2K Sports 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Opinion No. 25, “Accounting for Stock Issued to Employees.” The revised statement addresses the accounting

for share-based payment transactions with employees and other third parties, eliminates the ability to account

for share-based compensation transactions using APB 25 and requires that the compensation costs relating to

such transactions be recognized in the consolidated statement of operations. The revised statement is effective

as of the first interim period beginning after June 15, 2005. The adoption of this standard, effective August 1,

2005, is expected to have a material impact on our consolidated financial statements.

In December 2003, The Financial Accounting Standards Board (“FASB”) revised Interpretation No. 46

“Consolidation of Variable Interest Entities” with certain clarifications and modifications. Revised

Interpretation No. 46(R) provides guidance on the identification of variable interest entities, entities for

which control is achieved through means other than through voting rights, and how to determine whether

a variable interest holder should consolidate the variable interest entities. This Interpretation shall be

applied to all entities subject to this Interpretation no later than the first reporting period that ends after

March 15, 2004. The adoption of the revised Interpretation did not have a material impact on the consolidated

financial statements.

In December 2003, the SEC issued Staff Accounting Bulletin (“SAB”) No. 104, “Revenue Recognition,”

which supercedes SAB No. 101, “Revenue Recognition in Financial Statements.” The primary purpose of

SAB No. 104 is to rescind accounting guidance contained in SAB No. 101 related to multiple element

revenue arrangements, superceded as a result of the issuance of Emerging Issues Task Force (“EITF”) Issue

No. 00-21, “Accounting for Revenue Arrangements with Multiple Deliverables.” Additionally, SAB No. 104

rescinds the SEC’s Revenue Recognition in Financial Statements Frequently Asked Questions and Answers

(“FAQ”) issued with SAB No. 101. The adoption of SAB No. 104 in the first quarter of fiscal 2004 did not

have a material impact on our consolidated financial statements.

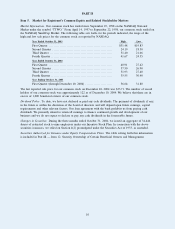

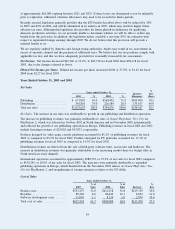

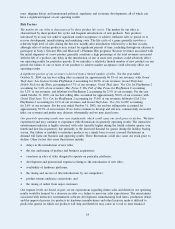

Results of Operations

The following table sets forth for the periods indicated the percentage of net sales represented by certain items

reflected in our statement of operations, and sets forth sales by territory, sales mix and platform:

Years Ended October 31,

2004 2003 2002

Operating Data:

Net sales ......................................................... 100.0% 100.0% 100.0%

Cost of sales

Product costs .................................................. 55.0 52.0 51.8

Royalties ...................................................... 10.1 8.6 10.1

Software development costs ................................... 1.4 1.1 1.0

Total cost of sales ............................................... 66.5 61.7 62.9

Selling and marketing ............................................ 10.4 10.0 9.8

General and administrative ....................................... 8.7 8.5 9.0

Research and development ....................................... 3.8 2.4 1.5

Depreciation and amortization ................................... 1.5 1.6 1.4

Interest (income) expense, net ................................... (0.2) (0.2) 0.1

Other non-operating expense ..................................... 0.7 — 0.10

Provision for income taxes ....................................... 2.8 6.5 6.2

Net Income ...................................................... 5.8 9.5 9.0

Sales by Territory:

North America ................................................... 72.5% 72.1% 80.0%

International ..................................................... 27.5 27.9 20.0

Sales Mix:

Publishing ....................................................... 68.1% 65.0% 71.5%

Distribution ...................................................... 31.9 35.0 28.5

Platform (publishing):

Console .......................................................... 93.1% 81.2% 83.9%

PC ............................................................... 2.7 17.2 14.3

Accessories and Handheld ....................................... 4.2 1.6 1.8

14