2K Sports 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

rates, shipping delays and international political, regulatory and economic developments, all of which can

have a significant impact on our operating results. See Note 19 to Consolidated Financial Statements.

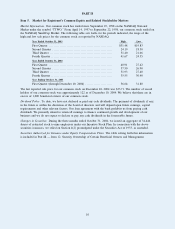

Employees

As of October 31, 2004, we had 1,435 full-time employees. None of our employees is subject to a collective

bargaining agreement. We consider our relations with employees to be good.

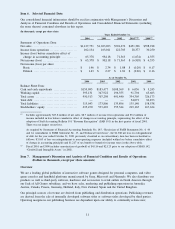

Item 2. Properties

Our principal executive offices are located at 622 Broadway, New York, New York in approximately 50,000

square feet of space under a ten-year lease, which provides for annual rent of approximately $1,488,000. We

also sublease an additional 15,000 square feet at this location for an annual rent of approximately $368,000.

Take-Two Interactive Software Europe leases 12,500 square feet of office space in Windsor, United Kingdom.

The lease provides for a current annual rent of approximately $634,000 plus taxes and utilities, and expires in

2011. Rockstar North currently leases 14,600 square feet of office space in Edinburgh, Scotland, at an annual

rent of approximately $993,000, which expires in 2014.

Jack of All Games leases approximately 206,000 square feet of office and warehouse space in Cincinnati,

Ohio. Jack of All Games pays $1,100,000 per annum, plus taxes and insurance, under the lease, which expires

in May 2006. Effective September 2004, Jack of All Games entered into a ten-year lease for 400,000 square

feet of new office and state-of-the-art warehouse space. Jack of All Games pays approximately $1,000,000

per annum under the lease, plus taxes and insurance. Jack of All Games is entitled to a rent reduction in

connection with its former warehouse space and will seek to sublease this space in April 2005. The transition

to the new facility is planned to be completed by the end of May 2005.

In addition, our other subsidiaries lease office space in Sydney, Australia; Vienna, Austria; Ontario, Toronto

and Vancouver, Canada; Paris, France; Munich, Germany; Breda, Holland; Madrid, Spain; Geneva,

Switzerland; Milan, Italy; Auckland, New Zealand; London, Lincoln and Leighton Buzzard, Newcastle-upon-

Tyne, UK; and in San Diego, San Francisco and Los Angeles, California; Baltimore, Maryland; Fenton,

Missouri; Austin, Texas; Salt Lake City, Utah; and Bellevue, Washington; for an aggregate annual rent of

approximately $3,657,000.

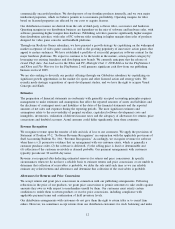

Item 3. Legal Proceedings

In November 2004, we submitted an offer of settlement of the previously announced investigation by the

Enforcement Division of the Securities and Exchange Commission to the Staff of the Commission. The Staff

has agreed to recommend the offer of settlement to the Commission. If approved by the Commission, the

proposed settlement, under which we would neither admit nor deny the allegations of a Complaint, would

fully resolve all claims relating to the investigation that commenced in December 2001. Pursuant to the offer

of settlement, we would pay a civil penalty of $7.5 million, which has been accrued in the accompanying

financial statements, and would be enjoined from future violations of the federal securities laws.

We are also involved in routine litigation in the ordinary course of our business, which in management’s

opinion will not have a material adverse effect on our financial condition, cash flows or results of operations.

Item 4. Submission of Matters to a Vote of Security Holders

Not Applicable.

9