2K Sports 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Product Costs. The increase in product costs was primarily attributable to higher costs associated with our

expanded distribution operations. These costs were partly offset by lower product pricing from suppliers and

lower manufacturing costs (principally attributable to volume purchase discounts and rebates) and lower cost

PC titles. Product costs for fiscal 2003 included a charge of $7,892 relating to the impairment of intangibles

related to certain products in development, including Duke Nukem Forever and its sequel. The impairment

was based on continued product development delays and our assessment of current market acceptance and

projected cash flows for these products. Product costs for fiscal 2002 included $3,064 of litigation settlement

costs relating to a distribution agreement.

Royalties. The increase in royalties was primarily due to expense under a royalty program based on product

sales for certain of our internal development personnel, partly offset by lower royalties payable to third parties

and lower write-downs and amortization of prepaid royalties.

Software Development Costs. Software development costs increased due to the release of a greater number

of internally developed titles during this period resulting in higher amortization in the current period. These

software development costs relate to our internally developed titles.

In future periods, cost of sales may be adversely affected by manufacturing and other costs, price competition

and by changes in product and sales mix and distribution channels.

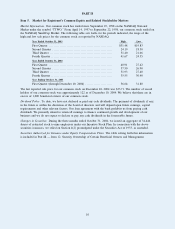

Operating Expenses

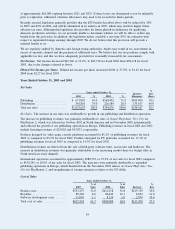

Years ended October 31,

2003

%of

Sales 2002

%of

Sales Increase

%

Incr

Selling and marketing ................ $103,015 10.0 $ 77,990 9.8 $25,025 32.1

General and administrative ........... 88,083 8.5 71,544 9.0 16,539 23.1

Research and development ........... 25,107 2.4 11,524 1.5 13,583 117.9

Depreciation and amortization ....... 16,923 1.6 10,829 1.4 6,094 56.3

Total operating expenses ............. $233,128 22.6 $171,887 21.6 $61,241 35.6

Selling and marketing. The increase in selling and marketing expense was attributable to increased levels of

advertising and promotional support for existing and new titles as well as higher personnel expenses and is

consistent with the growth of our business.

General and administrative. The general and administrative expense increase in absolute dollars was

principally attributable to costs associated with the consolidation of our distribution operations, as well as

increased personnel expenses (including bonuses, severance payments and the issuance of restricted stock),

higher rent and bad debt expenses. Higher costs were partly offset by lower professional fees, including the

reimbursement of $1,100 of legal fees from insurance proceeds in fiscal 2003 relating to costs recorded

in the prior year. Fiscal 2002 costs reflected litigation settlement costs of $1,190 relating to a distribution

arrangement. The fiscal 2003 net consolidation charge of $7,028 consisted of: lease termination costs,

representing the fair value of remaining lease payments, net of estimated sublease rent; disposition of fixed

assets, representing the net book value of fixed assets and leasehold improvements; and other exit costs. Bad

debt expense increased as a result of customer bankruptcies not covered by insurance during the current year.

Research and development. Research and development costs increased primarily due to the acquisitions

of development studios, as well as increased personnel costs. Once software development projects reach

technological feasibility, which is relatively early in the development process, a substantial portion of our

research and development costs are capitalized and subsequently amortized as cost of goods sold.

Depreciation and amortization. Depreciation and amortization expense increase includes $4,407 related to the

impairment of a customer list from a previous acquisition as a result of the consolidation of our distribution

operations, higher amortization of intangible assets as a result of acquisitions and higher depreciation related

to the implementation of accounting software systems.

Income from Operations. Income from operations increased by $40,306, or 32.8%, to $163,011 for fiscal

2003 from $122,705 for fiscal 2002, due to the changes referred to above.

Interest Income, net. Interest income of $2,265 for fiscal 2003 was attributable to interest earned on the

invested cash. Interest expense of $480 for fiscal 2002 reflected borrowings from our credit facilities, which

were repaid in early fiscal 2002.

20