENTORIES, NET

As of October 31, 2004 and 2003, inventories consist of:

2004 2003

Parts and supplies ................................................. $ 7,146 $ 4,793

Finished products ................................................. 147,199 96,955

Total .............................................................. $154,345 $101,748

Estimated product returns included in inventories at October 31, 2004 and 2003 are $7,371 and $8,706,

respectively. Allowances to reduce inventory amounts to net realizable value are $7,520 and $3,781 at

October 31, 2004 and 2003.

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

3. BUSINESS ACQUISITIONS AND CONSOLIDATION (Continued)

48