2K Sports 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

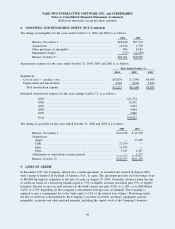

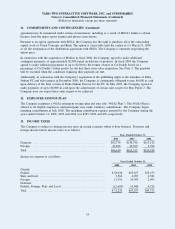

6. FIXED ASSETS, NET

As of October 31, 2004 and 2003, fixed assets consist of:

2004 2003

Computer equipment .............................................. $16,973 $12,963

Office equipment ................................................. 6,405 5,096

Computer software ................................................ 15,480 11,529

Furniture and fixtures ............................................. 4,413 3,157

Leasehold improvements .......................................... 10,906 6,047

Capital leases ..................................................... 398 398

Construction in progress .......................................... 3,922 —

58,497 39,190

Less: accumulated depreciation and amortization ................. 24,206 16,930

Total .............................................................. $34,291 $22,260

Depreciation expense for the years ended October 31, 2004, 2003, and 2002, amounted to $12,443, $9,510

and $6,457, respectively.

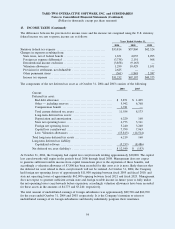

7. CAPITALIZED SOFTWARE DEVELOPMENT COSTS

The following table provides the details of capitalized software development costs:

Years Ended October 31,

2004 2003 2002

Balance, November 1 ................................................. $ 16,336 $ 10,385 $ 9,739

Additions ............................................................. 25,960 15,923 9,645

Amortization .......................................................... (12,902) (10,940) (7,633)

Reclassification ....................................................... — — (1,419)

Write down ........................................................... (3,020) (63) (490)

Foreign exchange ..................................................... 1,411 1,031 543

Balance, October 31 .................................................. $ 27,785 $ 16,336 $10,385

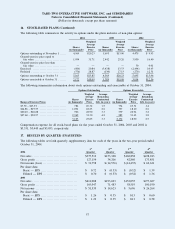

8. GOODWILL AND INTANGIBLE ASSETS, NET

The following table sets forth the components of the intangible assets subject to amortization:

As of October 31, 2004 As of October 31, 2003

Range of

Useful Life

(years)

Gross

Carrying

Amount

Accumulated

Amortization Net

Gross

Carrying

Amount

Accumulated

Amortization Net

Trademarks ................... 7 – 10 $26,825 $(10,438) $16,387 $23,342 $ (7,391) $15,951

Customer lists and

Relationships ............... 5 – 10 4,673 (3,007) 1,666 4,673 (2,733) 1,940

Intellectual property ........... 2 – 6 39,783 (27,151) 12,632 31,823 (8,737) 23,086

Non-competition

Agreements ................ 3 – 6 7,888 (3,002) 4,886 4,790 (2,311) 2,479

Technology ................... 3 4,192 (3,659) 533 4,192 (2,812) 1,380

Total ......................... $83,361 $(47,257) $36,104 $68,820 $(23,984) $44,836

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

49