2K Sports 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

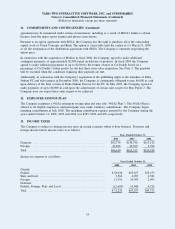

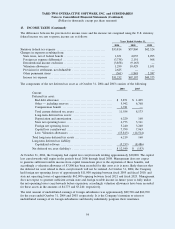

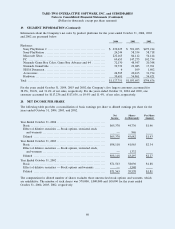

The differences between the provision for income taxes and the income tax computed using the U.S. statutory

federal income tax rate to pretax income are as follows:

Years Ended October 31,

2004 2003 2002

Statutory federal tax expense ......................................... $33,814 $57,860 $42,324

Changes in expenses resulting from:

State taxes, net of federal benefit ................................... 1,651 4,035 2,995

Foreign tax expense differential .................................... (3,738) 2,191 568

Extraterritorial income exclusion ................................... (3,858) (9,163) —

Valuation allowances ............................................... 1,299 10,429 1,101

Provision for settlement, not deductible ............................ 2,625 — —

Other permanent items ............................................. (561) 1,845 2,387

Income tax expense ................................................ $31,232 $67,197 $49,375

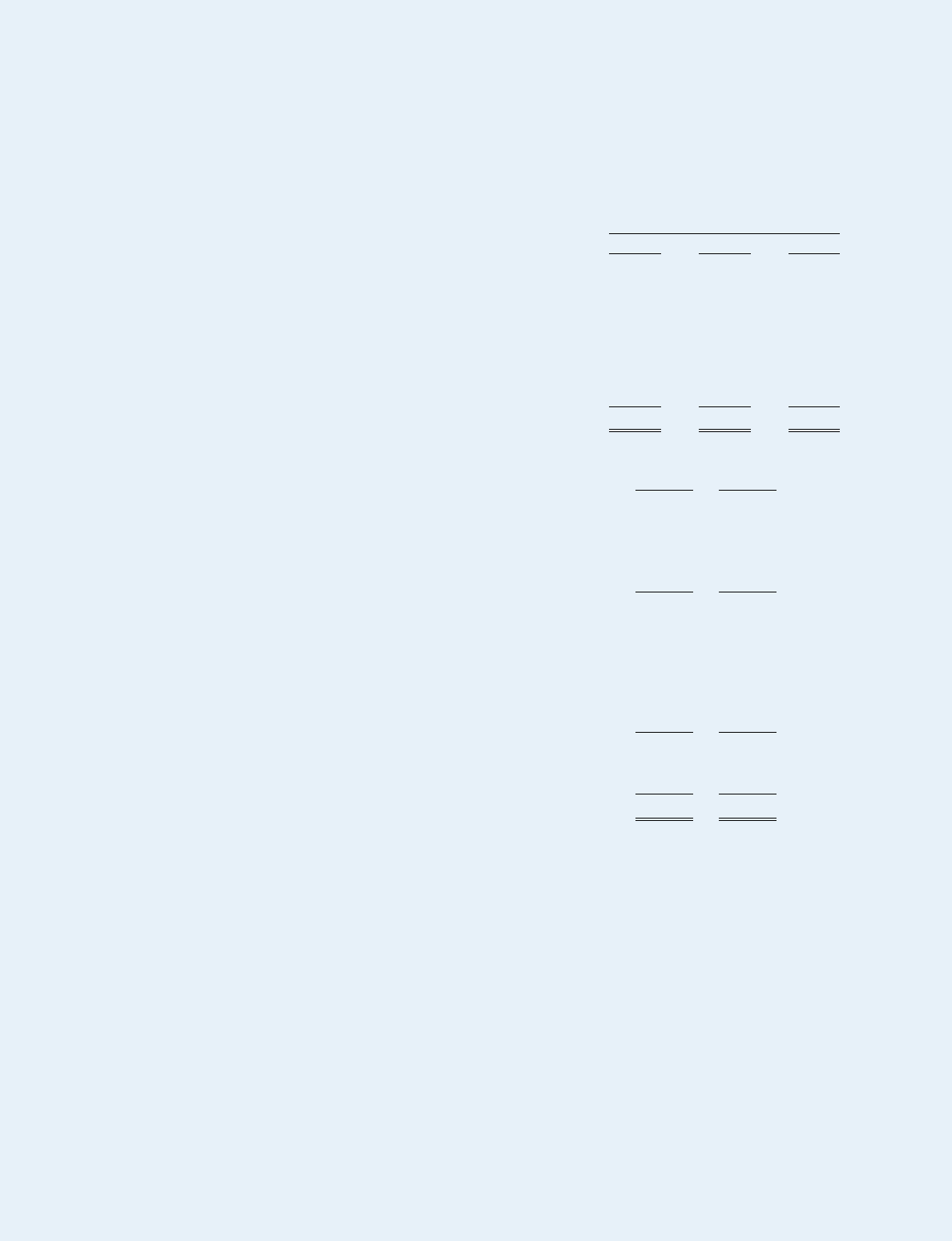

The components of the net deferred tax asset as of October 31, 2004 and 2003 consists of the following:

2004 2003

Current:

Deferred tax asset:

Bad debt allowance ............................................ $ 3,871 $ 1,405

Other — including reserves .................................... 5,942 6,768

Compensation benefit .......................................... 1,741 —

Total current deferred tax assets ................................ 11,554 8,173

Long-term deferred tax assets: .................................

Depreciation and amortization .................................. 6,220 160

State net operating losses ....................................... 4,773 3,311

Foreign net operating losses .................................... 3,240 3,240

Capital loss carryforward ....................................... 7,799 7,963

Less: Valuation allowances ..................................... (15,813) (14,514)

Total long-term deferred tax assets ................................ 6,219 160

Long-term deferred tax liability:

Capitalized software ............................................ (5,233) (8,486)

Net deferred tax asset (liability) .................................. $ 12,540 $ (153)

At October 31, 2004, the Company had capital loss carryforwards totaling approximately $20,000. The capital

loss carryforwards will expire in the periods fiscal 2006 through fiscal 2008. Management does not expect

to generate sufficient taxable income from capital transactions prior to the expiration of these benefits, and

accordingly a valuation allowance of $7,800 has been recorded for this asset as it is more likely than not that

the deferred tax asset related to these carryforwards will not be realized. At October 31, 2004, the Company

had foreign net operating losses of approximately $11,000 expiring between fiscal 2005 and fiscal 2010, and

state net operating losses of approximately $62,000 expiring between fiscal 2021 and fiscal 2023. Management

does not expect to generate sufficient certain state and foreign taxable income in future years to fully utilize

the net operating losses carryforwards before expiration, accordingly valuation allowances have been recorded

for these assets in the amounts of $4,773 and $3,240, respectively.

The total amount of undistributed earnings of foreign subsidiaries was approximately $89,700 and $60,700

for the years ended October 31, 2004 and 2003, respectively. It is the Company’s intention to reinvest

undistributed earnings of its foreign subsidiaries and thereby indefinitely postpone their remittance.

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

13. INCOME TAXES (Continued)

54