2K Sports 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

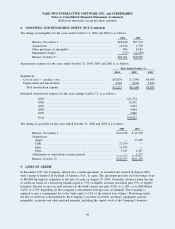

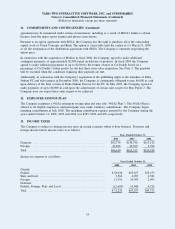

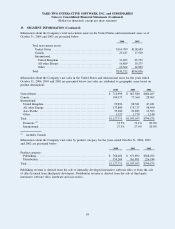

The change in intangibles for the years ended October 31, 2004 and 2003 is as follows:

2004 2003

Balance, November 1 ............................................. $68,820 $67,714

Acquisitions ...................................................... 14,364 4,720

Other purchases of intangibles .................................... 894 8,685

Impairment charges ............................................... (717) (12,299)

Balance, October 31 .............................................. $83,361 $68,820

Amortization expense for the years ended October 31, 2004, 2003 and 2002 is as follows:

Years Ended October 31,

2004 2003 2002

Included in:

Cost of sales — product costs ...................................... $18,870 $ 2,940 $4,059

Depreciation and amortization ...................................... 4,403 8,660 5,834

Total amortization expense ....................................... $23,273 $11,600 $9,893

Estimated amortization expense for the years ending October 31, is as follows:

2005 ............................................................... $11,374

2006 ............................................................... 10,371

2007 ............................................................... 5,872

2008 ............................................................... 4,464

2009 ............................................................... 2,846

Total ............................................................... $34,927

The change in goodwill for the years ended October 31, 2004 and 2003 is as follows:

2004 2003

Balance, November 1 ............................................. $101,498 $ 61,529

Acquisitions:

Angel .......................................................... — 37,425

TDK ........................................................... 17,079 —

Indie ........................................................... 11,593 —

Other ........................................................... 5,307 1,267

Adjustments to acquisitions in prior periods ...................... — 1,277

Balance, October 31 .............................................. $135,477 $101,498

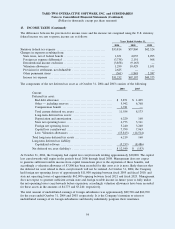

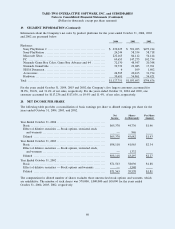

9. LINES OF CREDIT

In December 1999, the Company entered into a credit agreement, as amended and restated in August 2002,

with a group of lenders led by Bank of America, N.A., as agent. The agreement provides for borrowings of up

to $40,000 through the expiration of the line of credit on August 28, 2005. Generally, advances under the line

of credit are based on a borrowing formula equal to 75% of eligible accounts receivable plus 35% of eligible

inventory. Interest accrues on such advances at the bank’s prime rate plus 0.25% to 1.25%, or at LIBOR plus

2.25% to 2.75% depending on the Company’s consolidated leverage ratio (as defined). The Company is

required to pay a commitment fee to the bank equal to 0.5% of the unused loan balance. Borrowings under

the line of credit are collateralized by the Company’s accounts receivable, inventory, equipment, general

intangibles, securities and other personal property, including the capital stock of the Company’s domestic

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

8. GOODWILL AND INTANGIBLE ASSETS, NET (Continued)

50