2K Sports 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

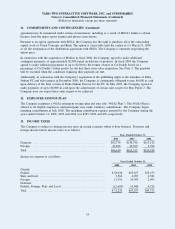

closing. In connection with the acquisition the Company recorded $5,828 in identifiable intangible assets,

$11,593 of goodwill and $280 of fixed assets, and accounts receivable of $829 on a preliminary basis.

In December 2003, the Company acquired all of the outstanding capital stock and assumed certain liabilities

of TDK Mediactive, Inc. (“TDK”). The purchase price consisted of $16,827 in cash (which is net of $8,051

previously due to TDK under a distribution agreement) and issuance of 163,641 shares of our restricted stock

valued at $5,160. In connection with the acquisition, the Company recorded identifiable intangibles of $7,690,

goodwill of $17,079 and net liabilities of $10,833.

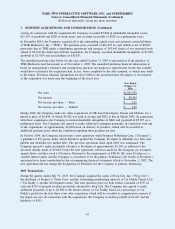

The unaudited proforma data below for the year ended October 31, 2003 is presented as if the purchase of

TDK Mediactive had been made as of November 1, 2002. The unaudited proforma financial information is

based on management’s estimates and assumptions and does not purport to represent the results that actually

would have occurred if the acquisition had, in fact, been completed on the date assumed, or which may result

in the future. Proforma financial information for fiscal 2004 is not presented since the impact is not material

as the acquisition was made near the beginning of the fiscal year.

Year Ended

October 31,

2003

Net sales ........................................................... $1,063,359

Net income ........................................................ $ 80,403

Net income per share — Basic .................................... $ 1.91

Net income per share — Diluted .................................. $ 1.85

During 2004, the Company made two other acquisitions of UK-based developers, Venom and Mobius, for a

purchase price of $5,844, of which $4,922 was paid at closing and $922 is due in March 2005. In connection

with these acquisitions, the Company recorded identifiable intangibles of $846 and goodwill of $5,307 on a

preliminary basis. The Company also agreed to make additional contingent payments, in connection with one

of the acquisitions, of approximately $2,000 based on delivery of products, which will be recorded as

additional purchase price when the conditions requiring their payment are met.

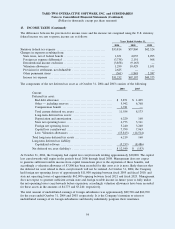

In October 2004, the Company entered into a new agreement with Destineer Publishing Corp. (“Destineer”),

a publisher of PC games, under which Destineer granted the Company the rights to distribute two titles and

publish and distribute two further titles. The previous agreement dated April 2003 was terminated. The

Company agreed to make recoupable advances to Destineer of approximately $3,149, in addition to the

advances already made of $5,604. Under the new agreement, advances made by the Company are recouped

against future royalties owed to Destineer. Pursuant to the requirements of FIN 46 (R), since Destineer is a

variable interest entity and the Company is considered to be the primary beneficiary, the results of Destineer’s

operations have been consolidated in the accompanying financial statements effective November 1, 2002. The

new agreement did not change the designation of Destineer nor the Company as primary beneficiary.

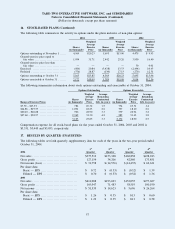

2003 Transactions

During the quarter ended July 31, 2003, the Company acquired the assets of Frog City, Inc. (“Frog City”),

the developer of Tropico 2: Pirate Cove, and the outstanding membership interests of Cat Daddy Games LLC

(“Cat Daddy”), another development studio. The total purchase price for both studios consisted of $757 in

cash and $319 of prepaid royalties previously advanced to Frog City. The Company also agreed to make

additional payments of up to $2,500 to the former owners of Cat Daddy, based on a percentage of Cat

Daddy’s profits for the first three years after acquisition, which will be recorded as compensation expense if

the targets are met. In connection with the acquisitions, the Company recorded goodwill of $1,267 and net

liabilities of $191.

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

3. BUSINESS ACQUISITIONS AND CONSOLIDATION (Continued)

47